This video is about investing, but a lot of people muddle the word “investing,” so I prefer to think of this as a video about “ownership.” One of the nice things about using the word “ownership” is that it is clearly distinct from “speculation.”

We know that an owner…

- Understands the business that he or she is in

- Can make reasonable plans about that business and forecasts about how that business is likely to do under different conditions

- Has a long-term perspective.

Let’s contrast that with the speculator, like somebody who walks into a casino, who…

- Basically operates by simple rules of thumb and those rules of thumb may or may not work but in fact may just be a kind of a superstition

- Has no real plan and no real ability to plan, except to say okay “When I run out of this $500 I’m not going to go to the ATM again.”

- Is not operating on a long-term perspective but more doing things for a short-term thrill.

When we’re talking about investing in a company, we are talking about approaching an investment in the same way that the owner of a flower store, for instance, may have approached her investment. IOI wants to create intelligent owners, in other words.

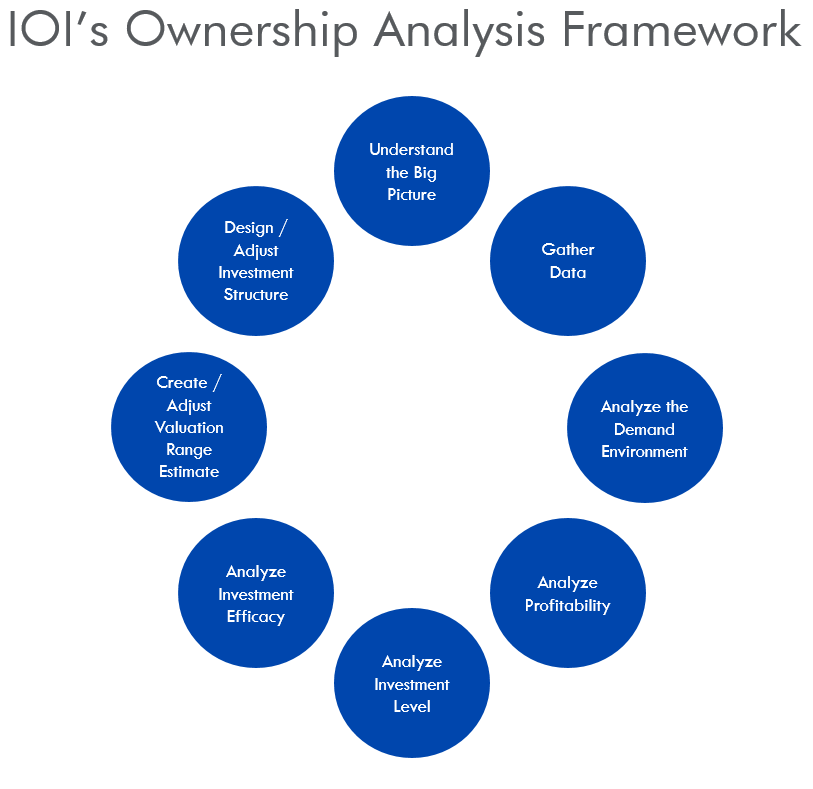

How do we do that well, with a sensible framework? This video explains the steps of that framework one-by-one. The Mini-Course on Gilead Sciences – available to IOI Members – walks through each of these steps, and helps you understand how to apply the framework when looking at it a single particular company.

The first step is understanding the big picture. This means understanding something about the company history what they do right now, what some of their issues are and so forth. It turns out that a lot of people, even people who consider themselves value investors never get really past this point. They kind of understand what the company does they might understand some relative multiples or something like that but really they only understand okay this company makes drugs or this company explores for oil and so mainly their ownership of their investment stake is based upon anecdote and feelings and we want to go beyond that in IOI.

The second step in our process and first step in going beyond anecdotes is gathering data. There’s a lot of data about companies and it’s really valuable. We want to get historical data related to the things that really matter to the owner of a business:

- Revenue growth,

- Profitability, and

- The investments that the company makes.

We also try to dig up something about segment or geographical data if the company offers it. We need data to make good decisions. We’re going to be making some forecasts for the company and how it will operate in the future, so if we don’t have a good handle on the historical data we won’t be able to make good forecasts.

The next step in the process and the first step in the forecasting process is analyzing the demand environment. The outcome of this step is a forecast of best and worst-case revenue growth rates. The demand environment really creates the revenue growth and the other goal of this is to identify underlying business drivers.

The next step in the process is to analyze profitability. Again, what we want to do is come up with best- and worst- case profitability scenarios, and we talk about profitability in the IOI sense of Owners’ Cash Profits (OCP). The other goal of doing this is to really understand how profitability has changed in the past which will in turn, help inform our forecasts for future best- and worst-case profitability scenarios.

The next step is to analyze how much the company is spending on investments. We’re going to do that in a very particular way, by saying how much of the company’s profits – the OCP – is the company spending on investment projects.

Once we have a sense for how much the company spending on investments, we need to figure out what the historical efficacy of their investment program has been and what the future efficacy is likely to be. This ties into is forecasting best- and worst-case medium growth assumptions for this company’s profits and cash flows. If investments are made skillfully, then in the medium-term, the cash flow from this company will grow very quickly and if not then cash flow will lag.

Once we have all of these estimates made – both the short-term and the medium-term estimates – we can go on and create a valuation range for the company. Once we have created our valuation range, we can go back and take a look at our individual operating scenarios and see whether they make sense together or not; this is what I mean when I say “adjust the valuation range” on this slide. You can read more about this in my book – The Framework Investing – and in the online appendix that deals with creating complex valuation ranges.

The last part of the ownership process is to design an investment structure. Once we understand the company and can make good forecasts about it, we are able to be good and knowledgeable owners. Now is the time when we decide how we want to go about structuring an ownership stake in this company. We do this by looking at a comparison between the price range that’s forecast by the markets to the valuation range we derived in our last step. Doing this, it’s a pretty simple matter of designing a structure to profit from any difference between price and value.

You might notice that in all of this, I’m talking about best and worst cases and I’m talking about valuation ranges. These two interrelated elements are really an essential part of the IOI Ownership Analysis Framework. Using this framework, we’re not stuck on getting the single right answer, but in fact at looking at a company’s value as a range. In my experience, this is the most practical and the realistic way of assessing the value of a company and deciding whether it is worthy of investment or not.