My friend, Joe Cornell, CFA, runs a successful research service specializing in investing in corporate spinoffs that is geared toward large institutional investors.

Back in March, his research team featured an investment opportunity in the Chinese operations of American fast food chain Yum Brands YUM, which is traded under the ticker YUMC. He asked me if I would write a guest post explaining how options work, then offer a suggestion about an option investment structure for his bullish view of Yum China.

That transaction did very well for investors – the stock is up by 50% and the option structure I highlighted is up by 200%.

Joe asked me to do a follow up on Yum China and to come up with a structure or two for a new investment idea from his shop: Hewlett-Packard Enterprise HPE.

You can find my original write up here (both the option primer and the Yum China structure explanation). My recap of the Yum China investment is below and I’ll post my Hewlett-Packard piece along with Joe’s report in another post.

Option Recommendation Recap – Yum China (YUMC)

Executive Summary

- Spinoff Research’s March 2017 recommendation on Yum China worked out spectacularly well – generating gains of 50% in only six months.

- The In-the-Money option structure we recommended amplified those gains by a factor of four.

- Moderately-levered strategies such as this one offer the potential for good payouts while decreasing timing risk.

In the March edition of the Spin-Off Report, we offered an option-based structure to enhance the value of the Yum China spin-off.

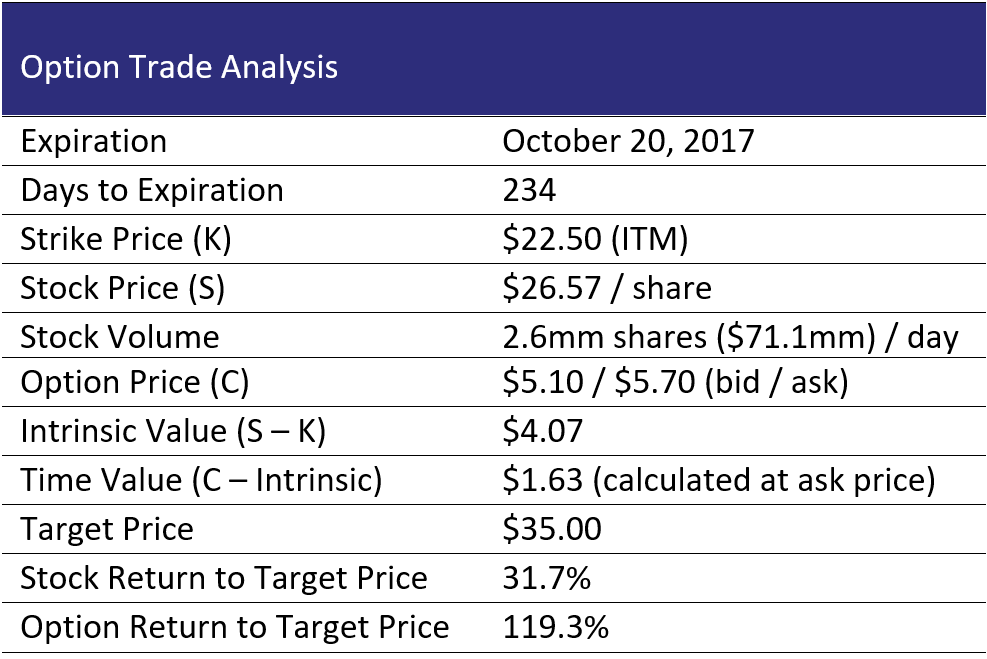

Our recommendation – shown in the table above, which was published in the March issue – suggested buying In-the-Money (ITM) call options struck at $22.50 and expiring on October 20, 2017. This structure, in which an investor placed $4.07 in capital at risk and paid ($5.70 – $4.07=) $1.63 in time value, was designed to reduce timing risk, allowing the investor to profit even if the stock price did not hit Spin-Off Research’s original target price of $35 / share.

