Since April of this year, we have been running a real-time case study related to incorporating option positions into the holdings of an investment portfolio of a positional, value-based investor. As a subject for our case, we used the quintessential “Old Tech” company — IBM — and walked through our thoughts on valuing the company, using options to enter a position, and managing option assignment and expiration (You can find all of the articles in the IBM Case Study here: Entering and Managing an Option Investment, Options Offer More Options, Fact-Based Valuation, Applying the Scientific Method to Investing, Managing an Option Investment, Option Assignment, Option Expiration).

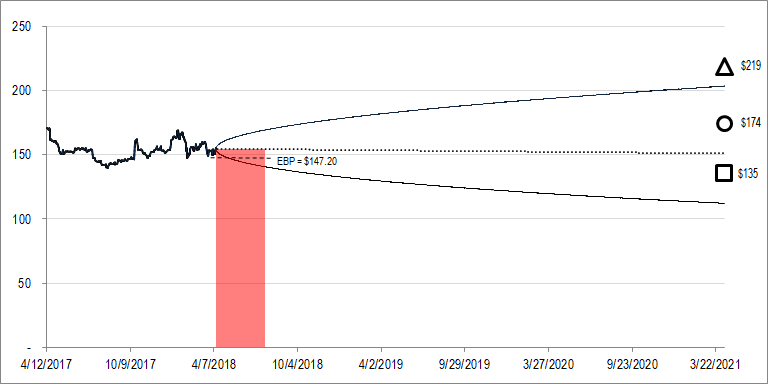

The market gods have not been with us in this investment, however, and the stock is now trading for about 13% less than our Effective Buy Price in the $147 / share range.

Figure 1.

While not thrilled to be holding a position with an unrealized loss, this is the essence of risk in the capital markets — not everything one buys as an investment increases in value right away, and some stocks decrease for awhile before they increase.

As you can see from the figure above, the stock price recently took a series of pretty hefty hits. The first of those was just IBM being dragged down by general market weakness. The more recent of those represents the market reaction to the company’s most recent quarterly earnings announcement.

Whether an investor uses options to effect an investment strategy or not, the most important determinant of ultimate investment success revolves around the relationship between the price at which the investor buys and the underlying value of the company. As such, my first reaction upon seeing the drop in IBM’s stock price was to look through the earnings announcement and decide whether the news changed my view of the company. I published an article to Framework members with my findings, and will summarize what I found here.

