We have published a new IOI Tear Sheet on Amazon (AMZN). This article provides more color on our valuation of the company.

Cash Flow from Operations and Net Working Capital

Generally, IOI uses Cash Flow from Operations (CFO) as a base for estimating the economic profit generated by a given firm. CFO can be thought of as the cash earnings for a firm in a given period, and is made up of several components, including changes in working capital (See Wikipedia’s articles on CFO and on net working capital).

Working capital reflects decisions made on a tactical level by management, and can have a large impact on short-term results. For instance, if managers believe a new product will be a huge success, they will spend shareholder cash building up inventory levels to meet expected demand. If that demand does not materialize, that cash was misspent and wasted.

For some firms–especially smaller, rapidly growing ones–working capital turns out to be a limiting factor to further growth. They experience great demand from clients, but cannot meet this demand due to their lack of hard cash or inability to get the short-term credit needed to build up the required inventory.

Amazon’s Float

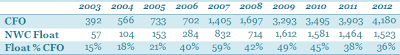

Compared to this Sisyphean situation, Amazon is truly fortunate. Its customers pay by credit card and credit cards pay Amazon once a month. Amazon pays its suppliers less often–on the order of once every two months. This means that Amazon has roughly 30 days of “float”–an interest free loan–from the time it collects money from a customer to the time it pays its supplier. It also means that Amazon’s annual CFO is boosted by the amount of this float. Over the past few years, the percentage contribution of this float to CFO has looked like this:

|

| Source: Company statements, IOI Analysis |

In other words, over the past five years, the contribution of this float to CFO has been anywhere between over a third to nearly a half.

Is Amazon’s Float Free?

Most fundamental analysts use some form of CFO as a basis for the calculation of free cash flow (FCF)–the quantity on which they base valuations. Indeed, as mentioned above, IOI uses CFO as a starting point to calculate economic profits and free cash flow.

If the float is included in our FCF calculations, the value of the company would be boosted by that amount. But is including the float in CFO and FCF the right thing to do?

FCF should represent the cash that is theoretically available to be distributed to shareholders–this is indeed the meaning of “free” in “free cash flow.” Clearly, the net working capital float is not free to shareholders– Amazon must pay suppliers around 30 days later than they receive their customer’s cash.

Indeed, Amazon enjoys strongly positive CFO every fourth quarter (when annual results are reported) thanks to consumers shopping for holiday gifts in November and their credit card companies paying in December. However, one quarter later, this effect reverses and Amazon sees strongly negative CFO.* Certainly, we would not expect true free cash flows to shareholders to be reversed out in this way.

Valuing Amazon’s Float

Following this reasoning, it is clear that we should not consider Amazon’s float as a part of its FCF. However, to completely ignore it would be tantamount to calling it valueless, and valueless, clearly it is not. If its own customers were not giving Amazon an interest-free loan each credit card payment cycle, Amazon would have to use its own cash or borrow short-term funds from a bank in order to operate.

To solve the Amazon riddle, we have accounted for its float not as a “flow” number, but as a “stock” number. In other words, we have not assumed this cash is a repeating, distributable stream, but rather modeled it as a “hidden” store of cash that is not reflected on the balance sheet. After deducting the float from CFO, we calculate FCF based on our projections and discount those true flows back to the present. Our last step is simply to add the “hidden” cash onto the value of the discounted future cash flows to derive our final valuation. The “hidden” store of cash is modeled as a gross-up proportional to the adjusted CFO we are projecting in the last explicit forecast year, discounted to the present.

NOTE:

* The largest source of net working capital float is not actually this timing difference between accounts payable and accounts receivable, but rather gift cards purchased but not yet redeemed. Because Amazon has not fulfilled the obligations of the gift cards they sell during the holiday season, it cannot “recognize” those purchases as revenue (Here is Wikipedia’s explanation of Revenue Recognition). So the cash inflow associated with gift cards doesn’t get counted in income. However, because it is a cash inflow, it is recorded on the statement of cash flows. This gift card effect actually has made up 70% of the net working capital float over the last two fiscal years.

fantastic example of how insightful accounting can have an impact on company valuation!

Thanks much–Glad you liked the piece. -Erik