In my last article about Union Pacific’s investment spending, I compared its capital expenditures to those of close competitor Burlington Northern Santa Fe, the railroad owned by Warren Buffett’s Berkshire Hathaway. I dug into BNSF’s data a bit and found some interesting details.

While privately owned, BNSF continues to issue financial statements on behalf of two companies. I have a call out to BNSF’s investor relations manager to make sure, but it looks as though Burlington Northern Santa Fe, LLC, is the entity most directly comparable to Union Pacific. BNSF LLC is a holding company that is the sole owner of Burlington Northern Santa Fe Railroad as well as numerous other subsidiaries. BNSF Railroad also issues financial statements and its operations are by far the most important assets held by the LLC — representing the entirety of BNSF’s North American system, in fact.*

BNSF Railroad issues mortgage and land grant bonds that are not the direct obligation of BNSF LLC and are collateralized by its physical rail assets. As such, we believe BNSF Railroad publishes separate financials for the benefit of fixed income investors.

Because of the notable differences between profitability and investment spending at BNSF, LLC and UNP that our previous article turned up, I calculated Owners Cash Profits (using Depreciation expense as a proxy for maintenance capex) and Free Cash Flow to Owners for BNSF Railroad and compared that to UNP’s as well.

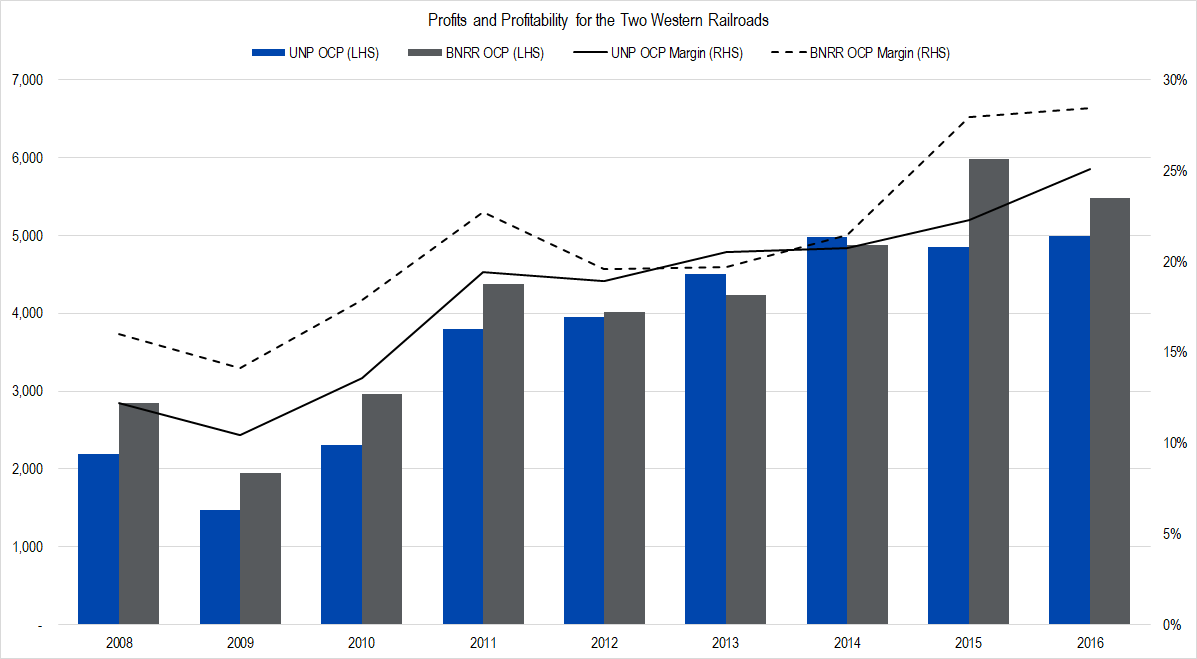

First, let’s look at profitability.

