In our previous article in this Option Investing Case Study on IBM (article 1, article 2), we showed that we had invested in IBM by accepting downside price risk in return for a monetary premium.

Even if you missed our Open Office Hour session last Saturday, you can see the details of this transaction in this video recording of the “Options Offer More Options” portion of our call. (You can find more videos on the Framework Investing YouTube Channel.)

As investors interested in the value of companies, the only reason we would have been willing to accept downside price risk is if we thought IBM’s intrinsic value is at least the same and hopefully higher than the present market price of the stock.

We view IBM through the filter of our valuation framework, which holds that there are only four factors affecting the intrinsic value of a company – all of which are tied to the company’s ability to generate cash on behalf of its owners. Those factors are:

- Revenue Growth

- Profitability

- Investment Spending

- Future Results of Investment Spending

You can watch this video from our Office Hour session that explains our valuation framework in more detail.

This article looks at each of these drivers as they apply to IBM.

Revenues

The biggest issue facing IBM at present is uncertainty regarding the tug-of-war between its legacy businesses and its new businesses, which CEO Ginni Rometty calls “Strategic Imperatives.” We offer a little background to this transition in this video:

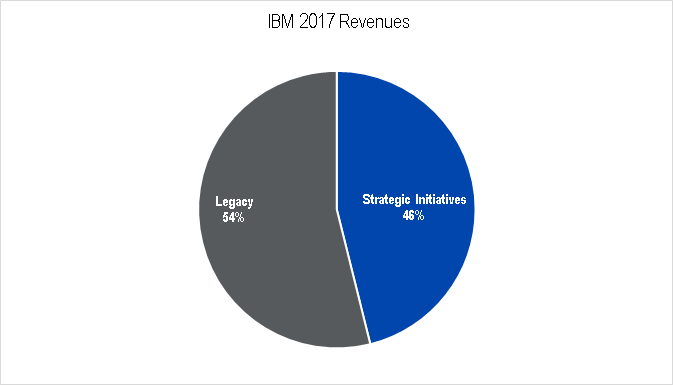

IBM’s revenues generated by its Strategic Imperative businesses is enjoying robust growth; its legacy revenues are suffering from contraction. For the past few years, IBM’s legacy businesses have represented a much greater proportion of revenues than its Strategic Imperatives, so the top-line trend has been strongly negative.

Figure 1.

However, as you can see from the hopeful upturn at the end of the above graph, Strategic Imperatives have grown to the point that they represent about the same proportion of overall revenues, so their robust growth is finally offsetting more or all the decline of legacy businesses.

