There are only two arguments in support of any investment position:

- Business conditions are exceptional now, but will return to normal eventually

- Business conditions will become exceptional in the future

When you are entering an investment, it is essential that you mentally check which argument you are making and whether you have enough evidence or reason to use that argument. I forgot to do this and missed out on a good opportunity – twice!

Kroger Case Study

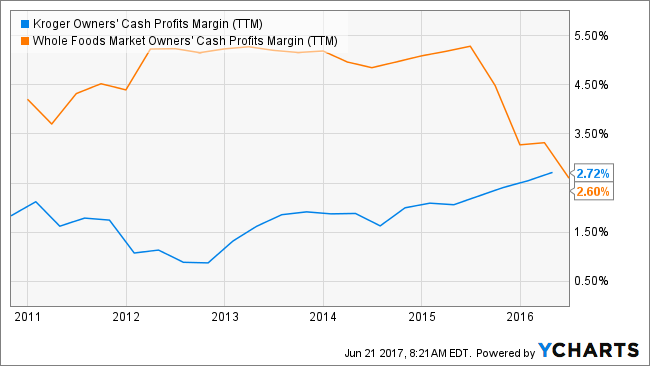

When I made a valuation of Kroger in 2016, I was impressed by how well-run of a company it is. I saw how it had used its much denser network of stores to steal share in organic groceries from Whole Foods Markets (WFM). (See also our Five-Minute Valuation of Kroger video on YouTube).

This change benefited Kroger at Whole Foods’ expense.

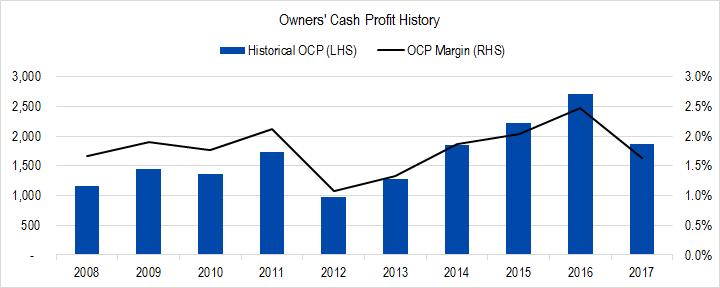

Figure 1

When I made my valuation of Kroger, I assumed that Kroger would continue to enjoy an exceptional rise in profitability from its historical 1.5% – 2% range to the 2.5% – 3% range.

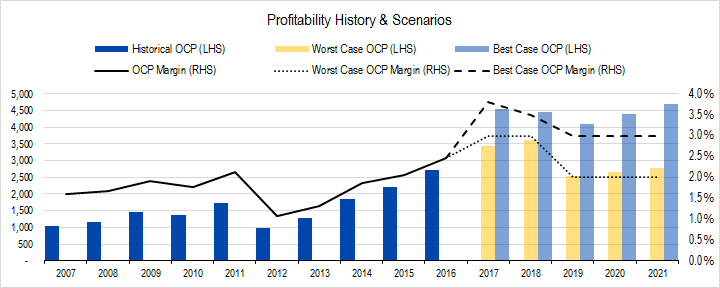

In graphical format, my assumptions for best- and worst-case profitability looked like this.

Figure 2. Source: Company Announcements, Framework Investing Analysis

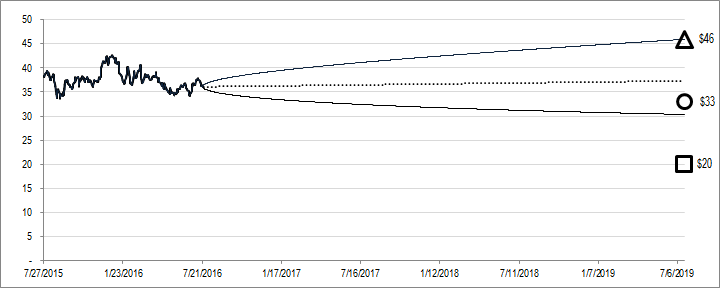

This assumption equates to the assumption that “business conditions will become exceptional in the future” and led to a wide valuation range that looked like this.