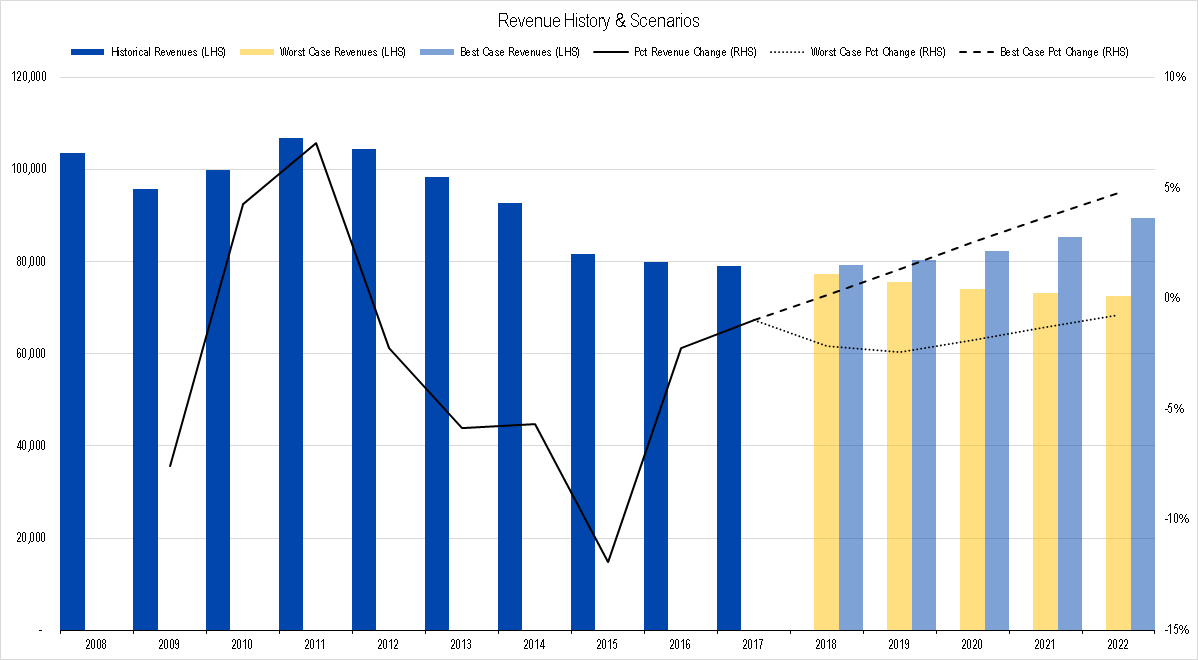

As I explain in my article entitled Fact-Based Valuation, there are only a few things that can influence the intrinsic value of a company, and those things all revolve around the process of generating cash flows. We focus in on Revenue Growth, Profitability, Investment Spending, and likely Future Growth based on the projects in which the company is investing. Most commentators talked a lot about IBM’s revenues and were disappointed with the flat (adjusted for foreign currency movements) or slightly down (nominal) change in quarterly sales.

In contrast, IBM’s revenue numbers were consistent with our projections for the firm’s top line growth this year, and — looked at from the perspective of nine months worth of results rather than just a quarter — the company is generating revenues in line with our best-case growth scenario.

Figure 2. Source: Company Statements, Framework Investing Analysis

Because revenues are the most visible representation of how effectively a company is responding to the demand environment, we consider this valuation driver to be the “King” of all of them. In IBM’s case, the King of Drivers is not completely healthy — we worry that the strength so far has a lot to do with a cyclical bump from a new product introduction (which is fleeting) and that IBM’s Watson business is struggling to gain traction. That said, IBM’s revenues are not completely sick either — we were especially happy that customer uptake of IBM’s “Hybrid Cloud” offerings were so strong. In the end, we viewed IBM’s revenue announcement as indicative of a company that is struggling with making a big transition between legacy and emergent businesses, not as a sign of impending commercial doom for Big Blue.

