The media world was put on notice earlier this month when Disney (DIS) — after apparently years of talking about it in dark, smoke-filled rooms — decided to acquire a majority of 21st Century Fox’s (FOX) production and content assets.

This article walks through what we found in our valuation of FOX, provides our initial take on why its value might be higher if managed by Disney, and provides a copy of the Framework Valuation Model for Fox. You can discuss our research on Fox on its Framework Forum thread.

We had valued Disney in November/December of last year and arrived at a range of values between $67/share and $110/share vs. a current market price of ~$111/share; the company is operating today at the top of our valuation range.

As we pointed out last month, Disney is a wonderful company and a skilled operator in the media and entertainment industries. No question about that. The best indication of its outsized skill is its repeatable revenue growth and strong OCP margins – running in the 15%-17% range.

The FOX acquisition is particularly interesting to us because it implies a series of things about what Disney thinks its good at and where they see themselves headed in the future. The obvious questions are, “What is FOX worth?” and “What is the value of the parts of FOX that Disney is acquiring?”

What is Fox Worth?

We have built an initial model for FOX attached below. We invite you to download the model yourself and walk through the details, but this will likely be the subject of next week’s Office Hours.

Our valuation of FOX relative to the market price is eerily similar to Disney in that our first take on the range of values is between $19/share and $31/share against a market price of ~$35/share. It appears that Fox is — like Disney — operating near the top end of its fair value range.

In the process of our analysis, we learned some interesting things about FOX.

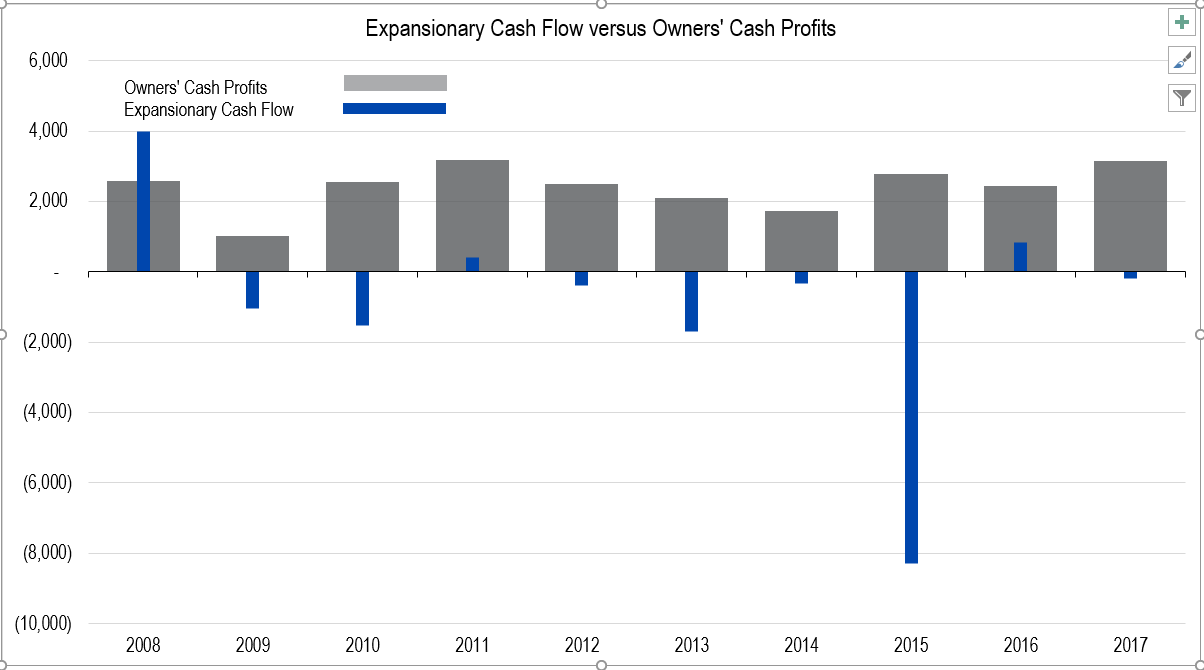

First, we found that the company has been shedding non-core assets at a prodigious rate over the last decade. Looking at the graph of net expansionary cash flows, you can easily see that the Company is raising cash vs. spending it.

