After taking a close look at Union Pacific’s valuation drivers over the last two weeks, we are summing up our findings and translating them into operational forecasts for our valuation model in this article. We will revisit this valuation again early next year after the firm publishes its annual report for fiscal year 2017. In addition to the articles linked in this note, we have a Framework Forum topic dedicated to Union Pacific for you to discuss and ask questions.

As with all of our work, we divide this article into each of the main valuation drivers: revenue growth, profitability, investment spending, and investment efficacy / medium-term growth.

Revenues

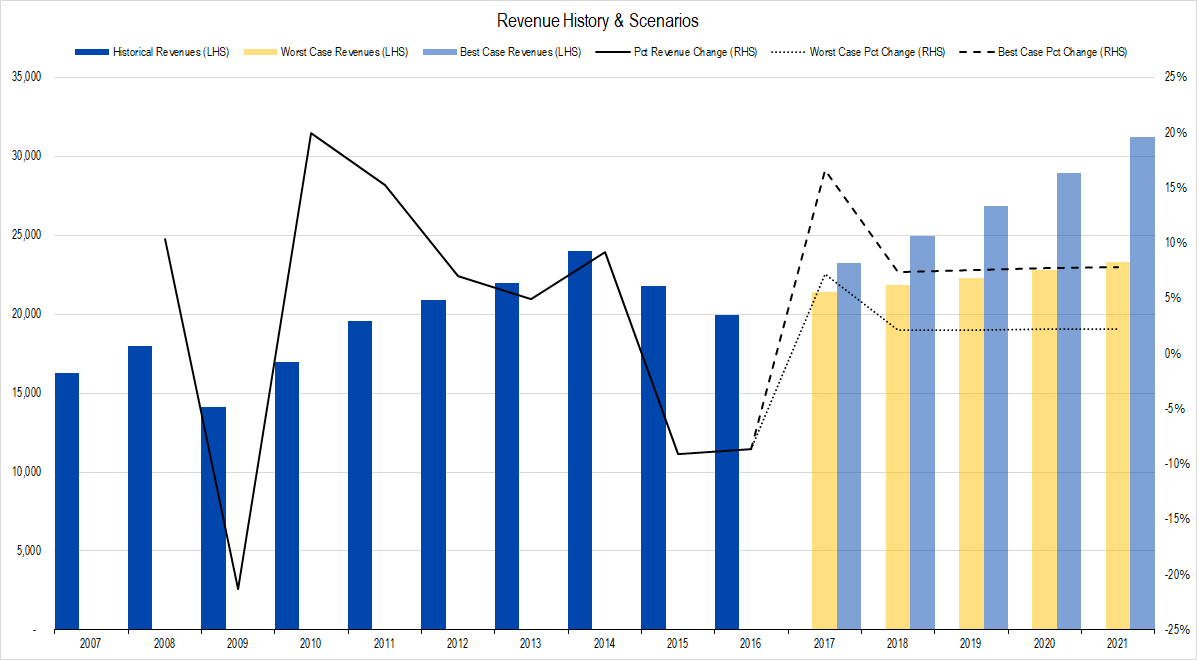

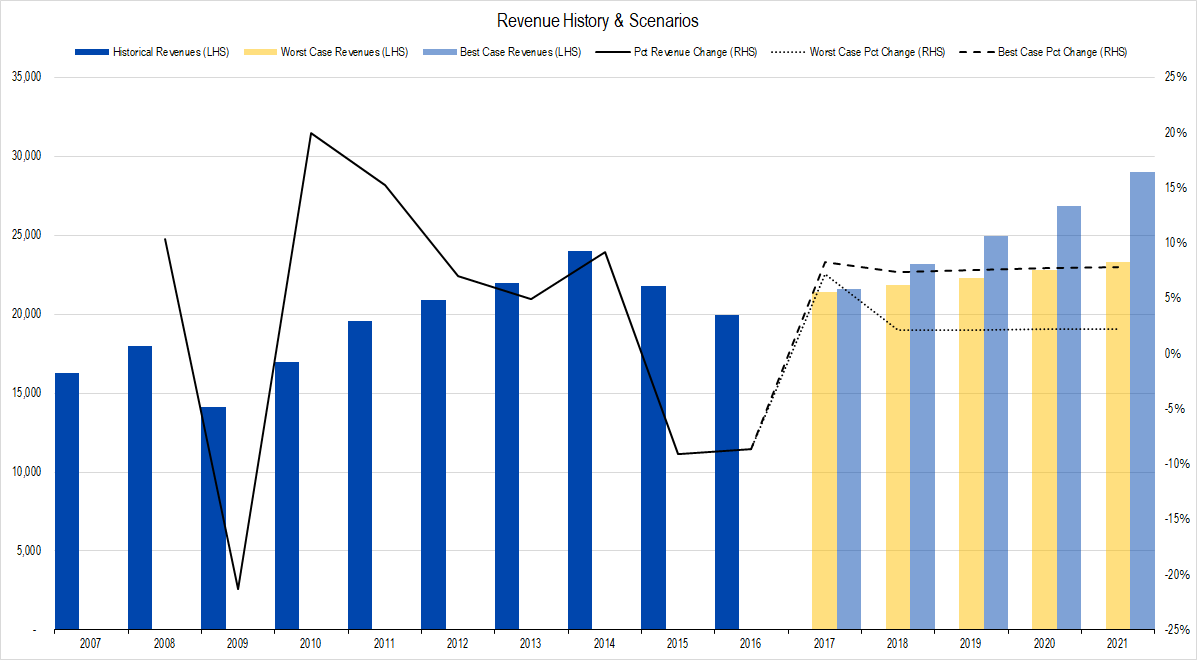

Our original projections were for roughly 17% revenue growth during 2017 in the best-case, followed by four years of 7%-8% growth, based on our statistical analysis of Union Pacific’s historical boom time revenue increases.

Figure 1. Source: Company Statements, Framework Investing Analysis

Union Pacific’s 2017 revenue growth has been much closer to our worst-case forecast of 7%. This late in the year, we are leaving our worst-case projection as it is and pulling down our best-case projection to 8% year-over-year revenue growth.

Figure 2. Source: Company Statements, Framework Investing Analysis

Our best-case percentage change forecasts for 2018-2021 remain as before, but since they start on a lower assumed 2017 base, our 2021 best-case revenue projection has come down to $29 billion — $2 billion less than our original forecast. Over the entire 5-year forecast period, our new best-case revenue forecasts represent just under an aggregate $10 billion drop from our previous model.

All else held equal, this change drops best-case fair value scenarios by roughly $8 per share.

When 2017 annual results are released, the firm has announced it would change its freight type classifications. We will go back and make this change in our model, and will also likely boost our assumptions for the present Industrials freight type revenue growth. This increase is due to our recognition of the tailwind from the demand for frac sand shipments in the proppant-intensive areas that Union Pacific serves that we discussed in this article.