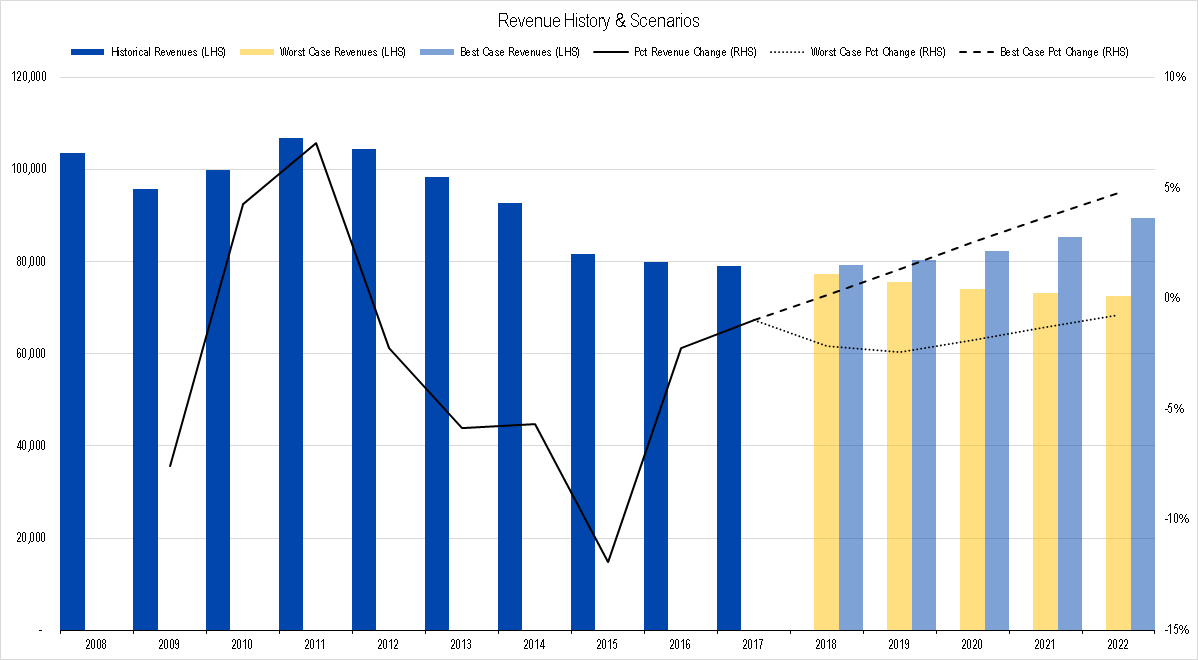

Figure 2. Source: Company Statements, Framework Investing Analysis

Legacy losses were very large a few years ago (e.g., 22% drop between 2014 and 2015), but are subsiding now – leveling out at a rate of around 10% per year. Strategic Initiative gains are moderating, but are still in the 10% per year or higher growth range.

Because the legacy and Strategic Imperatives business are about the same size, a slightly above- or below-trend result in any one quarter – very possible considering the complexities involved – will push the top-line slightly higher or lower than what the market as a whole is expecting. This causes great consternation and sighing amongst the short-term trading community, but offers great opportunities to investors – especially investors who understand the unique capabilities of options.

Our expectations for IBM are to generate, in the best-case, no revenue growth during 2018, and for revenues to decline by around 2% in the worst-case.

Figure 3. Source: Company Statements, Framework Investing Analysis

The quarterly results IBM released last week showed 5% year-over-year revenue growth on a nominal basis, but around 0% growth on a “currency adjusted” basis. We think the currency-adjusted revenue growth more accurately represents the economics of IBM’s business, so are satisfied that IBM is on track to generate revenues somewhat closer to our best-case projections for 2018.

Profits

Our preferred measure of company profitability is one that I set out in my book, called Owners’ Cash Profits (OCP).

