Long-time subscriber, Wilson M. recently sent me an email asking what I thought of Bristol-Myers Squibb’s BMY valuation. Without digging into the company’s drug pipeline, I just looked at historical numbers to try to get a sense of the relative valuation.

Our valuation framework focuses in on a handful of fundamental drivers, of which there are only three main ones in the short-term and one related one in the medium-term. We’ll work through each one-by-one.

Revenues

Bristol-Myers has been in the news recently because of its cancer treatments, but its drugs treat a wide range of conditions.

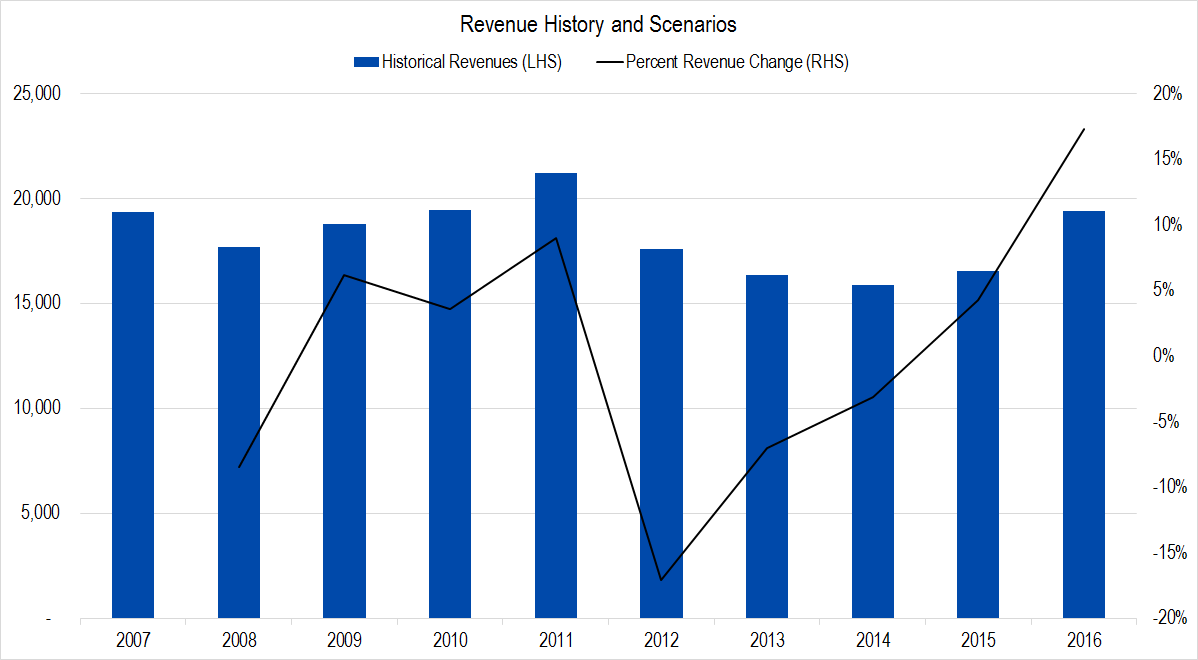

Figure 1. Source: Company Statements, Framework Investing Analysis

In this graph, we can see from the black line showing revenue growth rate that the 2016 was a good year for Bristol-Myers Squibb; that’s largely due to big revenue increases in Opdivo – a cancer drug – and Eliquis – a cardiovascular treatment.