Profitability

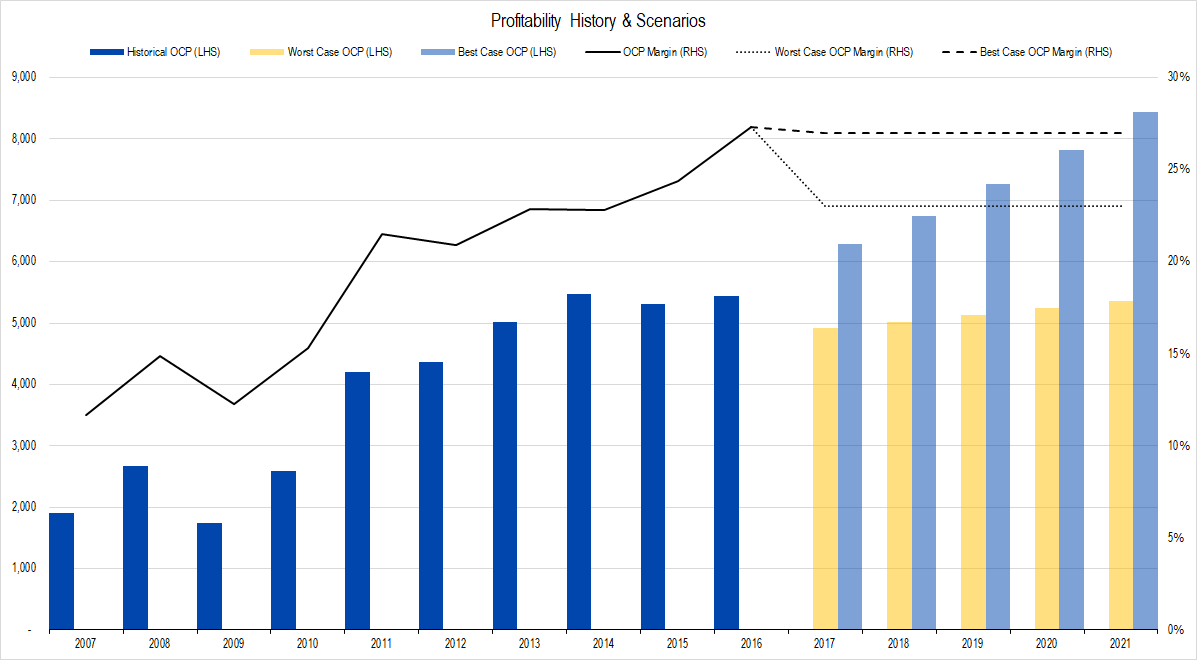

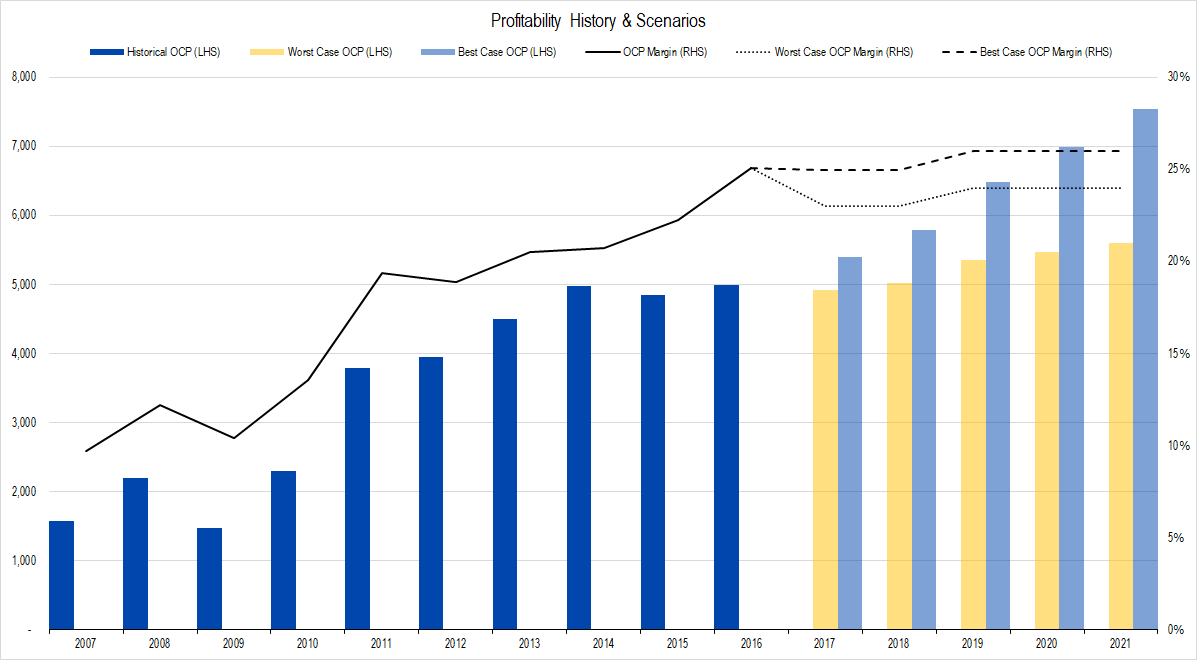

After carefully analyzing Union Pacific’s likely maintenance capital expenditures (maintenance capex), which form a fundamental input into our calculation of Owners’ Cash Profits (OCP), we made some significant changes to our assumptions about Union Pacific’s base level of profitability.

In our original estimates of profitability, we assumed maintenance capex levels to be about the level of the firm’s Depreciation Expense. This assumption implied OCP margins in the mid- to high-twenty percent range.

Figure 3. Source: Company Statements, Framework Investing Analysis

In an earlier article, we detailed our changing assumptions regarding Union Pacific’s maintenance capex spend. Old OCP margins and new paralleled one another, but our new assumptions for maintenance capex have cut our estimates of base profitability by several percentage points.

Figure 4. Source: Company Statements, Framework Investing Analysis

Our new best- and worst-case profitability assumptions build in margin expansion in 2019 to account for the completion of expenditures related to Positive Train Control (PTC).

As discussed in an earlier article, the company has targeted an operating ratio of around 60% and we believe our forecast OCP margin range reflects that improvement.

Reduction of our best-case profitability forecasts cuts around $4 per share off our best-case valuations, but our worst-case profitability forecasts actually increased slightly. As a result, the average of all eight valuation scenarios only fell by $1 per share due to this profitability change.

