Each month, we screen for attractive “bond replacement” investment candidates by looking up the reports of investments purchased by “Superinvestors” covered by the Dataroma site. Dataroma follows 64 managers that are all using value-based strategies.

Since second quarter of this year, we have had trouble finding managers who seem to be deploying capital to high-conviction ideas. We judge whether an idea is “high-conviction” or not by looking at purchases of stocks with a 2% allocation or higher.

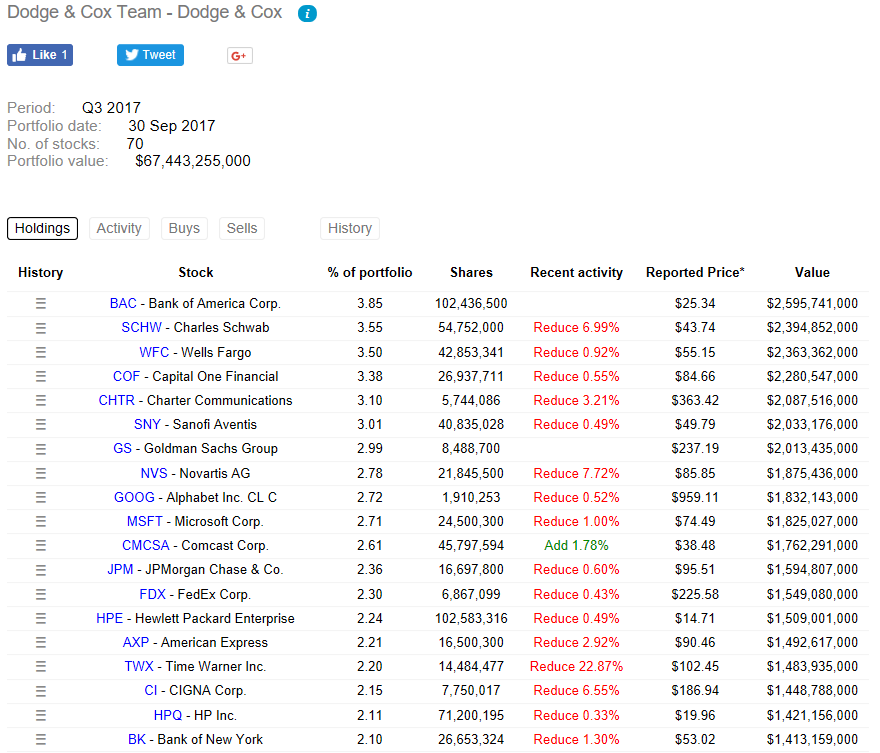

This month, we again have been looking through superinvestor purchases and have found two dominant patterns. First, some managers seem to be trimming large positions much more than adding to them, like you see for Dodge and Cox.

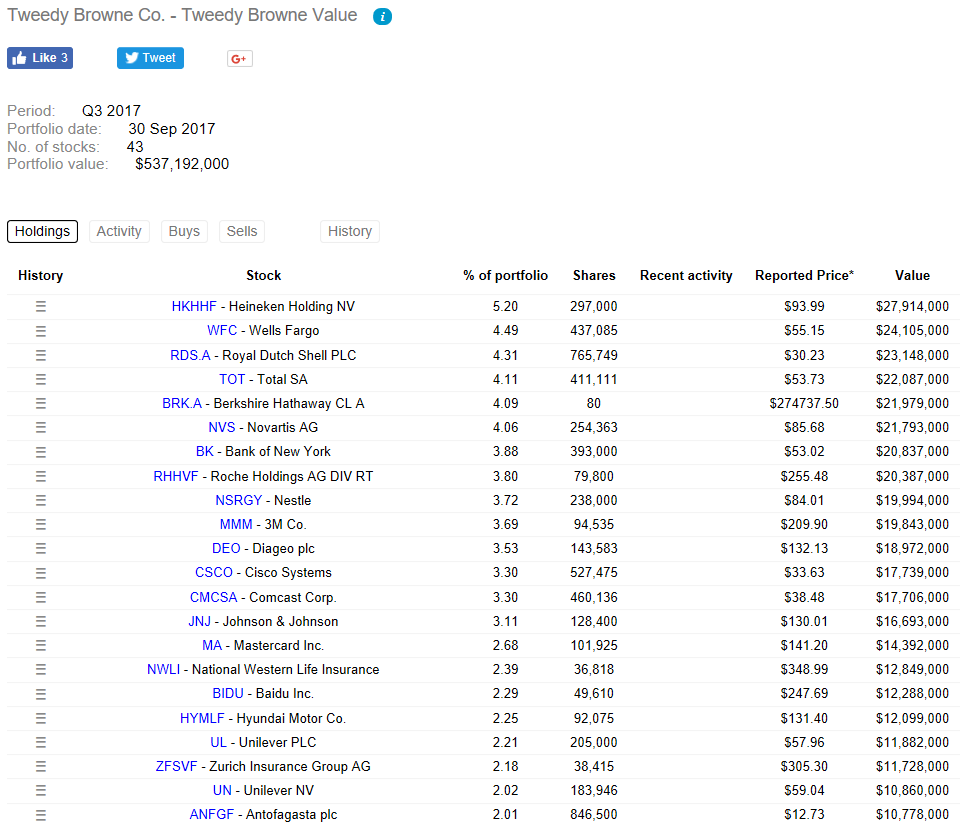

Second, some managers seem to be doing nothing or making just a few purchases, like Tweedy Browne:

The one fund we did find with third quarter purchases is the $1.6 billion Ariel Appreciation fund (CAAPX), managed by John Rodgers. This fund had a total of six securities that met both of our criteria:

- Stocks listed represented more than 2% of the portfolio’s value

- Stocks listed had been bought by the fund in the reported quarter

These conditions were to screen for the stocks in which the managers had demonstrated the most confidence (by portfolio weight) and about which they had made an active decision to invest. As we explain in our video introduction to “Bond Replacement” investments, we are using these portfolio managers’ actions as an indication of undervaluation.

Morningstar’s description of the fund gave me a bit of a pause. According to the analyst, this is a mid-cap fund that tries to milk bull markets for all they are worth, but which usually displays increased volatility during downturns. This is precisely the opposite characteristic from what we want from a bond replacement portfolio since good bond replacement candidates are stocks that display relatively less downside valuation risk.

In addition, Morningstar’s analyst characterizes the performance of the fund during Rodgers’ tenure as “tepid.”

The largest holding by percentage does look interesting to me, though I have never made a valuation of it: Smucker (J.M.) SJM. Another that sounds interesting and seems to have good liquidity on the options side is US Silica Holdings SLCA – the smallest allocation on the list.

While the pickings are a bit slim, I hope there is an idea or two that seems attractive to you.

Please reach out if you have any questions about this spreadsheet!