On October 27, 2016, we published an IOI Tear Sheet recommending a bearish investment in Garmin (GRMN), a company making navigational devices for retail and industrial markets. The options in the structure we featured in the Tear Sheet expire today (1/20/2017) and as they are Out-of-the-Money (OTM), we will be able to realize the entire net premium received. The success of this investments allowed us to generate period returns of 23% (annualized returns of 139%); not bad for a bearish investment in a generally rising market.

We wrote several public articles about Garmin (Three Things an Investor Should Know about Garmin, Garmin’s Hidden Revenue Growth) and published research to our members which can be found in the Research section of our site.

Valuation and Investment Structure

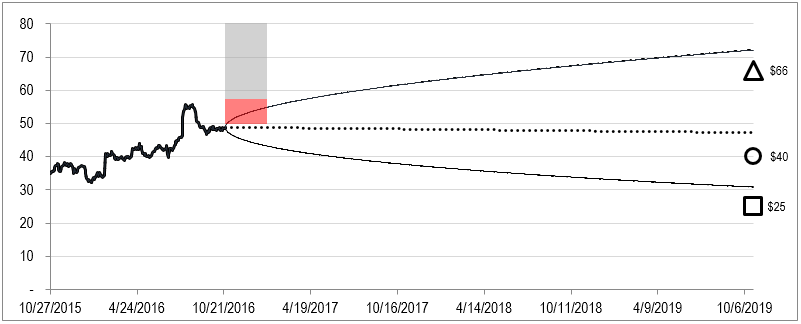

This bearish investment was structured as a “short call spread” – which amounts to us receiving a fee in exchange for accepting the risk that the company’s stock price might rise. This is expressed by selling a call option – in this case, with a strike price of $50.00 per share – and covering our upside risk by buying a call option at a higher strike price – in this case, $57.50. An graphic illustration of this investment is shown here:

Figure 1. Source: CBOE, YCharts, IOI Analysis. Geometrical markers show IOI’s best-case (triangle), worst-case (square), and equally-weighted average value (circle). Cone-shaped region indicates option market’s projection of Garmin’s future stock price. Shaded region represents the sale of a call option struck at $50 / share and the purchase of a call option struck at $57.50 / share on Garmin’s stock.

In exchange for accepting $7.50 worth of risk for 85 days, we received $1.69 worth of “insurance” premium. This gave us an Effective Sell Price (ESP) of $51.69.

The BSM Cone diagram above is a bit misleading – showing a best-case valuation of $66 per share. We made the investment for two reasons:

- We believe the $66 per share valuation to be very unlikely, though not impossible.

- Our most likely fair value range worked out to a fair value of $40 per share – 20% below the market price available when we entered the investment.

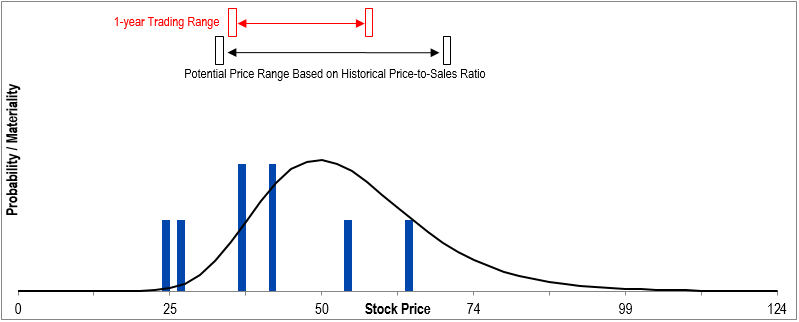

The nuance underlying our valuation is more visible in the Complex Valuation diagram:

Figure 2. Source: CBOE, IOI Analysis. Blue columns show IOI valuation scenarios, with taller bars being, in our opinion, relatively more likely than shorter ones.

Even the valuation in the mid-$50s range implies operational conditions that we think are overly optimistic in terms of medium-term growth, so we were encouraged to make a small allocation to this bearish investment.

Investment Results

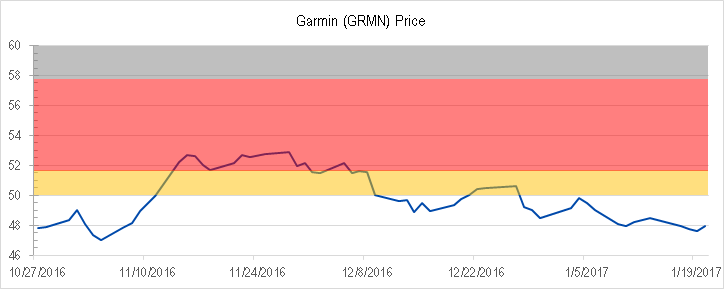

I am convinced that the main function of markets is to drive good people a little crazy – certainly, I have been caught in a more or less permanent double-take in the post-election “Trump Rally.” Garmin caught a bid in the Trump Rally, and I thought this investment was going to be one of my problem children.

Figure 3. Source: YCharts, IOI Analysis. Yellow region shows the range from our strike price to our ESP. The red region shows the range over which we would have had to realize a loss on the investment or open up a short position.

I had personally allocated this investment such that my portfolio would have about a 2% headwind if I suffered a total loss of capital on this investment. I had planned to increase my exposure to this investment if the stock rose to the $55 level.

The stock’s sudden rise post-election made me think that I would have to end up increasing my position size and / or holding a short position in the stock. However, the stock price never got up to the $55 level, and in the beginning of December, it began coming down again.

Today, the stock is trading at $47.66, and since this is below the $50 strike price, the option will expire “Out-of-the-Money,” we will realize the entire $1.69 per share in premium.

While the investment was a successful one, looking back, I would have liked to have increased my position size when the stock was trading in the $52 range. This is the “wonderful” thing about investing: even when successful, there’s always something you can regret doing or not doing…

Loading...

Loading...