Investment Level

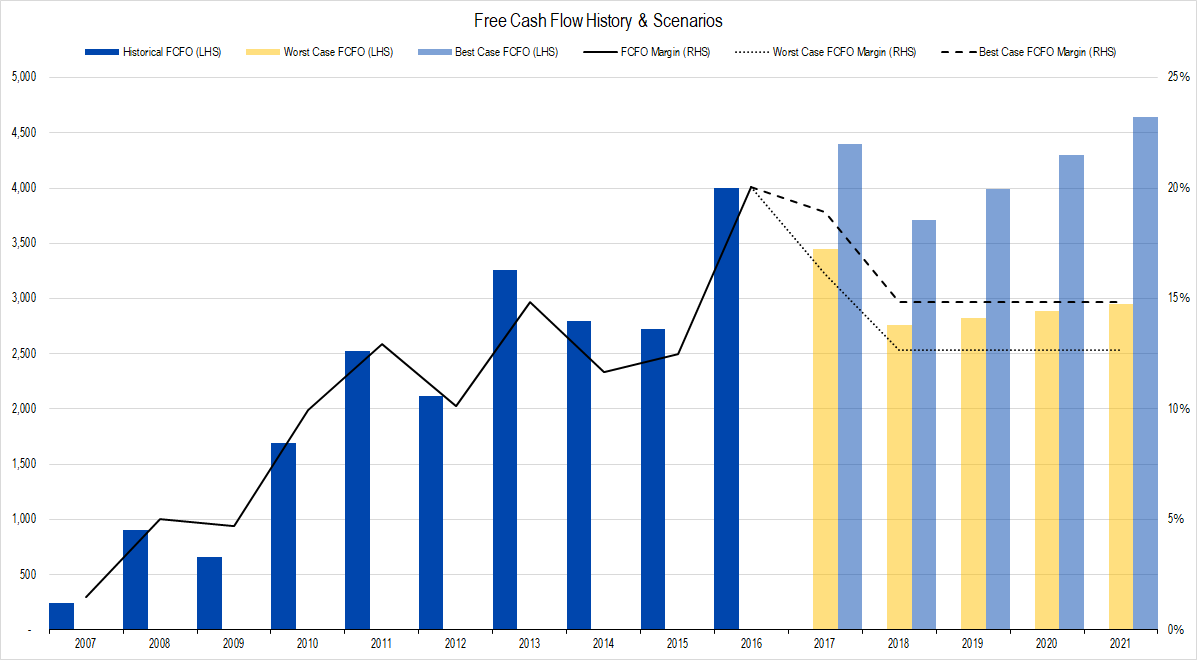

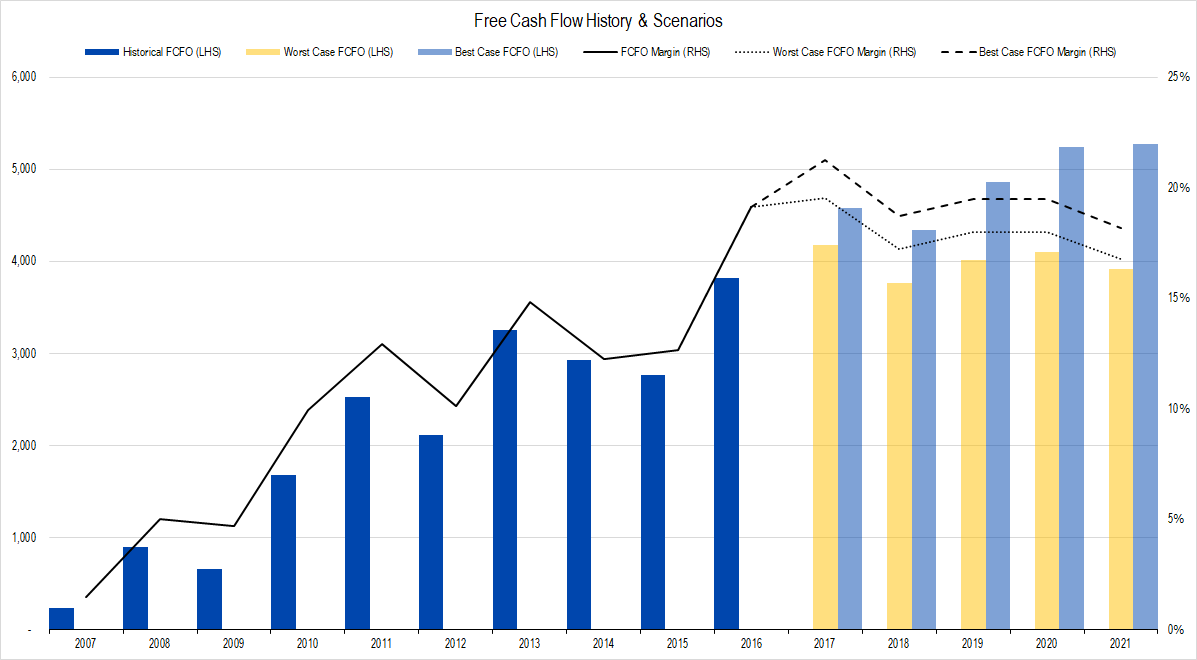

Our original forecast that the firm would spend 42% of its profits on average on investment spending was based on earlier estimates of higher profitability. Our forecasts for Free Cash Flow to Owners (FCFO) given this investment level averaged in the $4 billion per year range with worst- and best-case aggregate FCFO of $15 – $21 billion over the five-year explicit forecast period.

Figure 5. Source: Company Statements, Framework Investing Analysis

Our new assumption is that the firm will spend roughly 25% of its profits on investment spending — our reasoning is detailed in this article and we triangulate our forecasts by observing spending for BNSF, Union Pacific’s only competitor, in this article. This implies an average FCFO of in the $4.5 billion range with a worst- and best-case aggregate FCFO of $20 – $24 billion over the five-year explicit forecast period.

