After attending a recent small capitalization stock conference, I sent out an email and published an article about the companies that particularly caught my attention.

The company that seemed most interesting to me was UFP Technologies, a manufacturer of specialty packaging for various products, and since February of this year, disposable medical supplies.

The company has a strong technology and competitive position, has been in business for a long time, and — if company management is to be believed — the leading firm for designing and manufacturing specialty packaging (e.g., the fiber composite trays that hold and protect new mobile phones in their shipping and display boxes).

The story sounded good to me, so I took a closer look at the firm’s valuation. Very quickly, I decided it was a pass.

The main reason my ardor cooled was that the company’s profit growth has been spotty, its profitability level low, and its investment program suspect. In particular, this year, the company just spent roughly three generations’ worth (i.e., 60 years) of the company’s 10-year average Free Cash Flow to Owners on a single acquisition of a low-profitability firm.

Here is my analysis of the valuation drivers and valuation of UFP Technologies.

Revenues

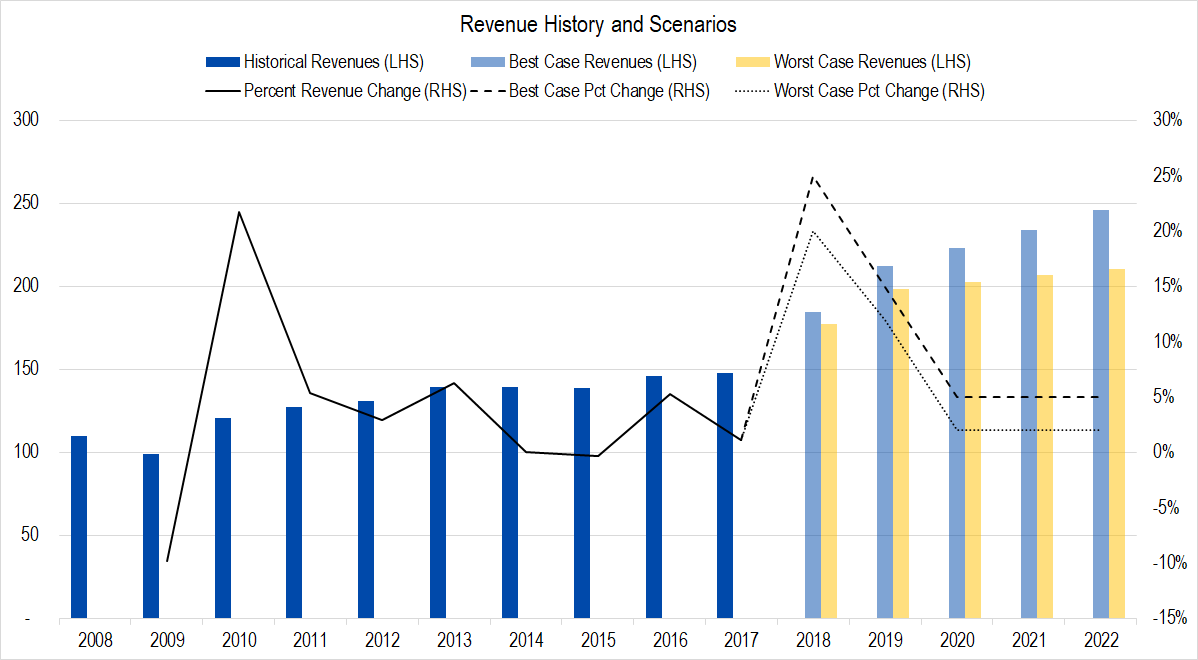

Figure 1. Source: Company Statements, Framework Investing Analysis

The company spent just under $80 million this year acquiring a company that manufactures disposable medical supplies, Dielectrics, Inc. According to UFP Technologies’ press release regarding the acquisition, in 2017, Dielectrics generated roughly $43 million in revenues. We have added revenues in order of that level to 2018 revenues (and a bit of a bump up in 2019 as that will be the first fiscal year that contains a full year of Dielectrics’ sales).

Neither UFP’s legacy business nor its acquired Dielectrics business is a quick grower, so other than the big near-term bump, we have forecast revenue growth at 2% (worst-case) and 5% (best-case) per year.