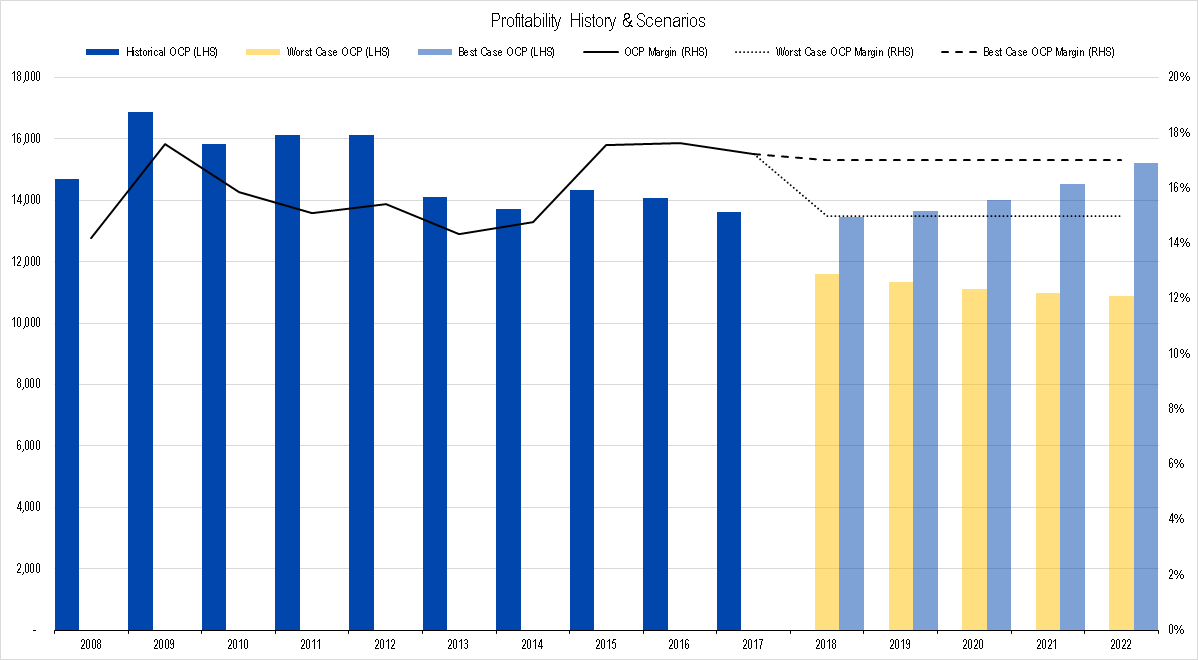

Regarding profits, in a lot of quarterly earnings announcements, companies do not provide enough cash flow data to make an accurate estimation of profitability in the way we like to measure it (a metric we call Owners’ Cash Profits (OCP)). IBM’s was no different in this regard. From what we are able to see, however, IBM is generating OCP at about the rate it did last year, when it generated an OCP margin of 17% — in line with our best-case scenario.

In my view, this is the one aspect of IBM’s business that is being overlooked by market participants. Even as revenues have been declining, profits have been holding steady. Steady profits in the face of declining revenues implies that the company is becoming more efficient in converting its revenues to profits; that “operating leverage” is a good thing for owners. IBM has been using a good portion of its profits to buy back its own stock. While stock buybacks often provide cover for profligate executive compensation schemes, in IBM’s case, the buybacks are certainly helping owners more than it is hurting them.

All things considered, IBM’s increasing profitability and decreasing share count should be viewed as positive developments for IBM’s owners.

Figure 3. Source: Company Statements, Framework Investing Analysis

Similar to profits, quarterly earnings rarely provide enough information about the company’s investment policy to force me to change my assumptions about this driver, so I am keeping my forecasts for medium-term cash flow growth as they are. Pulling together all the drivers to generate a valuation, we still find that IBM looks undervalued. When we entered into our short put option strategy, we thought the worst-case valuation was unlikely, but even in that scenario, the company was worth $135 / share. Since the present stock price is below that value, we believe IBM represents an investment whose risk / reward balance tilts much more on the reward side.

Figure 4. Source: CBOE, Framework Investing Analysis (original April ’18 diagram and strategy)

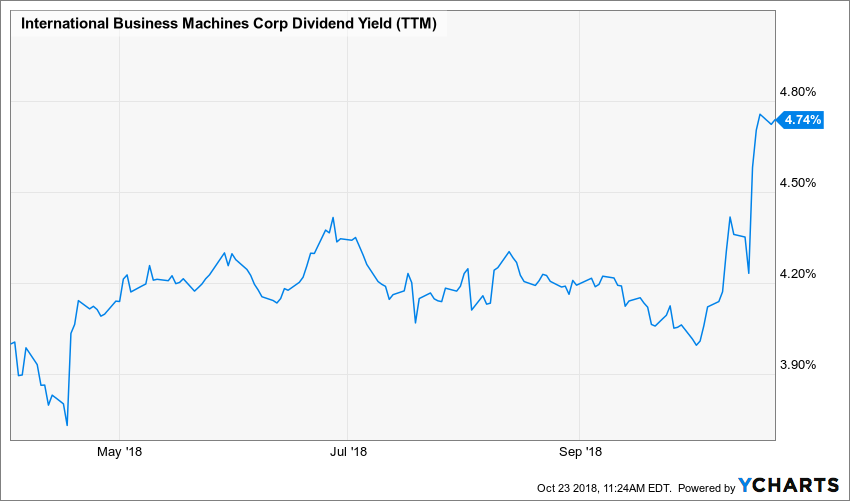

What do you do when bad things happen to good investors? In my case, I return to my assessment of intrinsic value and make sure that I understand that! Oh, and in the case of IBM, I can continue to collect the dividend till the cows come home. For new investors in IBM, the dividend yield is starting to look pretty attractive!

Figure 5.