Union Pacific UNP announced third quarter 2018 results last week, and looking through the numbers gave me a shock.

Revenues for the first nine months of 2018 came in at $17.1 billion, an 8% increase over the first nine months of 2017 and in line with our best-case revenue growth scenario. No surprise there.

However, when I calculated the Owners’ Cash Profit (OCP) generated by the company so far this year, I was shocked. OCP margins were just under 28% — a full 300 basis points better than my best-case scenario for this year and 200 basis points better than the average best-case OCP scenario over the next five years.

In my root cause analysis to understand the unexpected outperformance, I found that the biggest driver was the lowered tax rate.

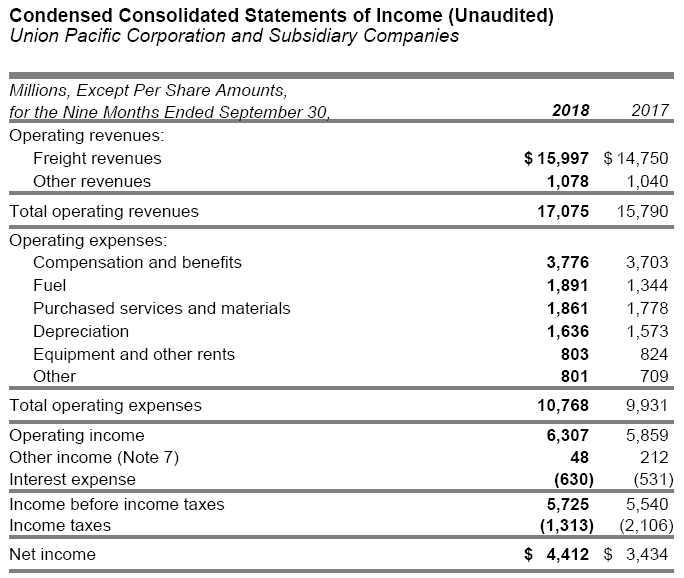

Figure 1. Source: Company Filings

Note that in the figure above, the “Income before income taxes” line in 2018 is higher than that of 2017 by only $185 million. However, because the Income tax expense line is so much lower, 2018 Net Income to date is nearly $1 billion higher than during the equivalent period last year.

I expected to see this difference — the statutory tax rate was cut from 35% to 21%, so the difference would have to show up here.

However, my expectation was that this (non-cash) tax expense would be reversed out on the Statement of Cash Flows as they were during the first year for the new tax law to take effect — 2017. In my review of 4Q17 and FY17 earnings, I pointed out that despite the huge drop in statutory tax rates operating cash flows had actually dropped because line items related to tax showed as a cash outflow.

In contrast with my expectations, I was surprised to see that line items related to taxes on the Statement of Cash Flows showed as a cash inflow rather than an outflow.

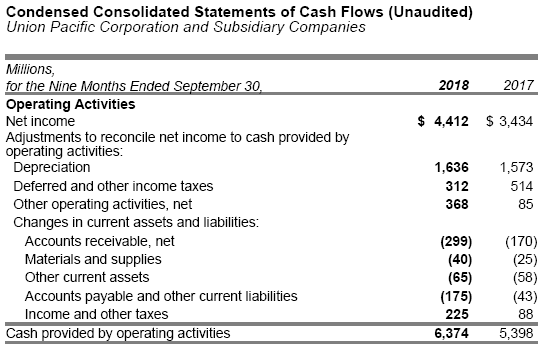

Figure 2. Source: Company Filings

The two line items related to taxes in the figure above were both positive and summed to a cash inflow only $65 million less than the first nine months of last year. Because of this, Cash provided by operating activities is, like Net Income, roughly $1 billion higher this year than last.

In terms of Union Pacific’s effective tax rate, the firm paid $845 million for the first three quarters of the year. Applied to the firm’s pre-tax income of $5,725 million, we calculate a rate of 14.75%.

After combing through announcements by the Financial Accounting Standards Board (FASB) and other industry groups, I finally realized the answer.

Namely, the “Tax Reform” law did not reform the tax system, it merely lowered the statutory rate. According to this study, published by the University of Pennsylvania’s Wharton School of Business, the Tax Act of 2017 lowered the statutory rate, but did not close many deduction loopholes.

For firms in the transportation industry, the study predicts an effective tax rate under the new regime of 15.97%, in the ballpark of what Union Pacific has paid this year.

The Wharton study suggests that as provisions of the tax law expire over time, the effective tax rate for firms will head up again. In light of this realization, I will be redoing my model and do not have confidence that a bearish position in the stock is still justified.

I will send another alert when the updated model is complete.