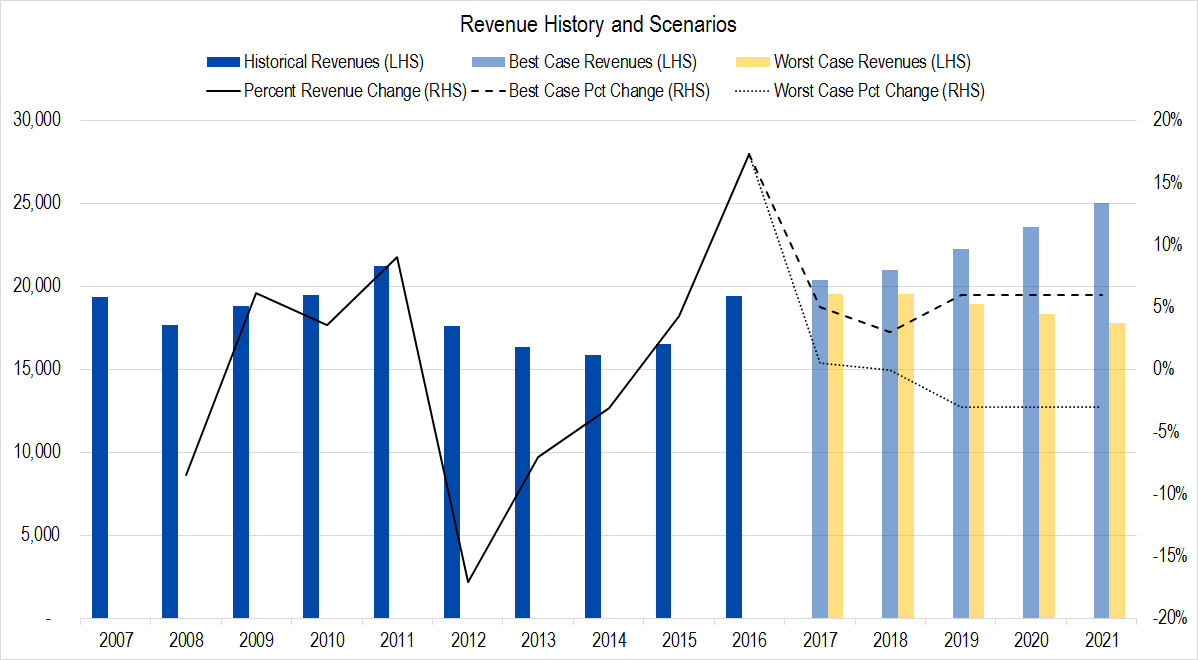

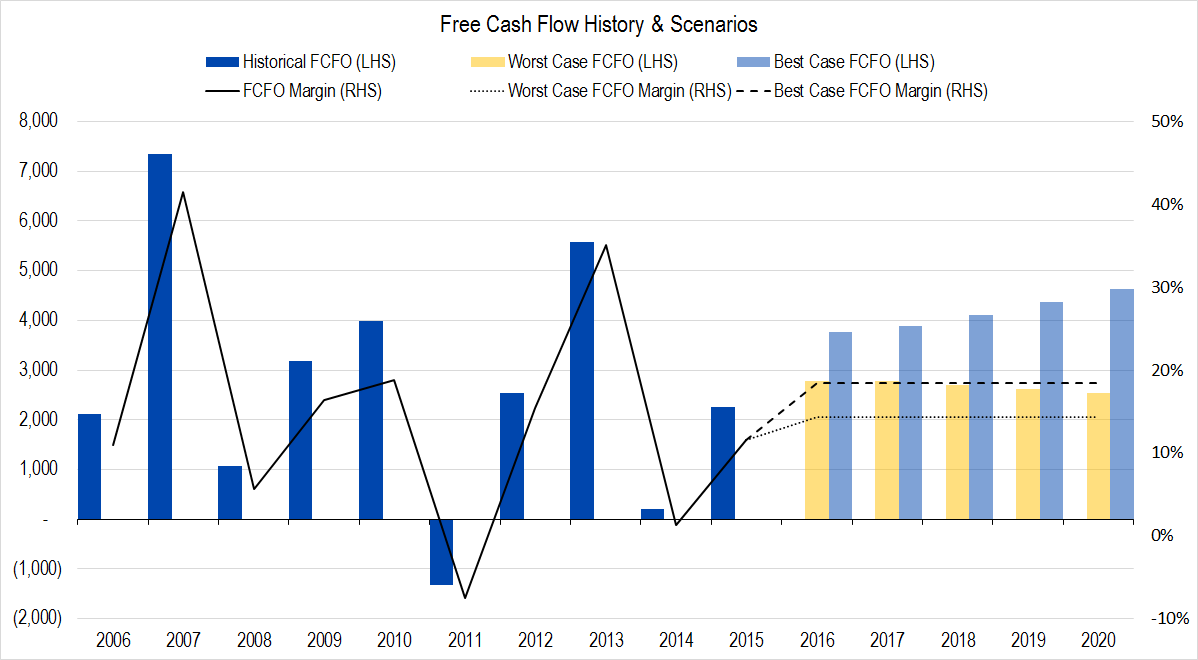

It is hard to forecast revenues for a drug company without understanding the firm’s pipeline and patent expiration cycle, but the best 3-year rolling revenue growth rate over this time was 6% per year and the worst 5-year rolling growth rate was -3% per year. We are using analyst estimates for 2017 and 2018, then plugging these historical rates in for the next three years. This gives us an average growth of 5% per year in the best case and an average contraction of 2% in the worst.