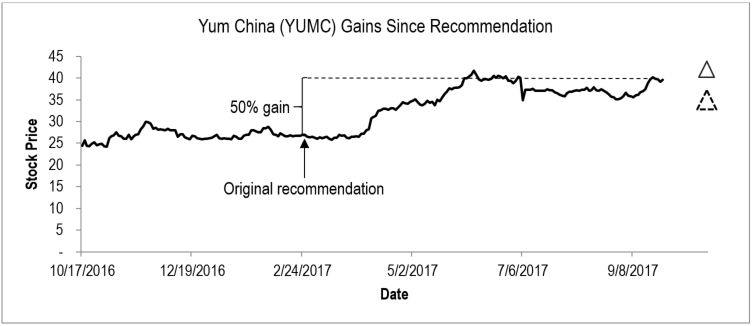

It turns out that the caution regarding timing risk was unwarranted in this case. Yum China’s shares are trading at $39.77 today, an increase of 50% over the price it was trading when we pulled data for the above table.

Figure 1. Dashed triangle shows initial target price of $37 / share. Solid triangle is new target price of $42 / share

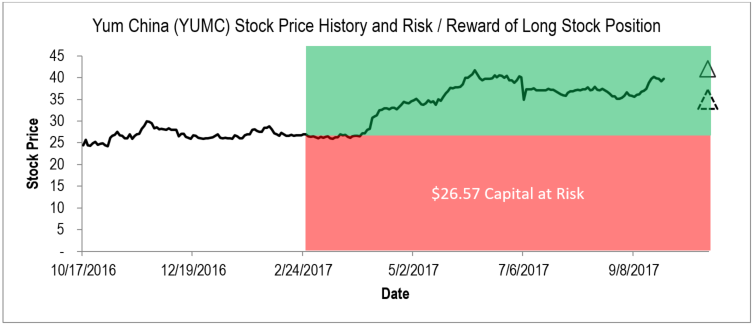

The long investor in YUMC accepted $26.57 of downside risk and gained $13.20 on that capital at risk. Using the range of exposure diagram shown in the option primer, we have the following.

Figure 2.

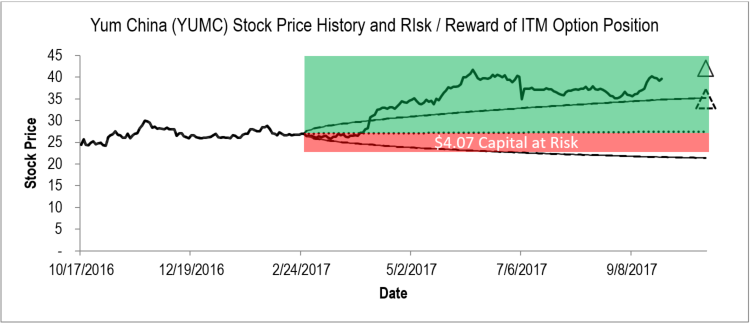

In contrast, the option contracts listed above are quoted at $17.10 / $17.40 (bid / ask), an increase in value of 200% – in line with what we had described in the March report as a transaction with a gearing of 4:1 on the upside.

The option contract exposed the investor to the same upside potential, but did so with a great reduction of capital at risk.

Figure 3.

An Out-of-the-Money option would have generated a larger percentage gain, but to generate as large of a dollar gain on this investment, an investor would have had to pay much more in time value premium, which we consider as an immediate realized loss, and would have had to accept a much higher leverage level. While the large percentage gains of a highly-levered, OTM option position may seem attractive, the combination of timing risk and the risk of an overlevered position make using more moderately levered, ITM option positions more attractive over the long-term, in our opinion.

On July 10, 2017, Spin-Off Research issued a follow-up note on YUMC raising its target price to $42 / share. Because the stock price is already within 6% of Spin-Off Research’s target price, we suggest allowing the options to expire ITM or to take profit on the position before expiration rather than “rolling” the contract into a more distant tenor.

If the investor choses to hold to expiration, keep in mind that listed single-name option contracts are settled in the underlying. This means that the investor will be required to purchase YUMC shares at $22.50 / share before taking profit on the position by selling the stake in the cash market. Taking profit before expiration means the investor does not have to free up cash to purchase the share, but will have to pay the other half of the bid-ask spread as well as brokerage and exchange fees.

Investors that transacted in the OTC “Listed Look-Alike” market may be able to settle for the cash difference, depending on how the contract is structured.