Profits

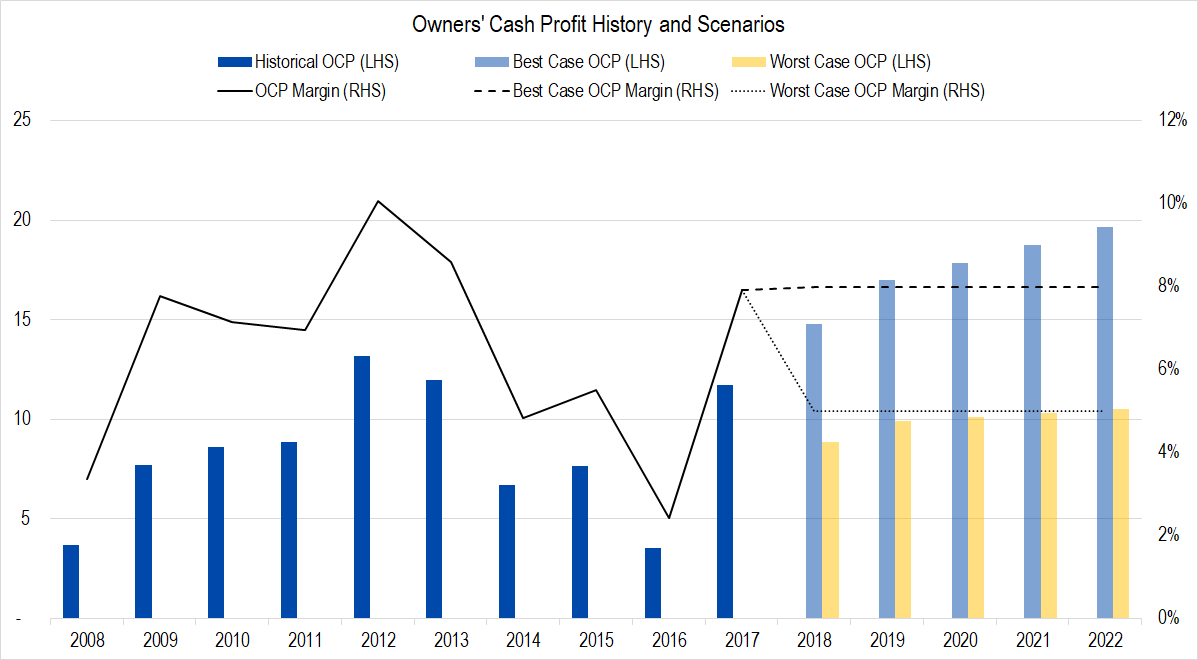

Figure 2. Source: Company Statements, Framework Investing Analysis

Profits — measured by Owners’ Cash Profits (OCP) — were hurt in the 2014-2016 period due to losses of profitable contracts. The bump up in 2017 looks mainly to be an improvement in working capital due to a draw-down in inventory. The 8% OCP margin best-case scenario looks relatively more likely to me given this historical series, but the 5% OCP margin worst-case scenario may end up being closer to reality if the first two quarters of 2018 are any indication.

Since the acquisition of Dielectrics, UFP’s OCP has actually declined pretty notably. OCP (margin) was around $5.0 million (7%) in the first half of 2017. They dropped to around $3.5 million (4%) in the first half of 2018. Granted, large acquisitions can throw off accounting numbers, but the early indication suggests the Dielectrics acquisition may drop profit margins.

