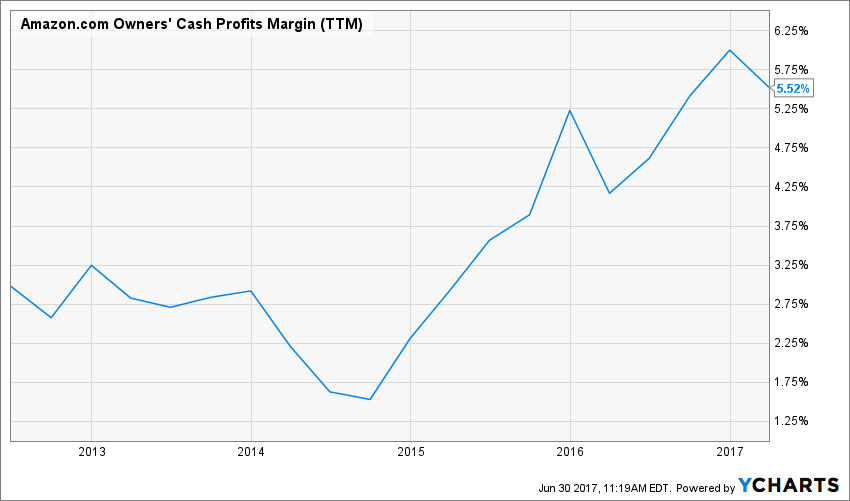

The other day, I wrote an article about the only two forms of investing arguments that exist – “things will get better” and “things will return to normal” – that looked at Kroger and Amazon as case studies. When I pulled up a chart for Amazon’s Owners’ Cash Profits (OCP), I was shocked to find how much margin expansion it has enjoyed over the past few years as a result of its investments in Infrastructure-as-a-Service (IaaS) in the form of its Amazon Web Services (AWS) offering.

Figure 1.

This interested me enough to gather some data and start to look at a valuation. Amazon has some peculiarities to the way it operates, one of which – net working capital “float” – I wrote an article about back in 2013 (note, in this article, I use the phrase “economic profits” to mean “OCP”).

I’ve adjusted my calculation of OCP for this issue of “float” and included cash it pays as a principal repayment of “capital lease” transactions as an investment expense.

With everything going on at Framework right now, I haven’t done the valuation, but for those of you who are interested, here’s the model without any projection assumptions filled in.

Stop by Office Hours if you have questions about how I handled OCP!