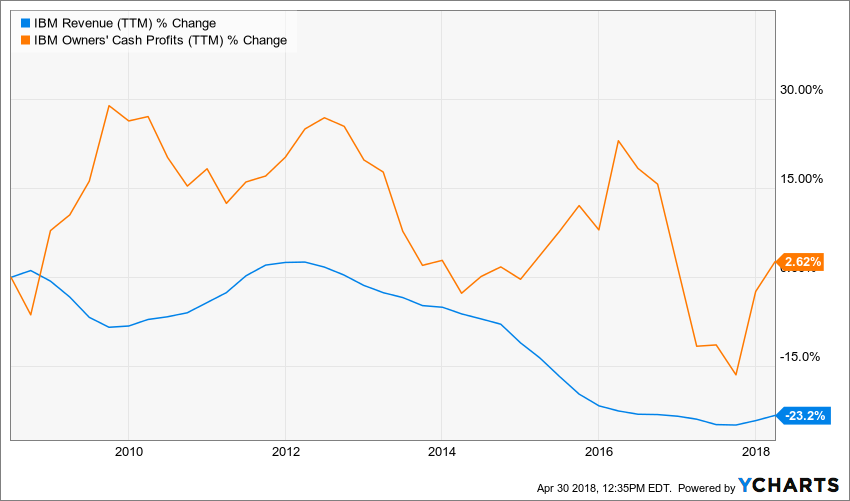

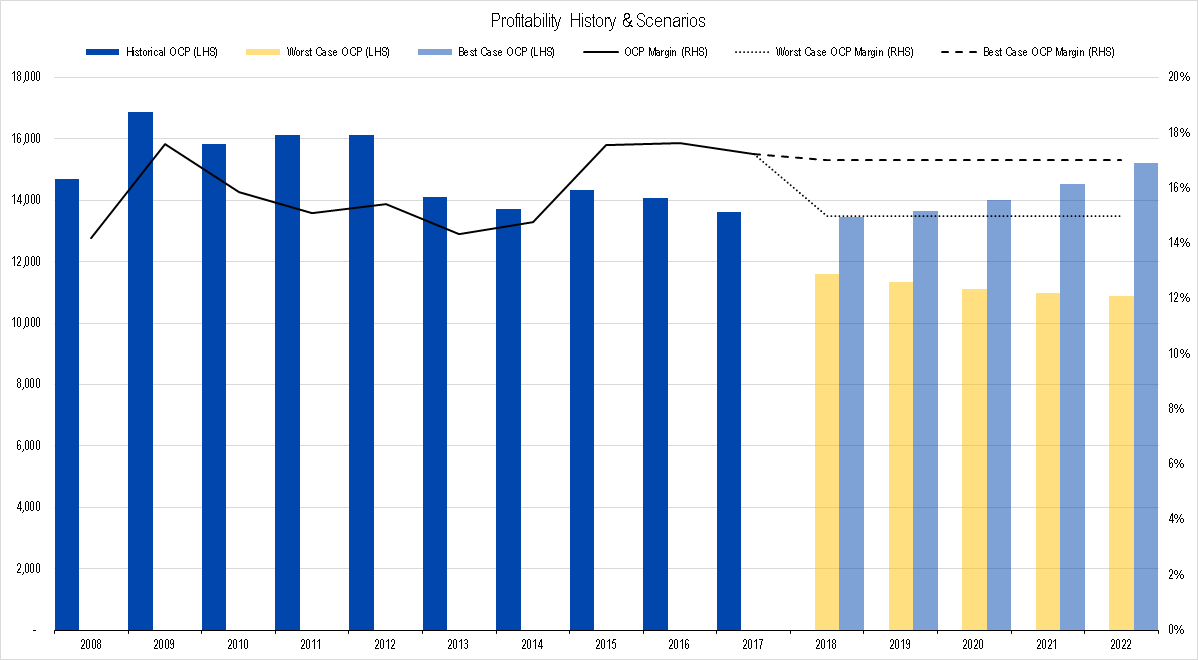

For investors in IBM, the profitability story offers some cause for optimism.

Figure 4.

As you can see from the above chart, even though IBM’s revenues have decreased by nearly one-fourth over the past 10 years, its profits are actually higher by a smidge. This suggests that IBM is becoming more and more efficient at converting its revenues to profits – exactly the kind of news that an owner should welcome. On a per-share basis, the news gets even better. IBM has been buying back shares, so its OCP / share has increased from $9.98 in 2008 to $13.11 in 2017 — an increase of over 30%.

A company’s profitability is usually pretty stable over time, so as the effects of the Strategic Imperatives business offsets that of legacy businesses, increased revenues should lead to increased profits over time, even if IBM is not successful at widening its profit margins.

Our best-case forecasts for IBM’s profits see this turn-around occurring over the next five years. Our worst-case profitability forecasts – which, as we will explain in our next article, look less and less likely – see a continued shrinking over the next few years.

Figure 5. Source: Company Statements, Framework Investing Analysis

It’s worth noting, that depending on how quickly IBM can expand its cash flows in the medium-term – which we take to be in the second half of the coming decade and which are related to how efficacious its present investment program is – IBM’s intrinsic value lies above its present market price in all but one valuation scenario.

Investments

Over the past several years, IBM has been acquiring firms that will bolster its Strategic Imperatives business, namely computer security, Cloud provisioning, and artificial intelligence.