Figure 6. Source: Company Statements, Framework Investing Analysis

The fall-off in FCFO in 2021 shows up because we are triangulating our forecasts with the company’s guidance. Managers have indicated that total capital expenditures would likely come in at around 15% of revenues.

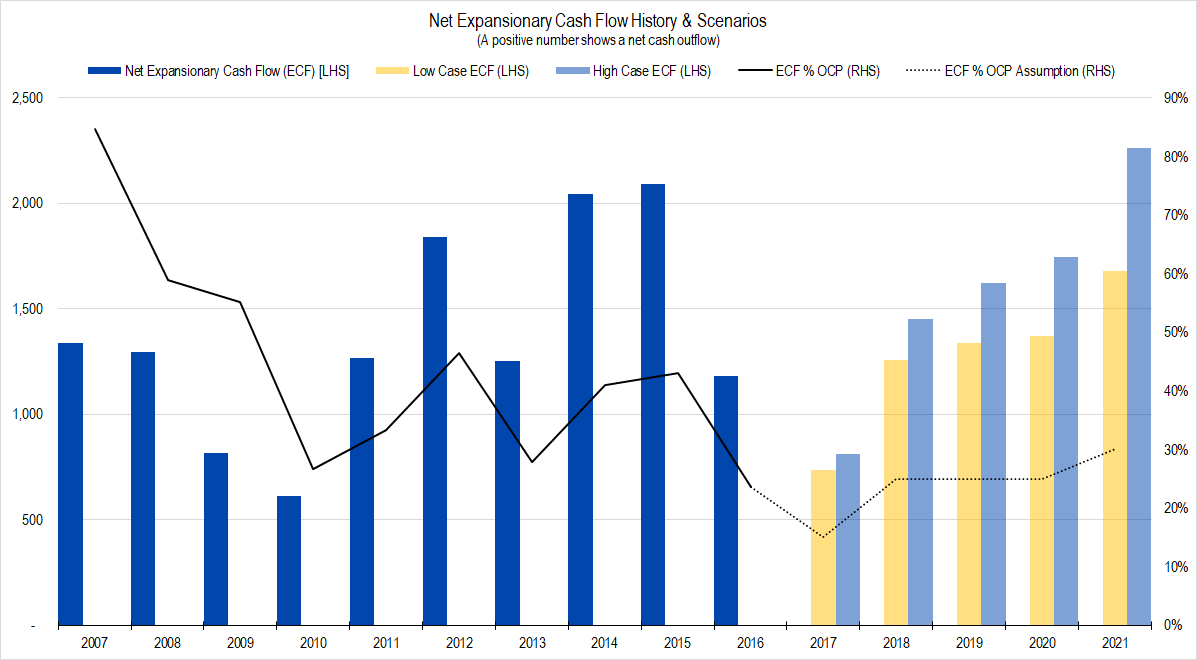

Charted against historical values, our assumptions for investment spending (Expansionary Cash Flow) looks like this:

Figure 7. Source: Company Statements, Framework Investing Analysis

These changes created somewhere on the order of $26 per share increase in our valuation range and more than offset the negative changes mentioned above. This seems like a big jump, but the reason for it is that the absolute level of FCFO is higher in our final year, which means that the perpetuity value of the cash flow stream grows from a higher base.

