In our review of Union Pacific’s UNP third quarter earnings, we compared the company’s actual results to our forecasts for each of the short-term fundamental valuation drivers: revenue growth rate, cash profitability (measured by OCP), and investment level. We found that, on most measures, Union Pacific was scraping along our worst-case scenarios – scenarios which imply an average fair value somewhere in the $70 – $80 per share range.

One metric in which we do not focus is earnings-per-share. EPS reflects non-cash charges and one-off economic events which we see, in many cases as transitory and not reflective of the firm’s long-term ability to generate value for its shareholders.

The rest of the Investing-Industrial complex does, however, focus keenly on EPS, since EPS provides one element of the two needed for the typical Wall Street valuation.

(The other necessary element is an “earnings multiple,” the selection of which turns out to be subject strong and dangerous behavioral biases that we discuss more in our Framework 101 course.)

A former colleague of mine, Dale Wettlaufer, who now runs his own hedge fund, Charlotte Lane Capital, posted a few comments on Union Pacific’s earnings the other day which illustrate the weakness in using EPS for a valuation metric if one is concerned with long-term value. Like me, he is bearish on the firm’s value, and notes that Union Pacific’s beating of analysts’ estimates of EPS – something that evidently thrilled the market and sent the price of the shares up – was based on a few tenuous one-off items.

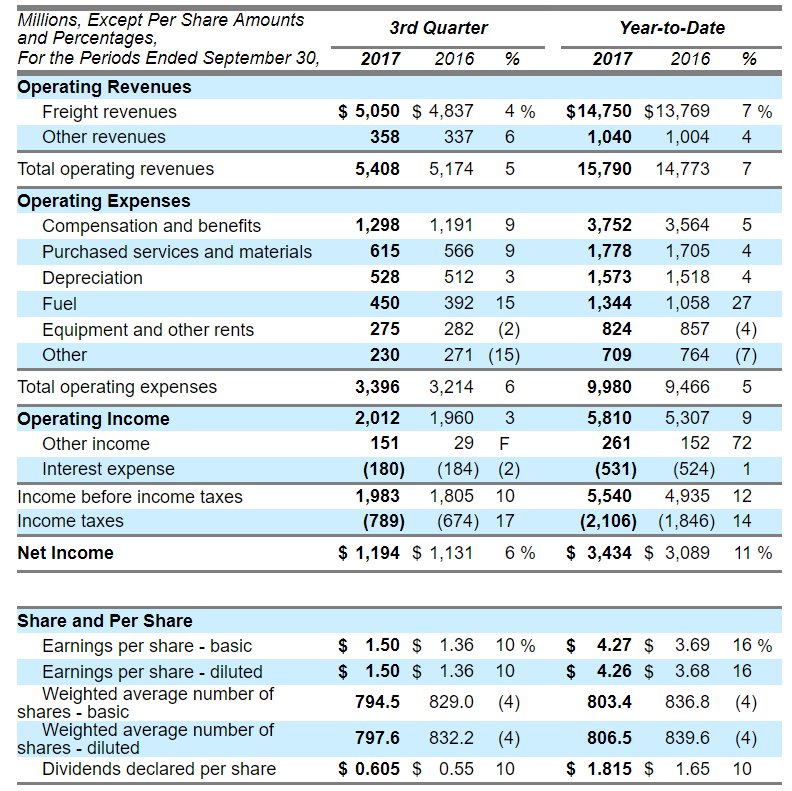

This is the Income Statement the company published when the company announced earnings:

Source: Union Pacific Investor Relations

Quarterly income before taxes increased by $178 million, from $1,805 million in the third quarter of 2016 to $1,983 million in the third quarter of 2017.

Looking for the root cause of that increase, we immediately notice an increase in “Other income” of $122 million (from $29 million in 3Q16 to $151 million in 3Q17). This increase represents ($122 / $178 =) 69% of the increase in pre-tax earnings for the quarter.

What does “Other income” include? In the conference call, Union Pacific’s CFO, Rob Knight, described that line item in the following way:

This increase includes the impact for both a large land sale and the settlement of a previous litigation matter.

The company and its predecessors bought land largely in the railroad booms of the 19th century, and assets are always recorded on balance sheets at “the lower of cost or market.” To translate out of accounting-speak, some significant portion of Union Pacific’s earnings beat was associated with the company selling some land for a gain compared to the real estate’s 1850 purchase price.

Regarding litigation, when a law suit is brought that has a material chance of being adjudicated against the firm, the company must set aside a reserve fund that totals management’s assumption about what the costs of the suit are likely to be. This reserve fund is deducted as a non-cash cost from the income statement.

At some later point, when the court case has been decided and the legal payment is made, any difference between the reserve amount and the actual payment again flows through the income statement. If the actual payment is less than the reserve, the difference flows through as a gain; if the actual payment is more, it is treated as a loss.

Again, to translate, some portion of Union Pacific’s earnings beat was associated with not having to pay as much as it originally estimated it would upon its losing a court case.

Unlike the original reserve, which was a non-cash charge, the payment for the law suit was made in cash, which must have been one of the reasons that Owners’ Cash Profit margins – our measure of cash profitability – was down for the quarter.

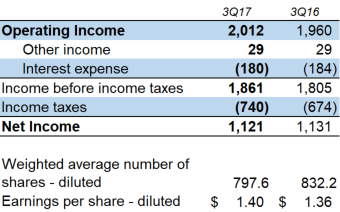

Let’s assume for a moment that these two “extraordinary items” did not manage to find their way into Union Pacific’s earnings announcement this quarter. We have restated the numbers to assume the same “Other income” as was recorded in the third quarter of 2016 and used the same tax rate as was actually charged in the third quarter of 2017 for our calculations.

Source: Company statements, Framework Investing analysis

Wall Street’s EPS expectations for Union Pacific this quarter were $1.49 and the company beat those expectations by $0.01. If, however, the one-off items related to the sale of land booked at historical cost and paying a little less than originally predicted for a law suit, the company would actually have missed by $0.09 per share.

While frustrating to be facing an unrealized loss on our bearish position this close to options expiration (mid-November), we believe our valuation is on target and are willing to continue investing according to the strategy we laid out in our earlier research on Union Pacific.