Investment Spending

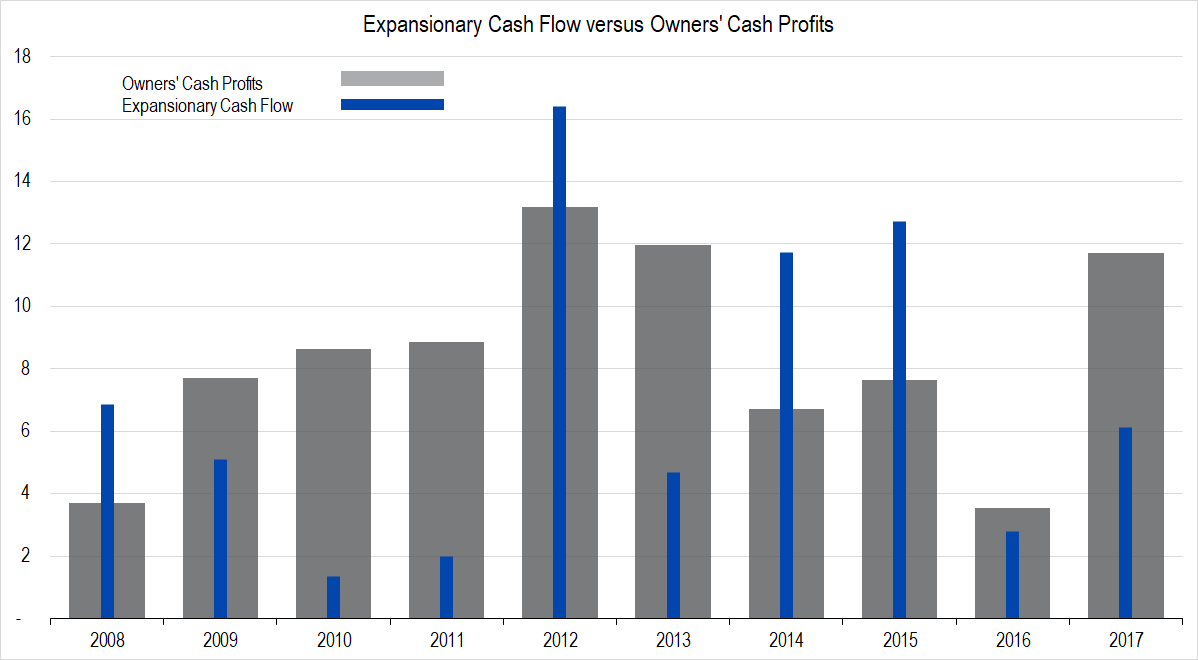

Figure 3. Source: Company Statements, Framework Investing Analysis

UFP periodically buys out smaller competitors, so its investment expenditures (shown by the blue column in the graph above) exceeded the company’s profits in four out of the last 10 years.

Figure 4. Source: Company Statements, Framework Investing Analysis

In addition, the firm issues roughly $1-$2 million worth of stock as compensation each year — generous for a company that has generated an average of only $8 million per year in profits over the last decade.

You read that right — one quarter of the owners’ profits are being paid out as compensation for employees. Especially with the low margins, this seems excessive; almost as if the company was being run for the benefit of the managers rather than the owners.

