[This article originally appeared in Forbes]

What an interesting start to the investing year in 2016! The S&P has lost over 8% (dividends included!). Chinese shares are in the bear’s den. The shares of the high flying “FANG” company’s Facebook, Amazon, Netflix and Google are all down more than 7% in 2016 and January isn’t even over yet. Many investors fail to consider options as financial tools until market volatility picks up. Then, when the market strings together a few losing days in a row (as they have of late), they scramble to find out more about protective puts and usually wind up paying too much for protection that they realize a few weeks later they really didn’t need.

Options are great tools for tailoring an investor’s exposure to risk and return, but even a great tool is dangerous to someone who doesn’t know how to use it properly. I can’t make you an expert option user in the space of a single Forbes article, but I can show you three examples of my favorite option strategies for volatile markets and give you some hints on how to implement them properly. (Our IOI 101 and IOI 102 courses, which take place over three days, are a good place to start a journey to mastery.)

The Short Put

When a hurricane is spinning offshore, uninsured homeowners along the coast are happy to pay up to get protected. The same thing happens when markets are falling. Investors suddenly imagine that the shares of Wal-Mart that they bought back in the $40s are going to drop and wipe out their gains. They go shopping for insurance, and I am happy to sell it to them as long as I am confident that the long-term value of the stock is at or above the present price level.

By doing this, I’m accepting a risk of loss (that I think is unlikely) in return for cash up front:

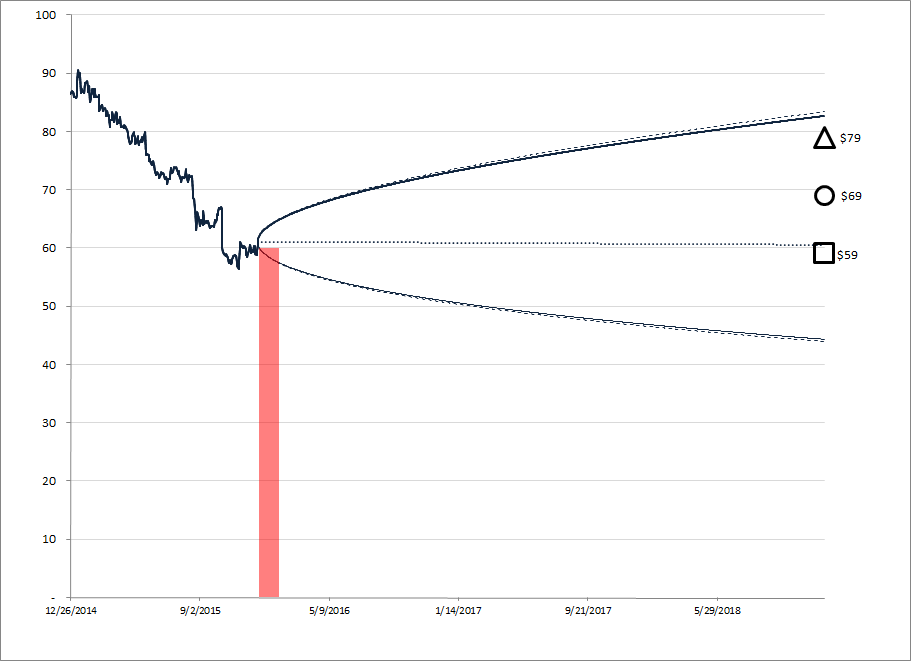

Figure 1. Diagram of a short put strategy on Wal-Mart. The cone in the diagram represents the implied future price range of the stock. The shapes on the right are IOI valuation estimates (best-, likely-, and worst-case). The red shaded region represents the acceptance of downside risk by selling (“writing”) a short-term put option on the stock. I was happy to do this because my worst-case valuation ($59) was higher than the option market’s idea of a worst-case price scenario ($45).

Tips for Short Puts:

- You stand to make more money per day selling puts over shorter timeframes.

- Selling puts with a strike price as close to the market price of the stock pays the highest return on your capital at risk.

- “Covered Calls” give you almost the same risk profile as short puts – don’t think you are “taking profits” with a covered call, you’re accepting downside risk.

Selling insurance to fearful investors requires three things: 1) a good understanding of the value of a stock, 2) a willingness to own the shares if the puts expire in-the-money, and 3) fortitude in the face of what might be temporarily falling prices.

It is a perfect strategy for people who can be “greedy when others are fearful.”

Long Calls

The weather forecast for my area tomorrow is a 40% chance of snow. With a forecast like that, I would never bet on whether I’ll have to shovel tomorrow. However, if you asked me to bet whether the air temperature six months from now will be hotter here than it is today (January 27, 2016), I would be happy to put some money down.

In the markets, it’s really hard to know where tomorrow’s stock price is going to be, but as long as you are focused on a company’s long-term value, it is easy judge if the present price is too low (see my recent Forbes articles on IBM — here and here — for an actual example). Buying calls with distant expirations allow you to make efficient, long-term investments in growing businesses. LEAPS (Long-term Equity Appreciation Securities) are options with expirations of up to two years in the future and are a terrific instrument for investors with longer time horizons.