Investment Efficacy / Medium-Term Growth

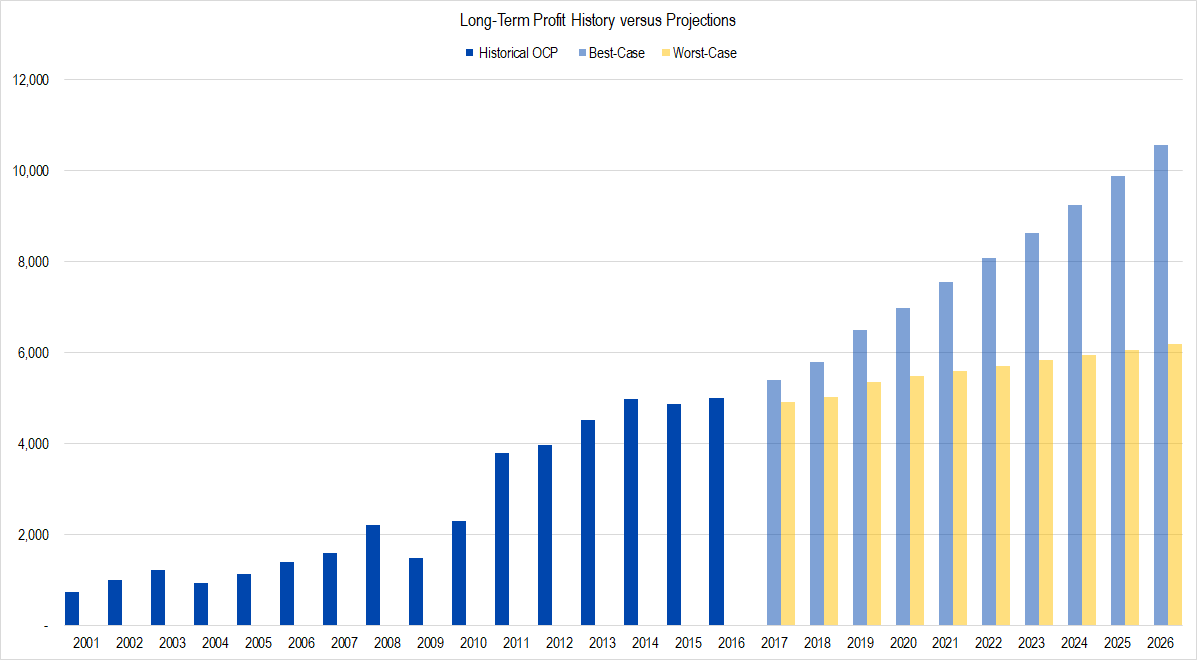

We analyze investment efficacy in terms of growth of profits. Our original assumptions were for medium-term growth to average 5% in the worst-case and 7% in the best.

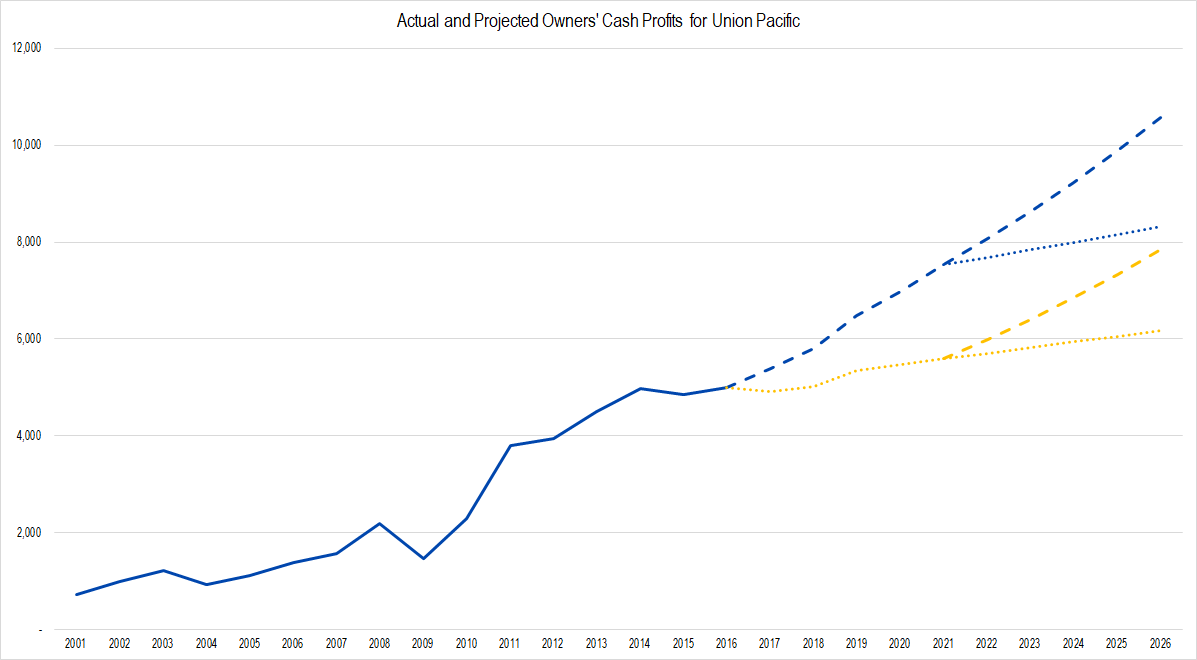

Our new model keeps the 7% best-case value, but drops the worst-case value to 2%. Graphing long-term historical OCP versus our best- and worst-case projections gives us the following.

Figure 8. Source: Company Statements, Framework Investing Analysis

Keep in mind that the long history shown here displays the results of a huge shift in the environment that saw the industry enjoy massive deregulation, consolidation, decommissioning of routes, and contract repricing that physically cannot be repeated in the future. This allowed average per-year profit growth to average in the 12-13% range — considerably faster than the economy at large.

If we look more granularly at our profit scenarios, we get the following:

Figure 9. Source: Company Statements, Framework Investing Analysis

Here, the blue branch shows the best-case and the yellow branch, the worst-case. Dashed lines after 2021 show best-case medium-term growth and dotted lines after 2021 show worst-case medium-term growth.

We believe that the best-best case (shown by the full blue dashed line) is unreasonable and unlikely. The worst-worst case (shown by the full yellow dotted line) is probably too pessimistic as well, though more likely than the best-best case considering the secular decline in coal transport and other competitive threats (e.g., Panama Canal extension).

