This month, IOI is working on a valuation of and possible investment structure for GPS device innovator, Garmin ($GRMN). It originally caught our eye in a screen for companies that had falling revenues and a recent decrease in Owners’ Cash Profits (OCP) with an eye for finding some bearish investments.

Upon digging into Garmin, though, the story is more complex than simply a falling top line and some profit weakness. (Quantitative screens like this have a way of turning up complex stories, which is why we tend not to rely on them much.)

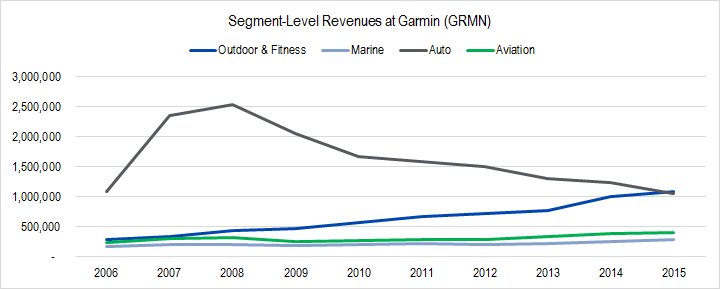

Yes, the top line has been pretty stagnant since 2009 (average year-over-year revenue drop of 3%) – consistent with the common wisdom that people use smart phones in lieu of special purpose GPS systems.

However, looking through Garmin’s revenue split out by product line, we found a surprise.

Figure 1. Source: Company Statements, IOI Analysis

Most of the revenue stagnation has been caused by a drop in revenues related to its Automotive product line, while the Outdoor & Fitness product lines have been growing at a good clip. Outdoor & Fitness now make up a larger revenue share than Automotive.

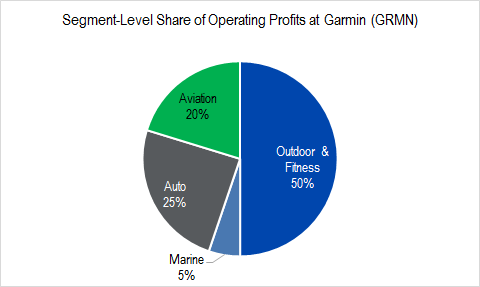

What’s more, the Outdoor & Fitness line carries with it a significantly higher margin than the Automotive (and other) lines, so is even more important in terms of operational profit.

Figure 2. Source: Company Statements, IOI Analysis

With a five-year rolling growth rate in the mid-teen percentages and operational profits about ten percentage points higher than the average of its other product lines, Garmin’s Outdoor & Fitness franchise is the company’s new crown jewel. The essential question is whether margins in this business can remain high given the fierce competition from niche companies like Suunto and mobile computing companies like Apple.

The answer means a lot in terms of valuation and a possible bearish investment, and we will be publishing an IOI Tear Sheet to our members this week with our conclusions.