Source: Company Statements, Framework Investing Analysis

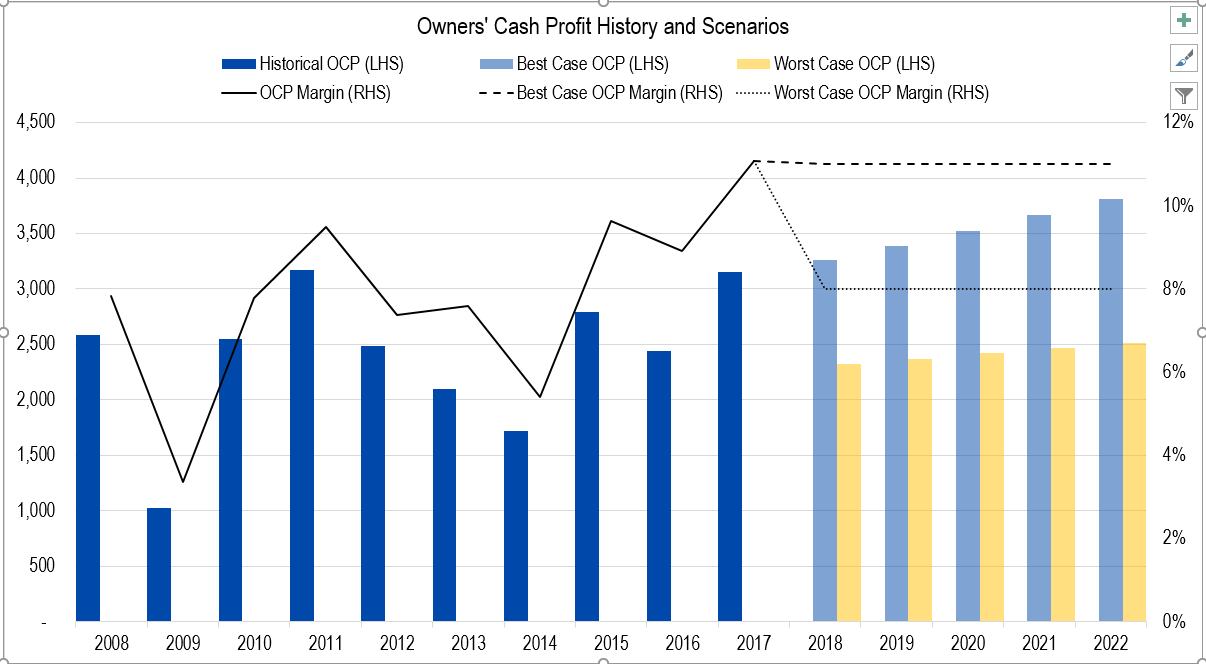

Second, we noticed that Owners’ Cash Profit margins have shown a marked improvement over the last 5 years; they now fairly consistently run in the 10% range after hovering around 7% prior. That’s 300 bps of margin improvement on around $28 billion of revenue.

Source: Company Statements, Framework Investing Analysis

Last, we noticed that a careful analysis of where FOX is spending its money suggests that it is focused on content distribution. The following comments come from my analyst partner, Deep Gada:

…recent acquisitions by Fox include MAA Television networks in 2015, 7% interest in RSN in 2016, trueX media inc. in 2015 and San Francisco-Bay Area Television Stations in 2014.

As you may already know, FOX has tendered a bid for all of the rest of the stock of SKY, plc that it doesn’t already own (FOX owns ~47% of SKY). That deal is under some scrutiny in Europe and will be reevaluated by regulators after the Disney deal closes. FOX’s investment spending point to it’s future as a content distribution channel owner vs. as a content creator.

What Are FOX’s Bits Worth to Disney?

Our valuation analysis of the present-day FOX gives us an idea of what FOX’s production and content assets are worth under the control of FOX. However, these assets might well be worth more under the control of Disney. While we haven’t taken this analytical step yet, we do have some initial impressions.

Thus far, it looks to us that FOX is good at news and distribution, but not as good at content. Content is really Disney’s forte. Because of this, we think that FOX’s studio and library would be more valuable under Disney’s control than under FOX’s.

To see why, recall that even though FOX has been able to increase its profit margin mightily over the past few years, its improved margin is still around a third lower than that of Disney’s. If Disney can successfully convert more of the FOX production and content revenue stream to profits, it follows that the value of those assets are higher.

We will keep working on our analysis, but this is a description of the DIS / FOX transaction, for your information.

On December 14, 2017, Fox announced plans to sell a package of entertainment assets to Disney. The transaction will be structured as a taxable spin-off of assets expected to stay with FOXA shareholders “New Fox” with the remaining assets “21CF” will merge with Disney in exchange for DIS shares. In short, FOXA shareholders will receive $30 per share in DIS stock and shares in New Fox…

Disney is offering 0.27455 shares of DIS per FOX/FOXA shares and assuming $13.7 billion in debt. All in, Disney is paying 11.9x EBITDA for the assets which include: National Geographic, FX/FXX, the 20th Century Fox film and television studio, Star, Hulu, a 39% stake in Sky PLC, a portfolio of regional sports networks, and other non-consolidated assets.

Disney expects to close the transaction in 12-18 months and realize at least $2 billion of synergies within two years of closing. The deal should be accretive to Disney beginning one year after the close. Disney plans to repurchase $10 billion of stock through the close, and another $10 billion in the 12 months after.

Deep and I will be looking through this deal and assessing it using our Framework. By making this analysis process transparent to you, we hope you will develop your own framework for looking at merger deals like this one for your own portfolio.

Framework Investing Valuation Model for 21st Century Fox (FOX) ![]()