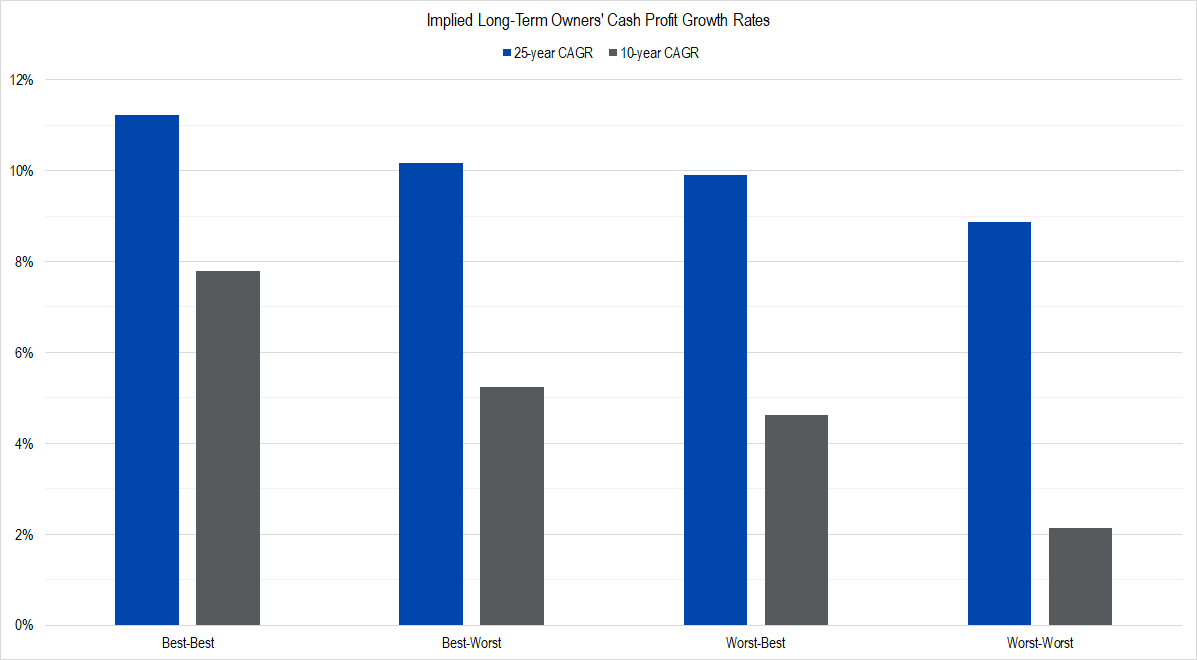

If we look at the long-term growth implied by each of the four scenarios shown above, we get the following:

Figure 10. Source: Company Statements, Framework Investing Analysis. 25-year CAGR calculations start in 2001; 10-year CAGR calculations start in 2016.

In any of the cases, 25-year CAGRs are considerable above the nominal rate of increase in US GDP of around 4% per year. Our Best-Worst (indicating best-case near-term revenues and profits and worst-case medium-term growth) and Worst-Best scenarios both generate 10-year annual growth rates of on the order of 5%. We believe the implied growth rates for either of these cases to be reasonable.

Note that while we are graphing out long-term OCP, we are using profit for a proxy of our real measure – long-term growth of free cash flow. We consider the 2% worst-case value to represent a case in which capital expenditures must increase in the medium-term and believe this scenario is fairly likely. Union Pacific bought a great many locomotives over the past few years, and the replacement of older locomotives and the shift toward driverless trains will likely necessitate higher investment spending on that time scale.

Note that these calculations do not take a change in U.S. taxes into account. We made an estimate of the effect of proposed tax legislation in an earlier article, but are reluctant to finalize our forecasts before the new tax legislation is passed and the timing of the tax change is known.