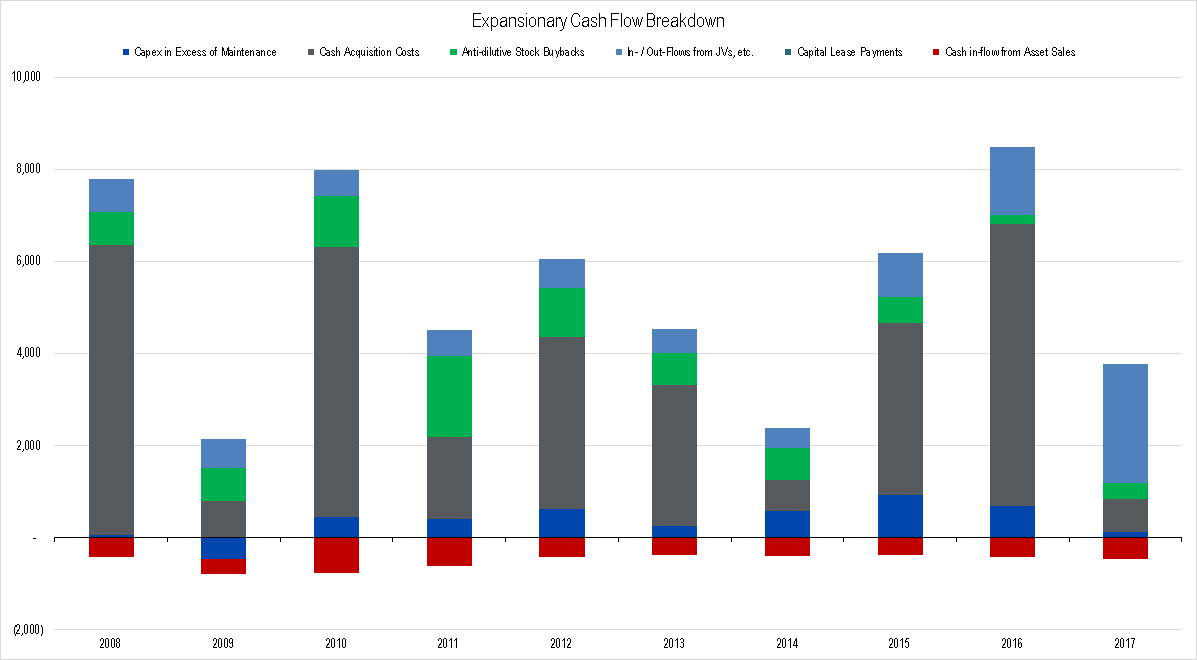

Figure 6. Source: Company Statements, Framework Investing Analysis

In 2017, the layer colored in light blue and listed as “In- / Out-Flows from JVs, etc.” was made up of $500 million in investments in internally-developed software and $2 billion in money loaned to clients. These loans serve to pull forward demand for IBM’s products and services and will provide a positive effect on IBM’s profitability in 2018 and beyond. (See how we define investments here.)

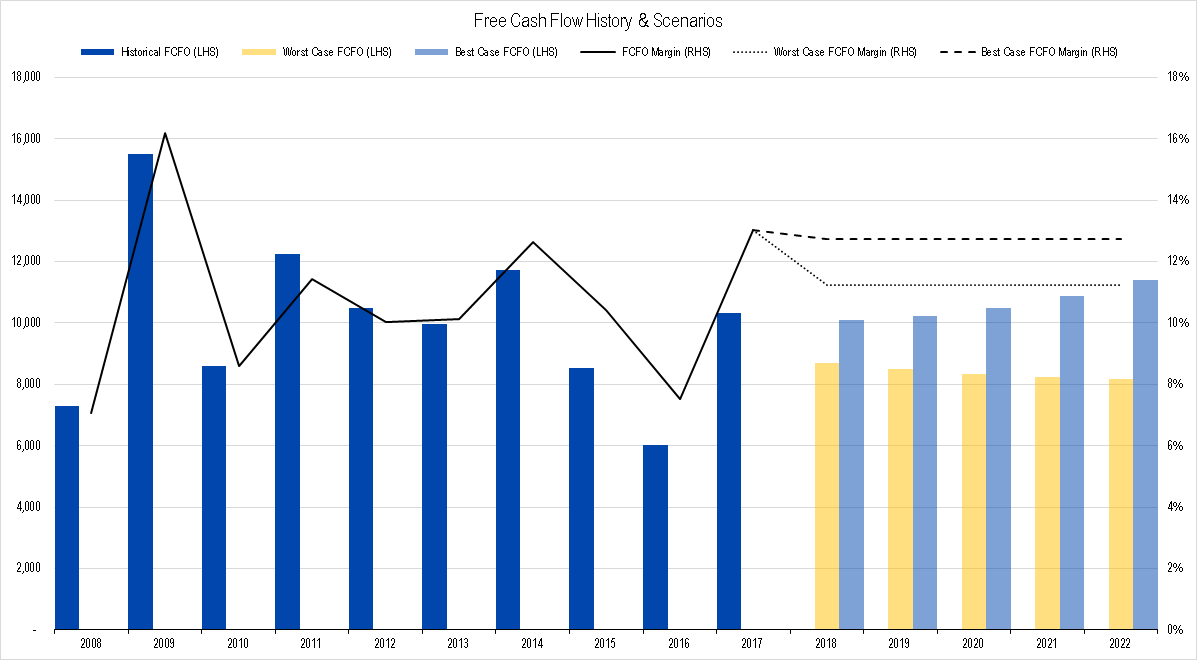

Deducting moneys spent on investments from profits gives us what we term Free Cash Flow to Owners (FCFO). Over the next five years, we project that IBM will be able to generate between $8 billion and $10 billion per year in FCFO on average.

Figure 7. Source: Company Statements, Framework Investing Analysis

Medium-Term Growth

Future growth is inextricably tied to the strength of a firm’s present business and the success of the investments it is making. IBM has a strong franchise, supported by its deep understanding of its clients and a very deep technical bench. It is investing in areas that allow it a valuable and differentiated product offering that will boost cash flow growth in the future, in our opinion.

We believe that best-case medium-term cash flow growth will average around 7% per year and worst-case growth, around 2% per year. Our cases frame our assumption for the nominal growth of the economy at large in the future – 5%.

Valuation Waterfall

These assumptions and projections generate a range for IBM’s intrinsic value that extends from $135 on the low side to $219 on the high side. In our next IBM Case Study article, we will discuss why we think the low end of this valuation range is becoming less and less likely with every passing day – offering us more confidence in IBM’s upside potential.

Our assumptions are spelled out in what we call a Valuation Waterfall mini-report, which you can find below.

We will be holding another Open Office Hour session on Saturday, May 5 to discuss our valuation assumptions. Many seats are already spoken for, but we have a few spaces left. If you are interested in attending, please send me an email.

Loading...

Loading...