Figure 1. Source: Company Statements, Framework Investing Analysis

In contrast to what we saw when we compared BNSF LLC to Union Pacific in our last article, BNSF Railroad is generally more profitable than the latter. This tells us that BNSF’s other subsidiaries are being subsidized by the more profitable operations of the railroad. This is an interesting tidbit, but not as important vis-à-vis our analysis of Union Pacific.

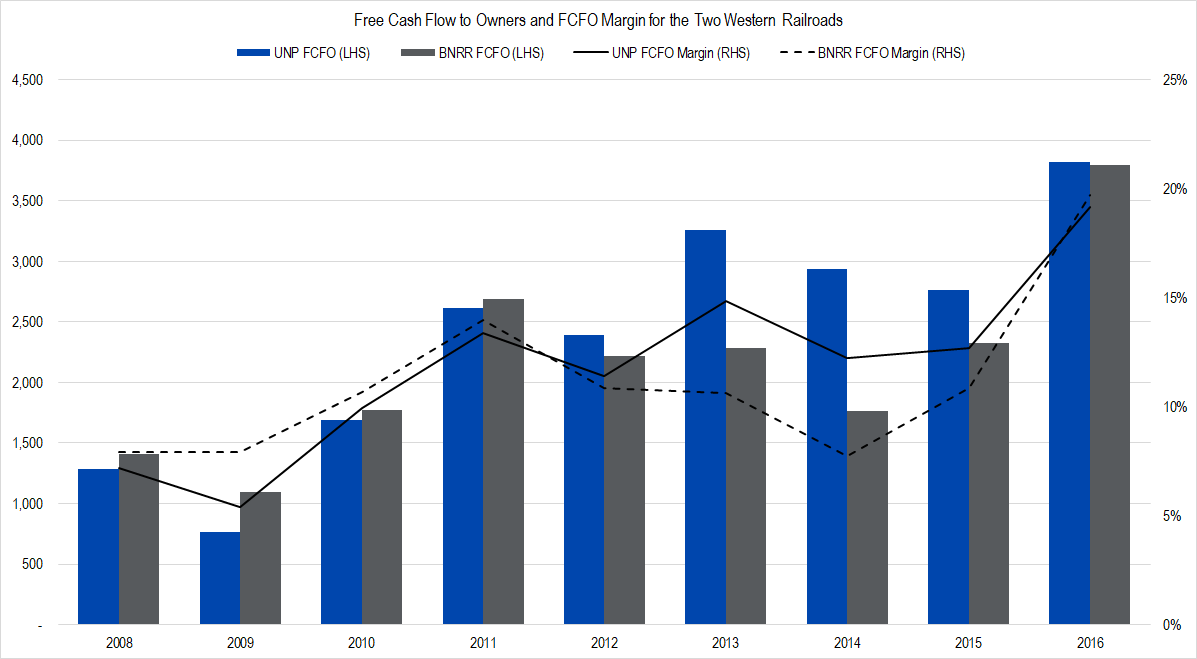

Next, we look at FCFO:

Figure 2. Source: Company Statements, Framework Investing Analysis

This diagram looks more similar to the comparison of BNSF, LLC and Union Pacific that we posted in our earlier article. Again, we see that BNSF Railroad has lately been spending more heavily on investments than Union Pacific. Since 2009, BNSF Railroad has spent an average of 20% of its revenues on capital expenditures versus Union Pacific’s average of 17%.

