This overview accompanies the IOI Tear Sheet on Iron Mountain (IRM) and is split into the following sections:

- Revenue Scenarios

- Economic Profit Scenarios

- Investment Efficacy Scenarios

- REIT Conversion

IOI?s explicit forecast period for Iron Mountain lasts five years.

Revenue Scenarios

Iron Mountain derives revenue from three main sources: 1) Storage of documents and media, 2) Document management (e.g., retrieval and destruction of documents and media) and other services, and 3) Sales of paper from destroyed documents on the recycling market. Revenue growth historically has come from acquiring businesses and through an increase in the amount of documents stored and services provided to existing clients. The company has a commanding position in the North American market and a growing market share in International markets. In 2010, it sold its online storage business, so now only reports data for North American and International segments.

|

| Iron Mountain Revenue Change by Segment Source: Company statements, IOI analysis |

The last few years have represented a perfect storm working against Iron Mountain’s revenue growth. The following factors have all depressed Iron Mountain’s revenue growth over the past few years:

- Decreased business activity in the U.S. and Europe has prompted companies to destroy documents more quickly, and to add documents to storage more slowly, thus decreasing the volume of records stored.

- Revenues related to digital storage services dropped out when Iron Mountain sold off that division in 2010.

- A secular trend to store in paper format, but to retrieve in digital format continues to negatively impact revenues from services.

- Lower than average paper prices in the recycling market means lower revenue per ton of shredded paper delivered.

Especially the trend to store in paper and retrieve electronically is likely to continue to affect the company for some time. However, unless you assume that business activity will not increases in both North America or Europe over the next five years or that emerging markets will not have as strong of a need for document storage, it is hard to believe the firm will not, in the next few years, reach at least a modest inflection point and begin growing again.

|

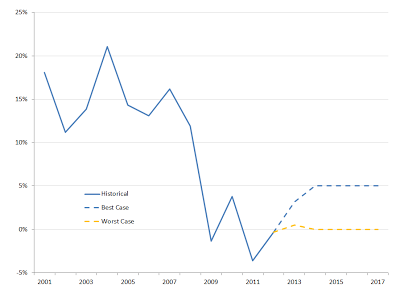

| Iron Mountain Revenue Growth Scenarios Source: Company statements, IOI analysis |

- IOI’s worst case revenue scenario generates an average year-over-year (YoY) growth rate and 5-year compound annual growth rate (5Y CAGR) of 0%.

- IOI’s best case revenue scenario generates an average YoY growth rate 5Y CAGR of 5%.

Economic Profit Scenarios

IOI’s estimate of economic profit deducts an estimate of maintenance capital expenditures from cash flows from operations. Iron Mountain’s North American operations have extremely high profitability–roughly 85% of the profits of the company come from the 75% of revenues generated in this geography. At the heart of IRM’s profitability is the fact that their primary costs are calculated in two dimensions (square footage) whereas their prices are are charged in three dimensions (cubic footage). In addition, once a company contracts with a document management company, the cost of moving to another company are prohibitive compared to the benefits of moving, so contracts tend to be “sticky” and relatively price insensitive.

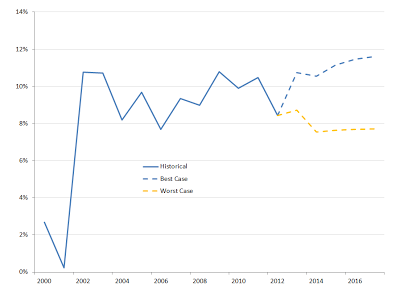

Iron Mountain’s economic profit has been consistently high, despite the pressure on the top line. Recently, a U.S. hedge fund mounted a proxy battle to change management policy, and to us, it seems as if their challenge to management has resulted in a more rational attitude toward growth and profitability, with the company coming down more on the side of the latter. Another change prompted by the hedge fund was the ongoing plan to convert at least part of its operations to a REIT structure rather than a C-Corporation. Preparation for this adjustment resulted in changes to asset and liability accounts which impact our calculation of economic profits in 2012. Adjusting for this non-material artifact, we estimate the historical level of profitability at Iron Mountain to be between 8% and 11% of revenues. We believe that, considering the trend toward more rational investment practices, there is a relatively good case to be made to assume that the average level of economic profits will reset relatively higher in the short- to medium-term.

|

| Iron Mountain Economic Profit Margin and IOI Scenarios Source: Company statements, IOI analysis |

- IOI’s worst case profitability scenario generates an economic profit margin of around 8%–a fall of about twenty percent compared to the previous 5-year period?s average.

- IOI’s best case profitability scenario generates and economic profit margin of around 11%–a rise of about 10% compared to the previous 5-year period average.

Investing Efficacy Scenarios

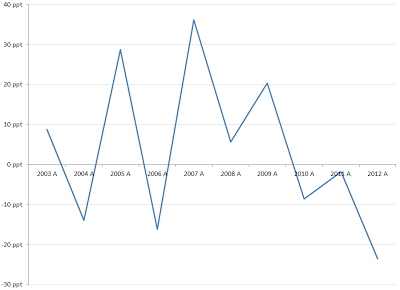

While some of Iron Mountain’s past acquisitions have been questionable (e.g., those related to data storage), the combination of strong revenue growth and relatively high profitability has meant that Iron Mountain’s investments have generally generated value for their shareholders. However, considering the mature nature of the business, we believe the mid-term profits will trend toward GDP-like growth.

|

| Iron Mountain Real Economic Profit Growth Source: Company statements, IOI analysis |

- IOI’s worst case medium-term (forecast years 6-10) growth scenario implies a growth in free cash flows of 5% per year.

- IOI’s best case medium-term growth scenario generates implies a 6% per annum growth in free cash flows.

REIT Conversion

Elliott Management, a hedge fund, mounted a proxy battle in 2010, attempting to force Iron Mountain’s management to rationalize its investment process and return a greater percentage of profits to its shareholders in the form of dividends and stock buybacks. Elliott issued a presentation detailing their suggestions which may be found on the SEC website.

The analysts for Elliott made what we believe is a valid point; namely, that much of the wealth that might have accrued to Iron Mountain shareholders over the last few years instead went to fund capital projects of dubious value.

One of Elliott’s specific suggestions was that Iron Mountain convert its organizational structure to be a real estate investment trust (REIT). This would confer certain tax advantages to the corporation while forcing it to payout a certain percentage of its profits in shareholder dividends each year. Elliott forced its way into the boardroom and succeeded prompting the management to begin the process of REIT conversion. Iron Mountain’s stock price soared, and somewhere in the $35 range, Elliott reportedly sold the stake it had bought for roughly $25–before the REIT conversion had actually taken place.

Last week, IRM’s stock fell heavily when the IRS sent the company a letter stating tentative disagreement with the characterization of Iron Mountain’s storage racks as “real estate,” and in so doing, cast doubt on whether the REIT conversion would be allowed under IRS rules.

When doing this analysis, we did not factor in REIT conversion into the valuation, so the intrinsic value estimates listed in our Tear Sheet are not contingent upon the firm converting to this legal structure. In other words, whether Iron Mountain becomes a REIT or not, we still believe there is likely more value in the stock than is presently reflected in the marketplace.