Yes, you read that right, $200Bn. That’s over the last 20 years. In this short article on Financial Illiteracy by Howard Gold over at MarketWatch, the author surveys a number of research pieces on the tangible effects of not knowing what one doing with investing.

For our readers, “knowing what you do not know” is an imperative skill for judging the quality of any single investment opportunity. But, there’s an even greater application of this basic truth as one surveys his or her total investing skill set. “Family CFO’s” have a giant responsibility thrust upon them to both account for and growth their wealth – whether it be wealth they have personally accumulated or it is generational wealth.

The research clearly shows a widening gap between the responsibility principal investors have and the basic skills they need in order to successfully achieve that goal. Here are just a few highlights.

- “There is a mismatch between the complexity of the financial decisions we have to make…and our own financial knowledge.” – Annamaria Lusardi, economics professor at George Washington University and Head of the Global Financial Literacy Center of Excellence.

- Many investors display what behavioral-finance experts call “overconfidence”: They believe they’re more knowledgeable than they actually are. “There is a big disconnect between what people think they know and what they actually know,” Lusardi told me in an interview. That’s particularly a problem among men, she said. Women at least “know that they don’t know.”

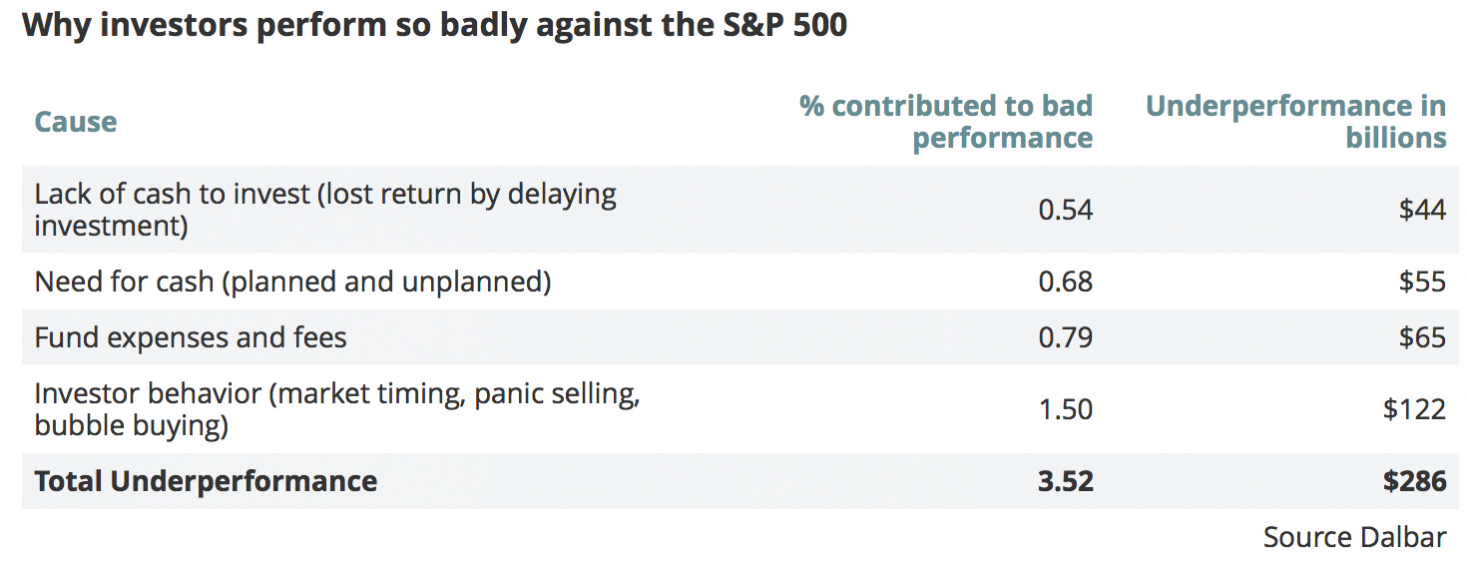

- Over the past 20 years, the S&P 500 has gained an average of 8.19% annually, but equity fund investors earned only 4.67% a year. That annual gap of 3.52 percentage points cost investors $286 billion over that time, Dalbar estimated. The table below shows why.

What we don’t know and/or don’t understand well can hurt our investment returns robbing us and our families of financial security and the benefits of it, like adequate planning for higher education and meeting important financial goals.

This short article points out the big hits to our performance and as you can see, much of the pain is BEHAVIORAL! Just combining the behavioral errors with opaque fees gets us to over $180Bn lost.

Successful investors have a process and they reap the benefits of that process in better annual returns and stronger resulting financial security. The research clearly shows this outperformance.

Here are three simple steps you can take now to get control of your investing and improve your returns:

- Step back and assess your investment knowledge and skill set – you can do this easily at IOI by taking our investor assessment. Do you understand compounding? Do you know what it means financially to own a share of a company? Do you understand the principles of risk diversification and asset allocation? How much of a role does emotion play in your investment decisions? The shear number of financial instruments and their complexity has exploded in recent years. To deal with complexity, we must endeavor to understand it and have the right frameworks in place to do so.

- Recognize that successful investing has 3 core components: a) understanding the playing field, whom you’re playing against and your own biases and blind spots; b) understanding how companies generate value for a shareholder or bondholder and c) structuring investments effectively based on our understanding of BOTH value and the instruments available to us. Get these three right and voila, better returns!

- Begin to develop a disciplined, repeatable investment process. This is not out of anyone’s league and, done over time, is entirely manageable. All you need to start is a notebook. Find a skilled teacher / mentor who can review your investments and investment ideas with you and teach you to apply a fundamentally grounded process, repeatably.

Each of the steps above will help you to improve whether you are managing your own investments or working with a paid investment manager!

To learn more about how IOI can help you become a better investor, just reach out to us and ask.

[caldera_form id=”CF56b3ac18bf490″]