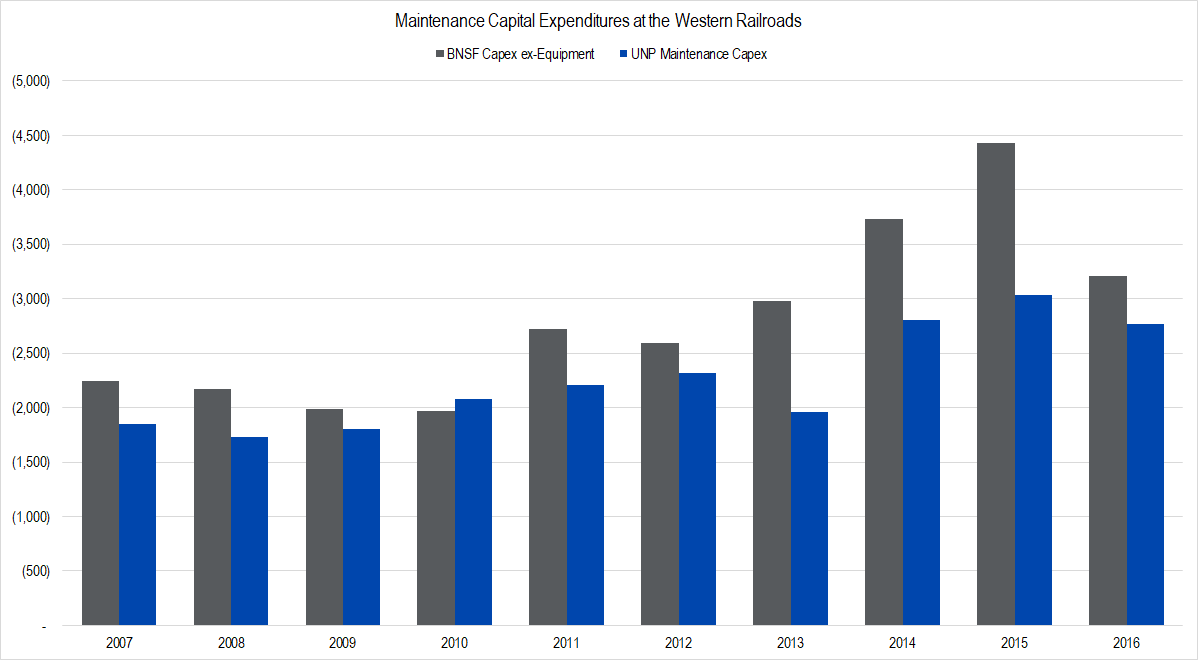

Unfortunately, BNSF does not provide as much detail about specific assets being replaced or acquired through its capital expenditures, so it is hard to make a direct comparison.** That said, the company does offer some data in “Annual Review” documents and provides a very gross classification of spending in its 10-Ks. We have done our best at comparing apples-to-apples between the two railroads and come up with this graph of maintenance capital expenditures.

Figure 3. Source: Company Statements, Framework Investing Analysis

Assuming that the two numbers are really comparable, it would seem that BNSF is spending more money on maintaining its tracks than Union Pacific. One implication is that Union Pacific might be skimping on essential repairs, making its rail network more dangerous. Indeed, I’ve found a recent series of articles from Oregon Public Broadcasting that seem to support that theory. BNSF has more derailments spilling oil — partially because it carries much more oil than UNP — but Union Pacific has a worse record and has been ordered by the Federal Railroad Administration to increase track inspections.

We have come about as far as we can come looking at Union Pacific’s investment spending. We will keep the points we’ve found in the back of our mind while speaking with Union pacific and BNSF management, and will develop an opinion about whether:

- Union Pacific’s investment spending is sufficient for brisk medium-term growth

- The appropriateness of Union Pacific’s maintenance capital expenditures.

In the process of doing the research on investment spending, I have also looked at two other near-term valuation drivers — revenue growth and profitability — and will conclude our Union Pacific series on articles on those topics, followed by a valuation summary and a new Tear Sheet.

Note:

* Like BNSF, LLC, Union Pacific is also a holding company that is the sole owner of a railroad operating company called Union Pacific Railroad. Unlike BNSF, however, Union Pacific Railroad does not publish independent financial statements.

** Certainly, Buffett was reported not pleased with BNSF’s 2014 results, saying in part that BNSF was outspending Union Pacific on capex while underperforming it on earnings (See articles regarding Buffett’s comments at DCVelocity and Fortune).