This month, we screen for attractive “bond replacement” investment candidates using new holdings of Wedgewood Partners (RWGIX), a $3.9 billion fund based in St. Louis and run by David Rolfe.

This fund did a lot of selling during the first quarter of the year – as I noticed a few other prominent investors were doing – so we have selected only the top six stocks that Rolfe reported purchasing in the first quarter of 2017 based on two criteria:

- Stocks listed represented more than 2% of the portfolio’s value

- Stocks listed had been bought by the fund in the reported quarter

These conditions were to screen for the stocks in which the managers had demonstrated the most confidence (by portfolio weight) and about which they had made an active decision to invest. As we explain in our video introduction to “Bond Replacement” investments, we are using the portfolio manager’s investments as an indication of undervaluation.

Out of the six investments here, three are trading at a price lower than the price at which the fund reported transacting during the previous quarter (the name is linked to a one-page report from YCharts, the ticker to the stock’s current pricing page on YCharts):

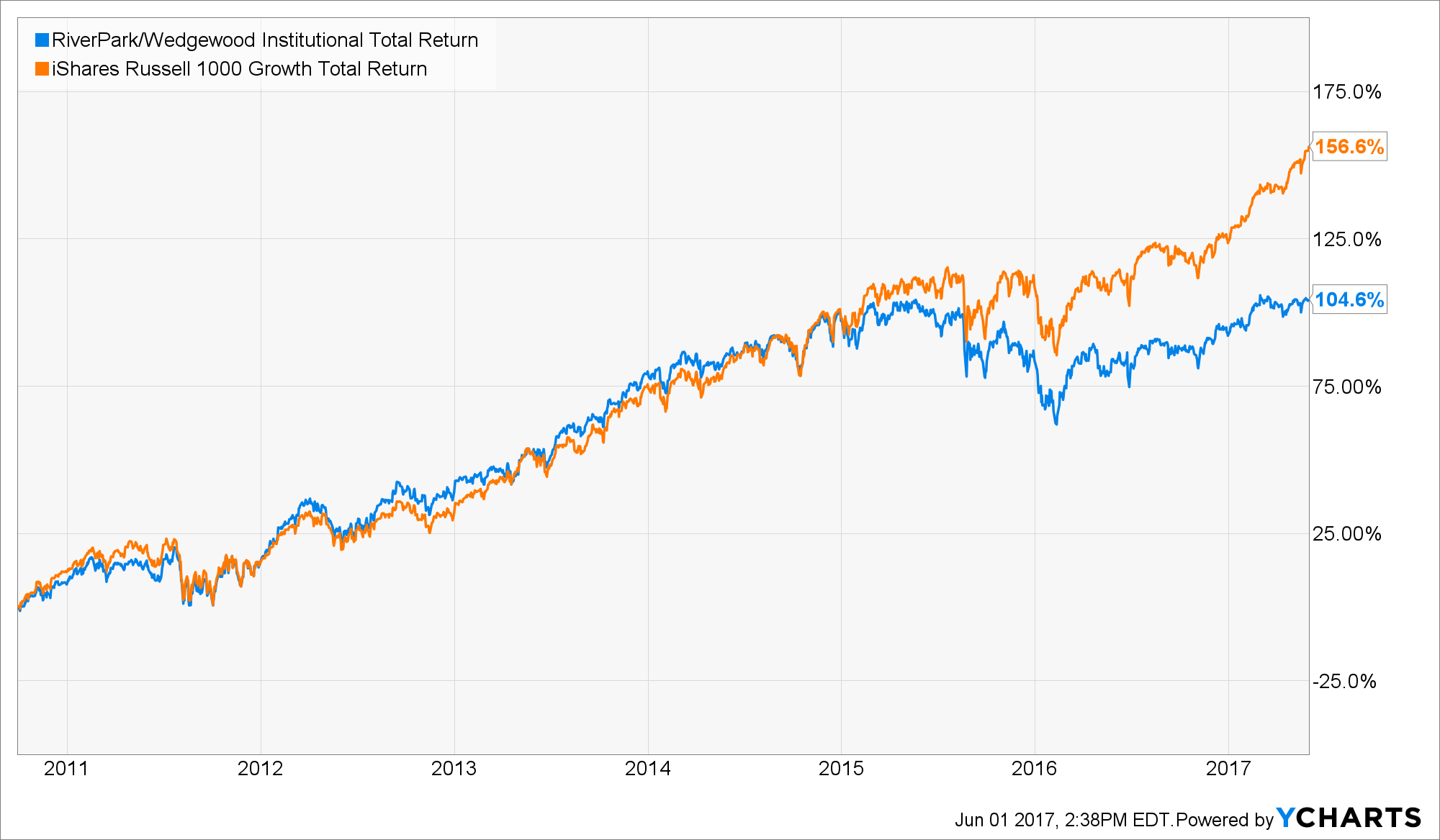

Morningstar’s report on this fund may be found here, and the 1Q2017 investor letter for the fund may be found here. Morningstar likes the process the fund uses and its manager, Rolfe, but points out that performance has lagged recently.

Performance of the fund versus its benchmark, the Russell 1000 Growth index

Setting aside Alphabet and Edwards Lifesciences, the per-share prices of the remaining stocks are fairly low, making bond replacements using these shares possible for smaller portfolios.

Please reach out if you have any questions about this spreadsheet!