This is what our graph looks like now – light blue columns being best-case, yellow columns being worst.

Figure 2. Source: Company Statements, Framework Investing Analysis

Profits

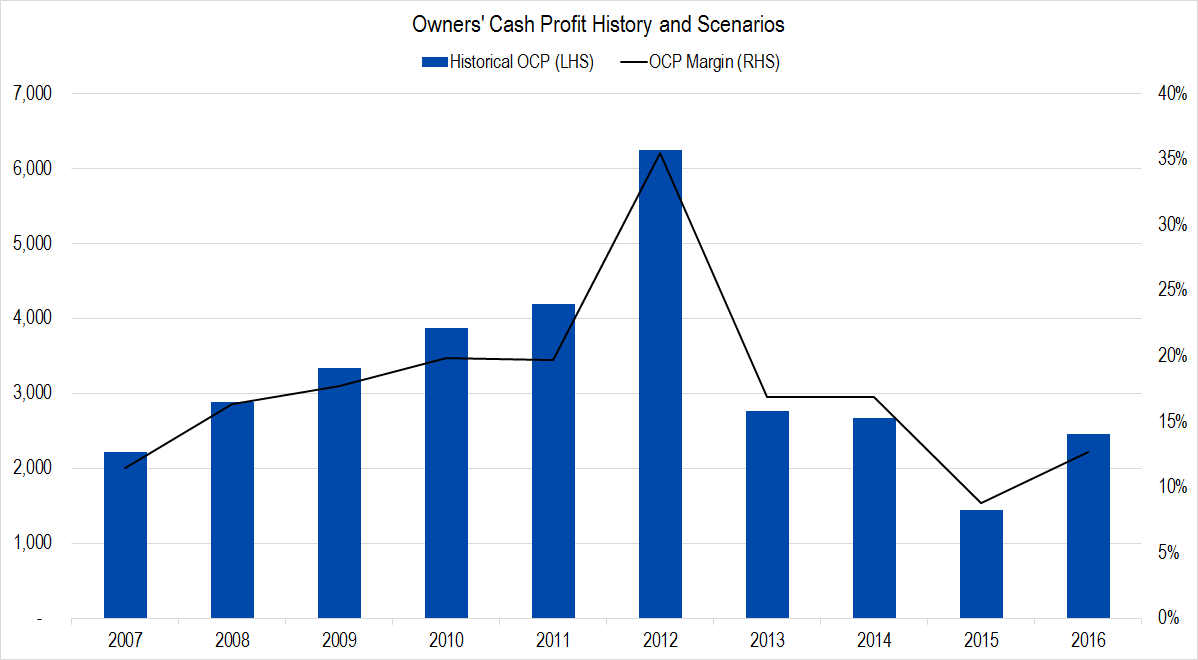

Our preferred metric is called Owners’ Cash Profits – OCP – which is based on the firm’s cash flows.

Figure 3. Source: Company Statements, Framework Investing Analysis

The most noticeable thing about this graph is the big bump in 2012. That was a one-off cash flow from a partner related to a diabetes drug. We incorporate that one-off into our average profitability calculation and forecast best-case profitability of 22% OCP margin and worst-case of 17%. Making the change in our model creates a graph like this.