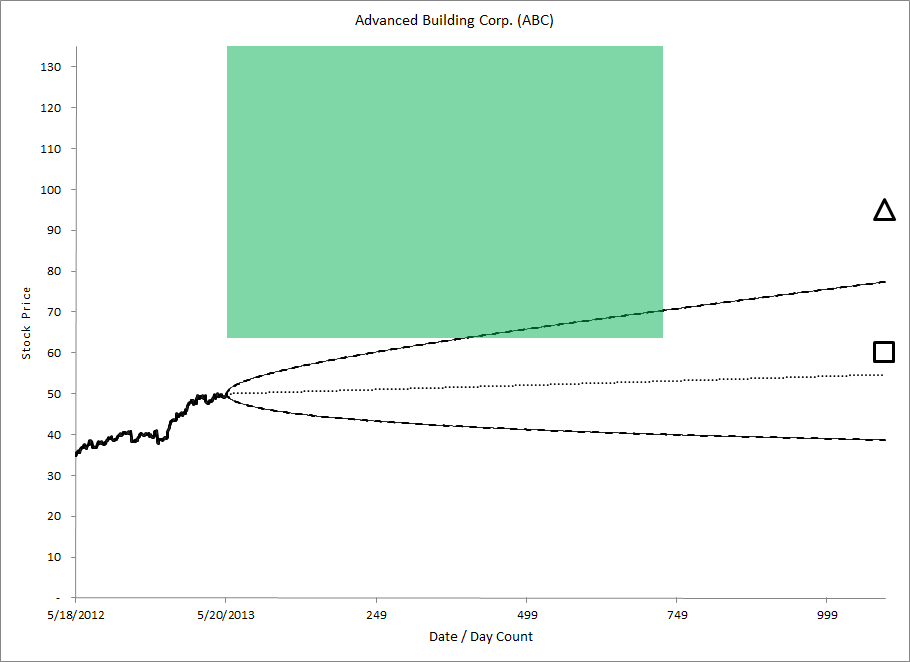

Figure 2. The green shaded region represents a strategy of gaining exposure to the upside potential of a stock by buying a Long-term Equity Appreciation Security (LEAPS) call option expiring in two years. Note that my best-case valuation (represented by a triangle) is much higher than what the option market thinks is a best-case price (represented by the upper edge of the cone).

Tips for Long Calls

- You pay less per day for options with distant expirations so consider buying options with the furthest expiration.

- Buying calls is usually a leveraged strategy. Leverage is dangerous and should be used sparingly and intelligently. We recommend limiting the size of highly levered allocations and limiting the leverage on concentrated allocations, much as Warren Buffett does.

Buying long-term options on a company requires three things of an investor: 1) an understanding of how to assess and measure the value of a stock, 2) a willingness to ignore media talking heads in the short term, and 3) a thorough grasp of the dangers and benefits of leverage.

It is a perfect strategy for patient, insightful investors.

Protective Puts

Buy an electronic gadget and the salesperson will invariably ask if you want insurance on it. The nominal cost of the insurance might not seem high, but the cost in proportion to the cost of the gadget and its likelihood of breaking turns out to be exorbitant.

In my experience, a lot of people overspend on protective puts, so I usually steer clients toward a more cost-efficient solution.

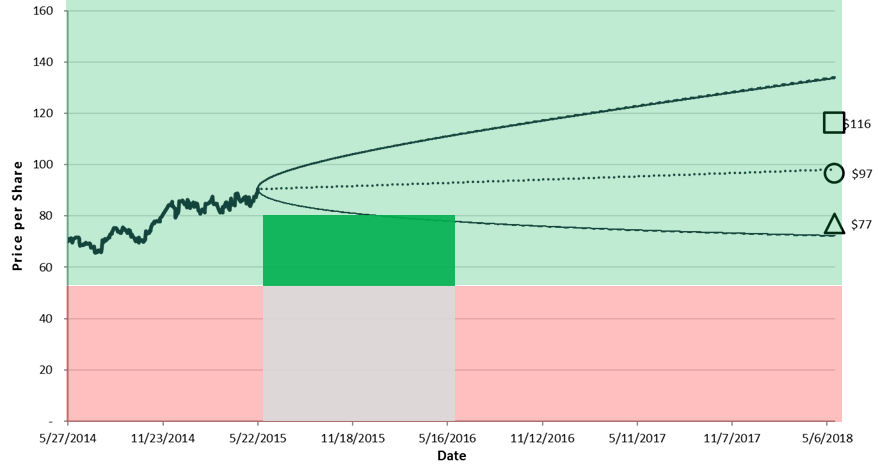

Figure 3. Actual example of a protective put position (struck at $80) on a legacy stock holding of Express Scripts (ESRX). The owner of the stock is in a high tax bracket, so does not want to take profit on the security position. Buying a put offsets losses from a fall in stock price but are typically quite expensive.

Tips for Protective Puts

- Protective puts on a single name (i.e., buying a put on Apple to hedge your Apple position) are usually very high. Would you spend $50,000 a year to insure a $500,000 house? If that seems pricy, you won’t want to buy single-name puts because you can usually expect to pay 10% or more for protection.

- Most “hedging” problems can be solved with better asset allocation. Nervous about that 20% of your portfolio made up of your company’s stock? Try diversifying rather than hedging.

- Other “hedging” problems can be solved with a bit of perspective. Nervous about that small cap stock that makes up 0.31% of your portfolio’s value? Even if it goes to zero, your net worth will hardly notice. If the volatile position bothers you, hit the sell button.

- Buying a put on an index ETF is usually a cheaper way to hedge some overarching economic exposure (like commodity price increases and decreases, etc.), so if you have an investment in a company that can be influenced by macro factors that you want to hedge, think about an ETF option.

- Effectively hedging using protective puts requires: 1) insight into how to structure a hedge in the most efficient way, 2) the willingness to look at hedging alternatives (such as reducing exposure), and 3) a plan for what to do with your cash if and when your hedge successfully offsets losses from a stock position.

Options present a wonderful tool for managing risk and uncertainty in volatile times, but using a tool to its fullest requires a good understanding of how the tool works.

Want to Learn More? Contact Us!