Valuation at IOI starts by looking hard at a company’s financial model, but is augmented by looking equally hard at what option prices imply about the future path of that company’s stock price.

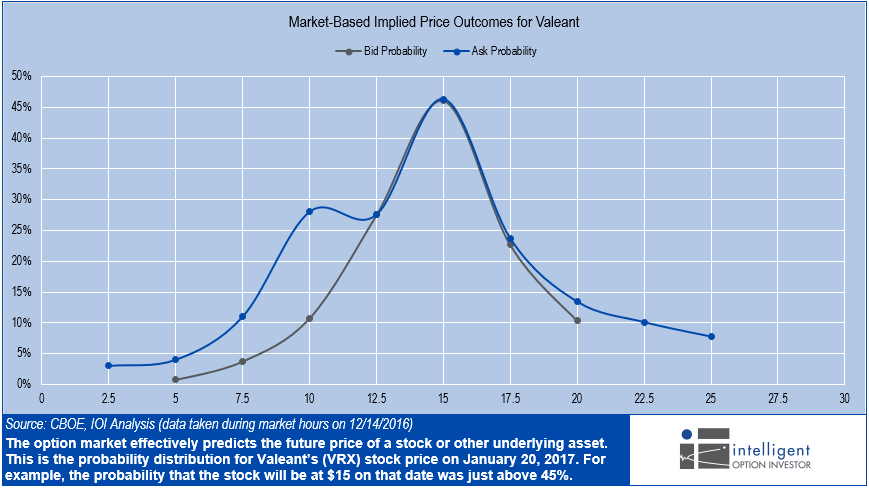

In effect, the market tells us, through option prices, what it expects the price of a company’s shares to be at future points in time. We need only pull that data into a graph to visually get the information about future prices that we want.

The portfolio manager of a special situations hedge fund contacted us this week after we published an article about the troubled pharma maker, Valeant (VRX).

The portfolio manager was interested in the probabilistic aspect of option prices. Option pricing models like Black-Scholes (the Black-Scholes Model or the BSM) work by assigning a probability to various prices for the underlying stock at a specific point in the future. The more “likely” a certain prices is deemed to be, the higher the option price for that specific strike and tenor.

These probabilities can be graphed out, and that is exactly what we did for the portfolio manager.

From the graph above, you can see that if you think there is a greater than 10% chance that Valeant will be trading at $7.50 or below in the third week of January, you have an excellent chance to profit using the options market.

So, if you have a good valuation of VRX and your range of values lies predominantly below the current price, this looks like an excellent way to tilt the expected value of the investment toward you.

More generally, our investment process at IOI is to “monetize knowledge”. So, we invest time to gain a detailed understanding of a company’s business and demand regime, and then seek to monetize that understanding of VALUE over time by investing in the difference between that VALUE and the PRICE. The option market offers us BOTH a) the data with which to lend probabilistic thinking to our investments as well as b) highly flexible instruments with which to take advantage of these differences. Institutional buy-side investors use strategies like this to drive above market returns.

This process is taught step by step in IOI 103 – Creatively Structuring Investments. For more information on the course, visit the courses page or Contact Us using the form below.

[caldera_form id=”CF56b3ac18bf490″]