Figure 3. Source: CBOE, Framework Investing Analysis

Even though the worst-case valuation scenario (indicated by the square in the figure above) was much lower than the price at that time, I considered that scenario unlikely considering how good of an operator Kroger is.

As time moved on and actual results came in, it was clear that I had been wrong in my fundamental assumption that Kroger’s profit was in the process of becoming exceptional. Instead, they had been exceptional and were in the process of returning to normal, as we can see in this graph.

Figure 4. Source: Company Announcements, Framework Investing Analysis

Notice how, in contrast with my expectations for the year ending in January 2017 for profitability to rise to above 3.5% (early data for that year was running at that high rate) shown in figure 2, actual 2017 margins fell back to the 1.5% range.

Unfortunately, I was not following Kroger closely enough and did not look at this graph when fiscal 2017 numbers were announced. If I had been, perhaps I could have changed my stance and recommended a bearish position in the stock. A position which would have come in handy the other day:

Figure 5

Amazon Case Study

It has been a few years since I analyzed Amazon. At the time – in 2013 – the value investing community hated the company. A lot of prominent managers were critical of the company and some were short Amazon shares. The main complaint was that Amazon was consistently generating a loss, so there was no way the share should rise.

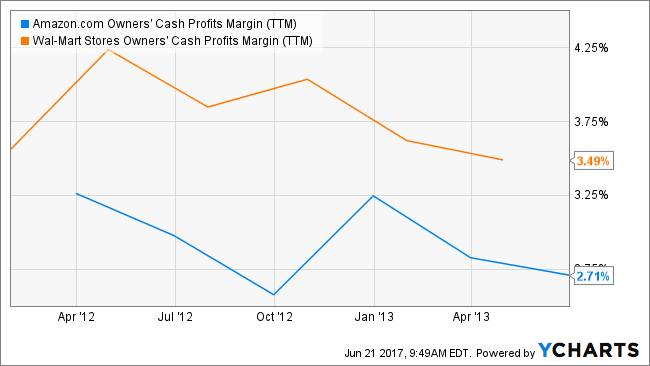

However, when I analyzed Amazon through the lens of our preferred cash-based profit metric, Owners’ Cash Profits (OCP), it looked to me that, on a cash basis, Amazon’s profitability was similar to that of Wal-Mart (WMT).

Figure 6

When I saw this chart, I thought that Amazon’s profits were exceptional low only because its business was growing so quickly and that. Over time, I reasoned, the company’s profits would “normalize” to around the level of those of Wal-Mart – Amazon’s closest discount retail competitor.

In other words, I was using the assumption that things were exceptional now, but would return to normal eventually.

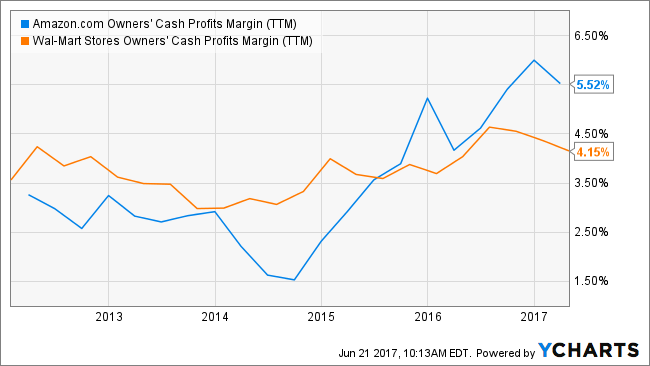

Imagine my surprise when I looked at a chart of Amazon’s OCP the other day, when I was thinking about its acquisition of Whole Foods’:

Figure 7

Amazon is no longer just a discount retailer – it is now a technology Infrastructure as a Service (IaaS) provider through its Amazon Web Services (AWS) offering.*

Looked at from this perspective, its margins back in 2013 were “normal” and now, are headed toward exceptional. This is a fact I missed when I first looked at the firm then. I have started a project with an institutional investor client to value Amazon, and will reframe my investment argument about the company to think of it as a firm that is becoming exceptional.

* With Alexa, it has even become an electronics device company, one which was able to out-innovate Apple with its introduction of a desktop personal assistant box.

This article originally appeared on Forbes.com