A few weeks ago, we wrote an article showing what the option market was saying the probability was for Valeant’s (VRX) stock price in mid-January. But even though most option transactions are made in the very short-term, the option market can give you a good idea of what the consensus view for a stock’s price further in the future.

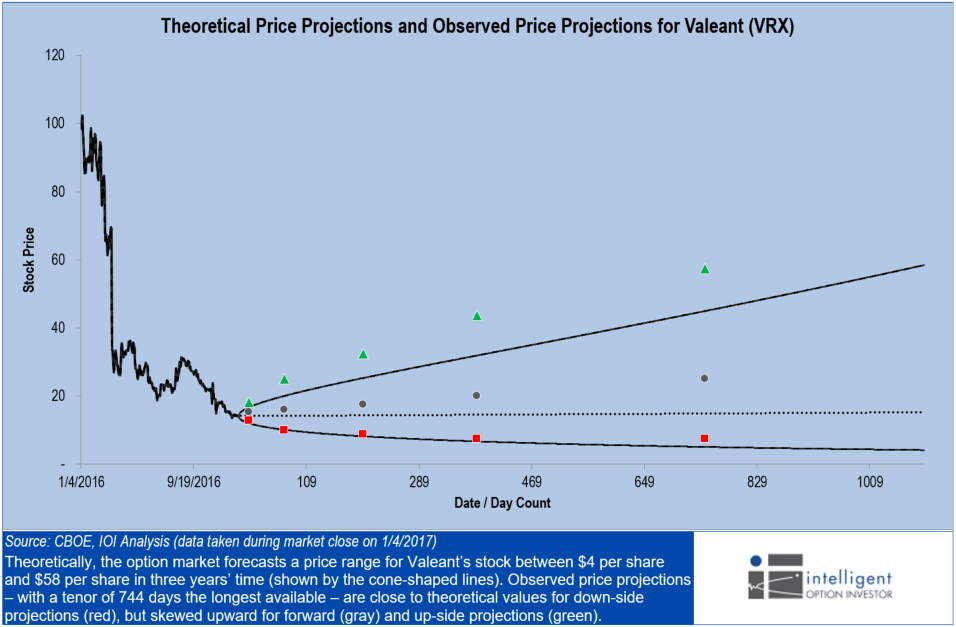

The figure below shows both theoretical and observed 1-standard deviation ranges for Valeant’s stock price in the future. “Implied volatility” when these data were taken was over 70%, which most people would consider high. However, a point that we make in our IOI 103 course on structuring investments is that no matter how “high” an option’s implied volatility is, if the actual future value is outside of the ranges shown below, the option is undervalued.

Figure 1.

In short, if Valeant is worth more than $60 per share or less than about $5 per share a few years in the future, the option market has a bargain for you!