Valuation

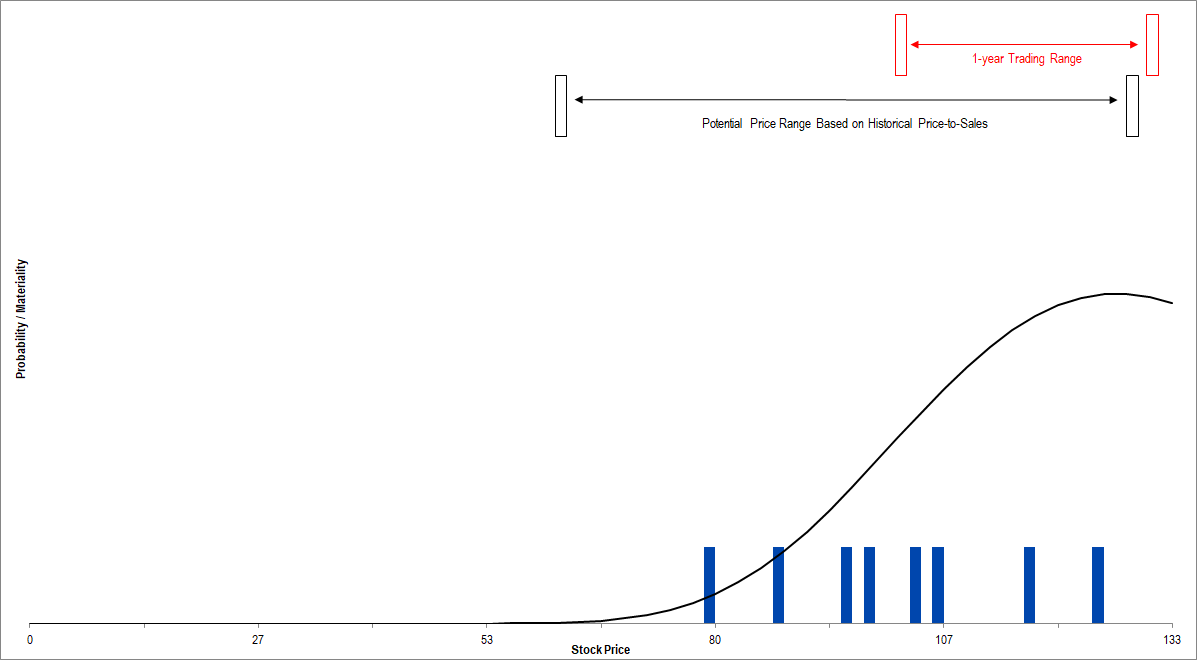

Pulling all of this together gives us a valuation range from around $80 per share to around $126 per share. All of our valuation scenarios are below the present price of the stock — around $128 — and the average of all eight scenarios equals $102 per share.

Figure 11. Source: CBOE, Framework Investing Analysis

We believe the firm is overvalued at present market prices, especially considering that the drivers implied by the two highest valuation scenarios are unlikely to occur, in our opinion.

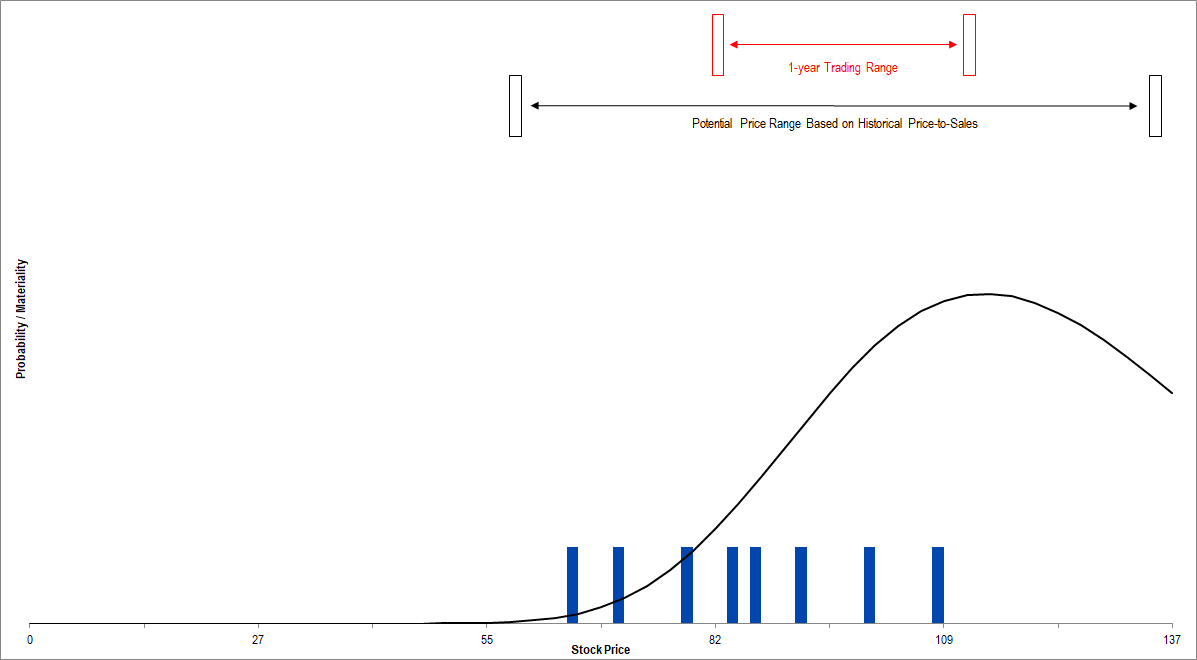

Our new valuation range has shifted up by around $15 per share. Our previous eight-scenario average value was $87 per share. The discrepancy comes, as discussed, from our lowered assumptions regarding investment spending in the near term.

Figure 12. Source: CBOE, Framework Investing Analysis

With the valuation work complete, we will publish another article regarding investment strategy.