In late April, we began a case study series investigating how one might use options to express a bullish investment opinion in IBM. This case study was based on a Tear Sheet I had published to Framework Investing subscribers earlier in April. The option we highlighted in our Tear Sheet and case study series was one with an expiration date of July 20, 2018.

Last week, we received word from our broker that we had been “put the shares” before the options expired. In this article, we look at the mechanics of option assignment and explain why exercising options is almost always a mistake.

Because we were the party on the other side of an investor mistake, we can enjoy a very small positive effect from someone else’s misunderstanding of how options work!

The Assignment Process

We sold put options on the shares of IBM in April, agreeing to buy the shares if they fell under the price of $155 / share – about the price at which the shares were trading at the time. In return for indemnifying another investor of a loss below $155 / share, we received $7.80 of option premium. In the parlance we use, we have an Effective Buy Price (EBP) for the shares of (155.00 – $7.80 =) $147.20.

Loading...

Loading...

IBM’s price has slipped, and closed last Friday’s session around $140 / share – an unrealized loss of less than 5% of the EBP of our position.

An investor holding put options on IBM exercised his or her options on Friday. My position was selected at random from the pool of sold put options to fulfill the contractual agreement to buy the shares for $155 / share.

When I sold puts originally, I needed to collateralize a margin account with the amount of cash I would need to fulfill my full financial obligation. The amount of collateral was the strike price of $155.00 times 100 – which is the number of shares represented by one option contract – or $15,500 / contract.

When the option exercise was assigned to me, the broker simply transferred over the margin cash and delivered IBM’s shares into my account. I had sold four contracts, so took possession of 400 shares.

The put option holder must not have realized that he or she actually destroyed a small bit of value by exercising, rather than selling his or her put options.

Intrinsic Value vs. Time Value

The price of every option has two components: Intrinsic Value and Time Value.

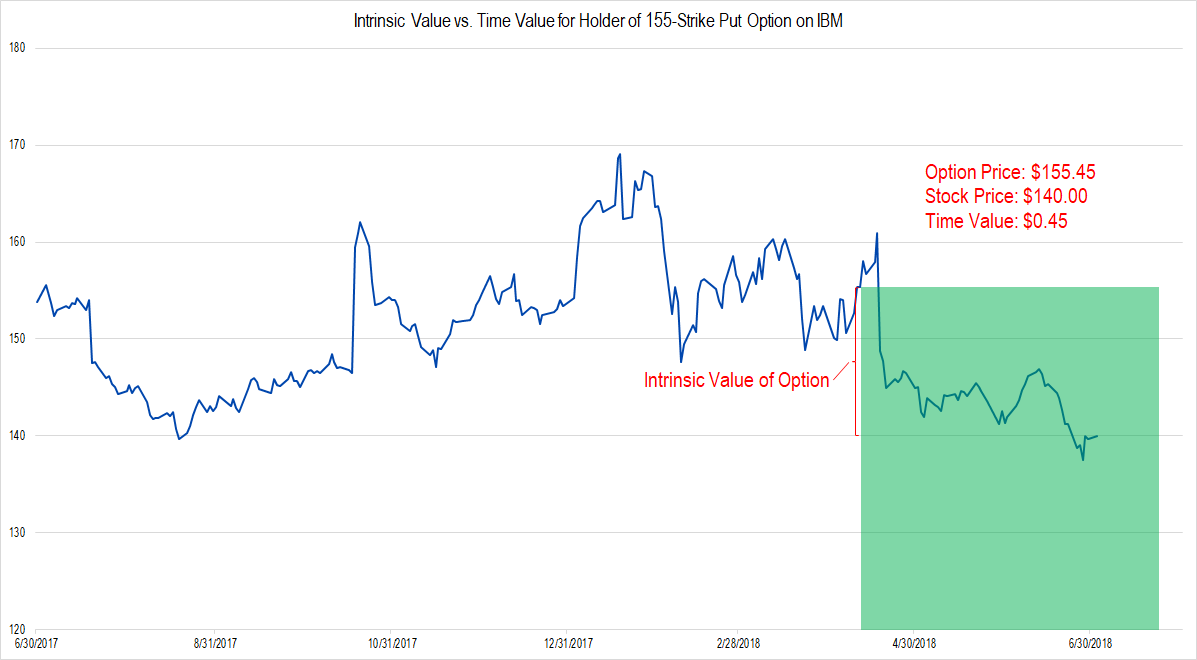

Intrinsic value is simply the difference between the strike price and the current stock price when the stock is within an option’s range of exposure. When IBM is trading for exactly $140.00, the put option struck at $155.00 has exactly $15.00 worth of intrinsic value.

Time value is the difference between the option’s price and its intrinsic value. As I write this, the ask price of the IBM put options struck at $155.00 / share and expiring in July 2018 is $15.45. The difference between $15.45 and $15.00 – $0.45 – is the time value of the put options.

Figure 1. Source: YCharts.com (price data), Framework Investing Analysis

When the investor decided to exercise rather than “Close to Sell” his or her put options, he or she effectively threw away the time value portion of the option, destroying about ($0.45 / $15.45 =) 3% of the value of the option position.

I hope the gentle readers of this article will never make this mistake! There is one case, which I talk about in my book, The Intelligent Option Investor, when it makes sense to exercise rather than sell an option, but that is not this case.

Happiness is a Low EBP

The one immutable rule of investing is that one should “Buy Low and Sell Dear.” Considering my valuation of IBM (which suggests IBM is probably worth around $175 / share), I was not at all worried about effectively buying IBM’s shares for $147.20 / share. The “margin of safety” in this investment is nearly 20% – ample for such a strong franchise like IBM, especially considering the dividend yield of around 4.5%.

When the put buyer exercised his or her option, I was given the chance to lower my effective buy price even more. This time by selling call options on the 400 shares I now own – in a transaction commonly known as a “covered call.”

There is less than three weeks before expiration, and one less trading day than normal because of the July 4th holiday. For agreeing to deliver my 400 shares of IBM to an investor for $155 / share, this morning I was paid $0.11 / share. Because a naked short put (my original position) and a covered call have precisely the same risk / return profile, I was able to effectively extend my original investment until the original July 20 expiration date and further lower my effective buy price from $147.20 to $147.09 / share.

Any reduction of an effective buy price, whether by dividend or by option transaction, is a good thing! In this case, the random holder of four put options on IBM did me a small favor in helping me reduce my EBP for my IBM position a little bit!