Free Cash Flow to Owners

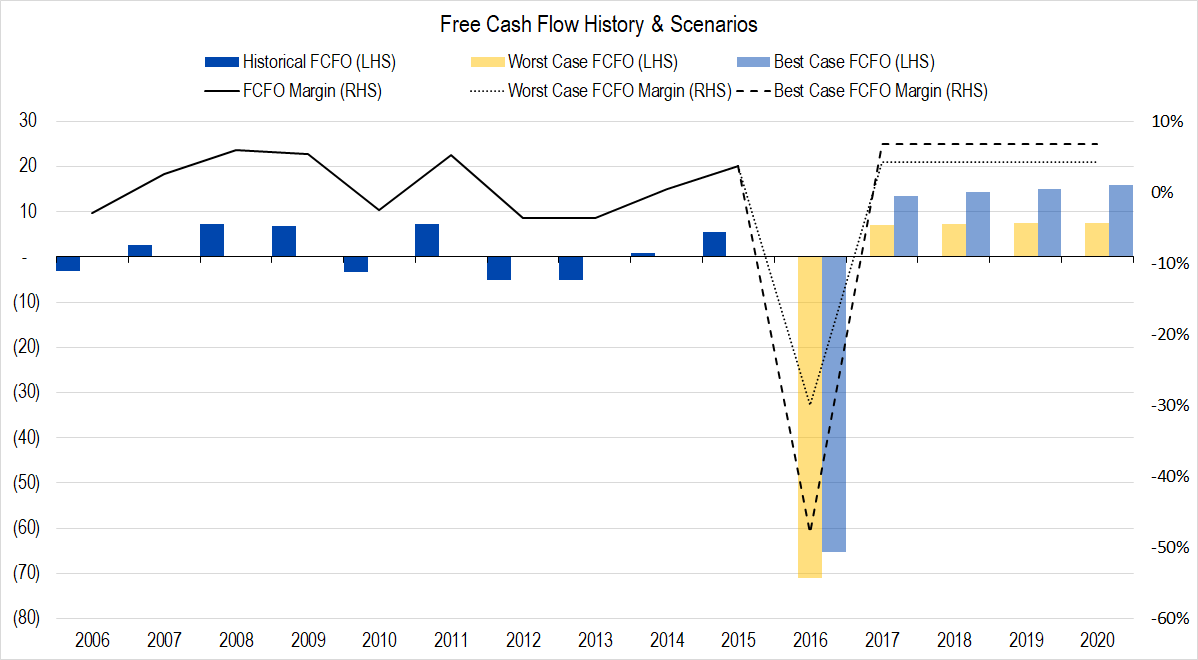

Figure 5. Source: Company Statements, Framework Investing Analysis

Figuring in the Dielectrics acquisition this year and generously assuming only $2 million per year in Expansionary Cash Flows over the following four years (the average over the past decade has been $7 million), we come up with the graph above.

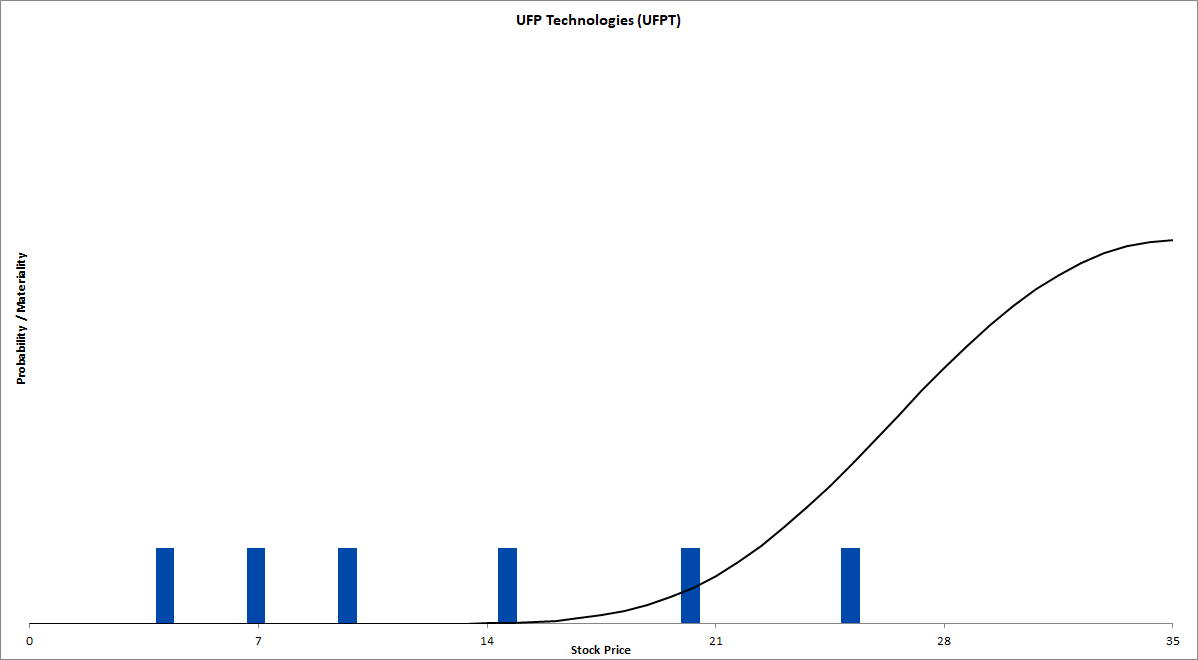

Valuation

Assuming a best-case medium-term growth rate of 10% per year and a worst-case of 5% per year, then discounting at 12% (our normal rate for small caps), we find a valuation range of $5 to $25 per share with an average of $14 per share. The present stock price is $35 per share.

Figure 6. Source: Company Statements, Framework Investing Analysis

This valuation suggests a bearish strategy for those open to that idea and, at the very least, avoiding a bullish position.

Valuation Model

We made some modifications to our valuation model, about which we will post an article later.