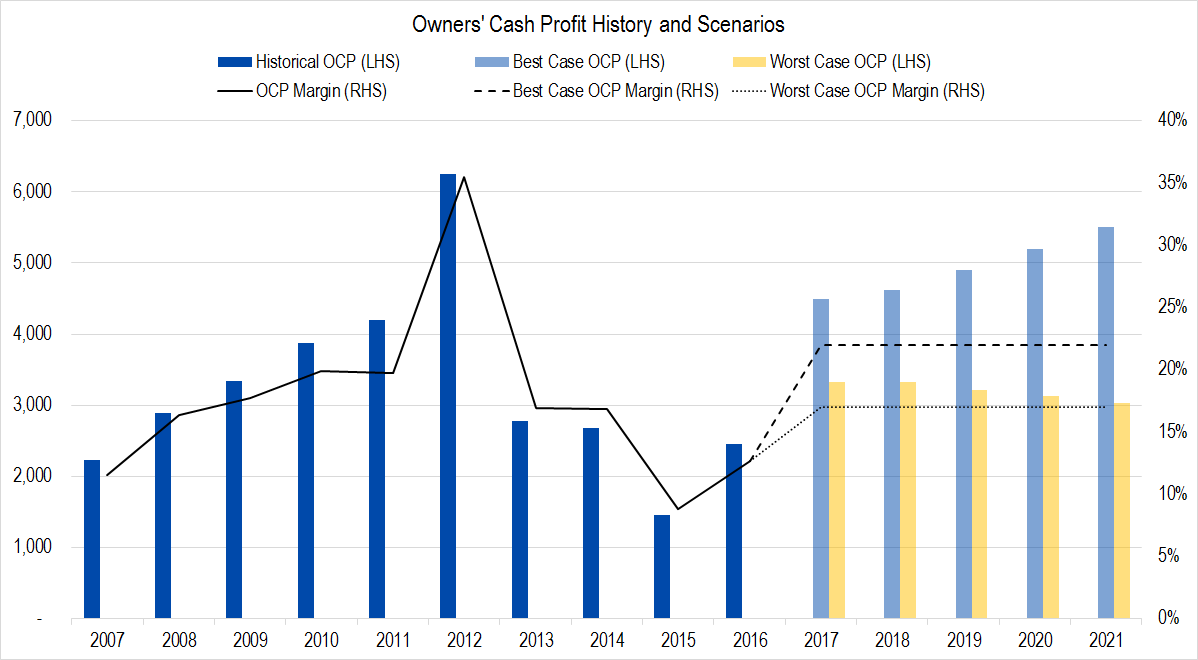

Figure 4. Source: Company Statements, Framework Investing Analysis

Investment Spending

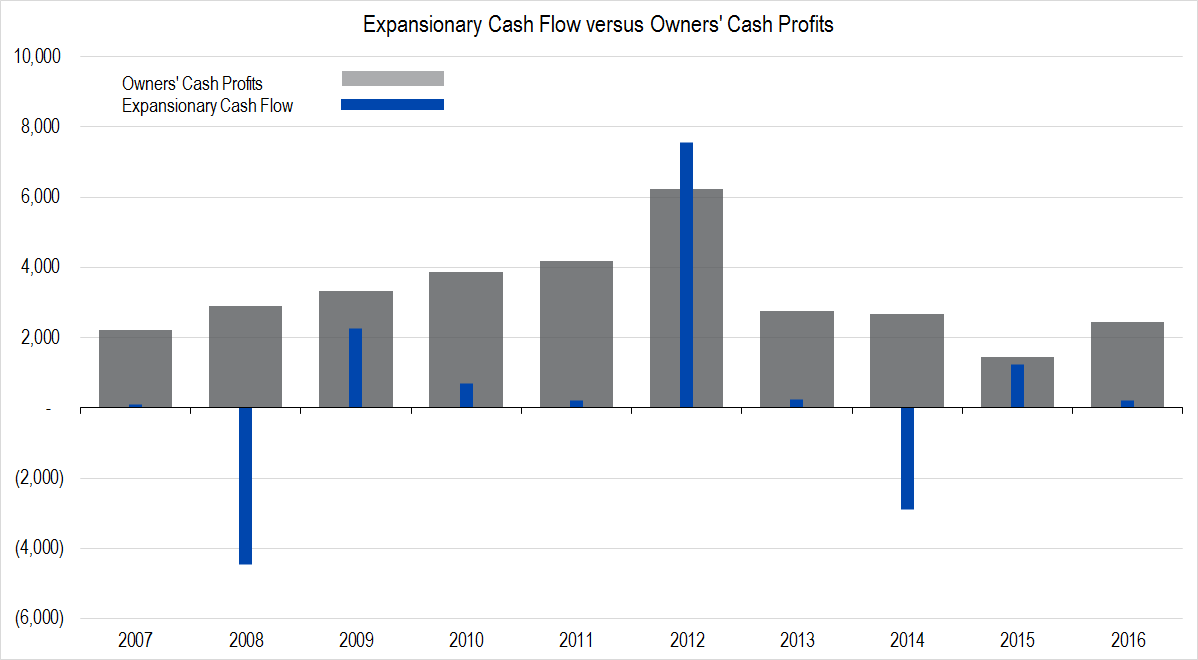

In this graph, the wide gray columns represent Owners’ Cash Profits generated by the firm and the blue columns, the amount the company spent on investments. Must of Bristol-Myers’ investments involve acquiring smaller drug companies; it has also been selling off non-core brands.

Figure 5. Source: Company Statements, Framework Investing Analysis

Including both acquisitions and divestitures, the company has been spending about 16% of its profits on investments. If we assume this investment level will continue into the future, we figure the firm will be generating between $0.14 and $0.18 of Free Cash Flow to Owners (FCFO) for every dollar in revenues generated.

Figure 6. Source: Company Statements, Framework Investing Analysis

Medium-Term Growth

Again, without understanding the firm’s drug pipeline, it is hard to make a determination on medium-term growth. However, looking at historical growth in profits and FCFO, we’re using 10% per year growth as our best-case estimate and 10% per year contraction as our worst-case.

Valuation

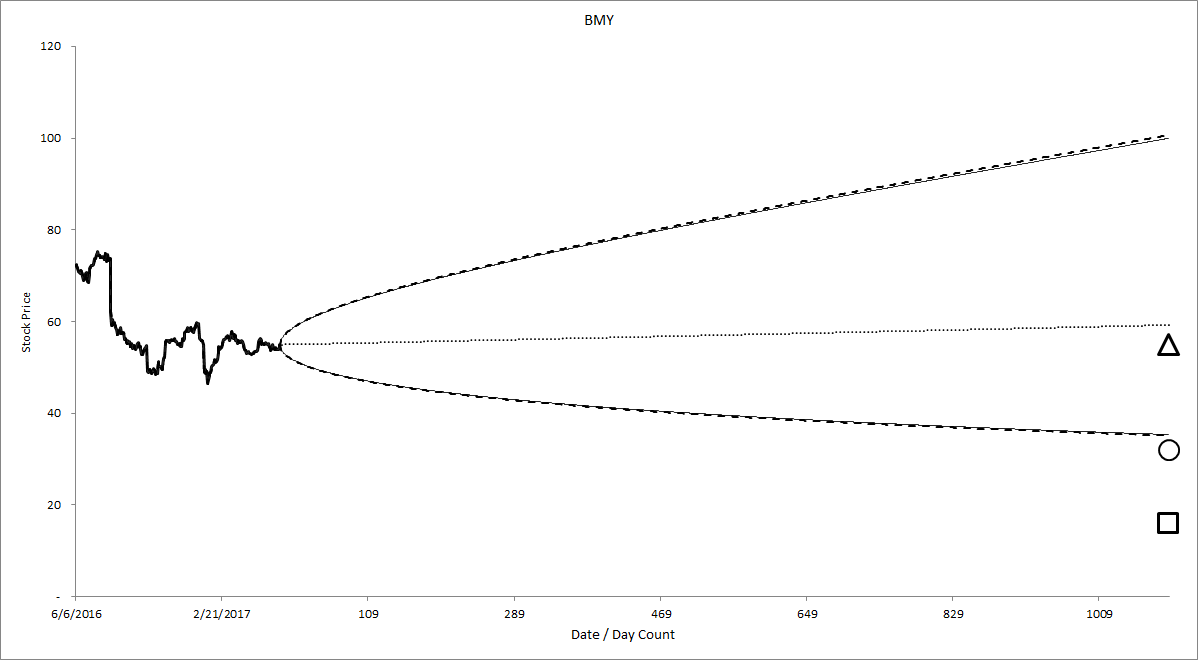

Pulling this all together gives us a best-case valuation of $55 and a worst-case valuation of $16 per share with an equal weighting of all our eight valuation scenarios at $32 per share.

Figure 7. Source: Company Statements, Framework Investing Analysis

This valuation range is obviously much lower than what the option market is forecasting for Bristol-Myers’ future price range. If I were a Bristol-Myers shareholder, I’d be worried about this valuation and want to sharpen my pencil especially on its pipeline. This valuation mainly uses historical growth rates on which to base our projections, and good valuations can’t be done by looking only in the rear-view mirror.

In looking through Bristol-Myers’ financial statements, I noticed that two of its three Stage III drugs will be competitors to Gilead’s hepatitis-c and HIV franchise, so those of you who are interested in Gilead would do well by learning a bit more about Bristol-Myers!