My friend, Joe Cornell, CFA, runs a successful research service specializing in investing in corporate spinoffs that is geared toward large institutional investors.

As I mentioned in another post, Joe has asked me to structure some option investments around spinoffs for his readers. In March, he had me do a write-up on Yum China, which ended up doing very well; this month, asked me to look at a favorite recommendation of his, Hewlett-Packard Enterprise HPE.

The article below is written for an institutional audience, and offers some insight into how “path dependency” of prices can change the payout of an option investment. Even if you are not interested in Hewlett-Packard, you may be interested in that discussion.

Spinoff Research’s report on Hewlett-Packard is also posted immediately after my article.

Option Recommendation – Hewlett-Packard Enterprise (HPE)

Executive Summary

- Spinoff Research is placing a Buy recommendation on HPE with a $17 / share price target, compared to its current price of just under $15 / share.

- We highlight two option structures that tailor an investor’s risk/reward exposure to HPE – one without leverage, the other with very high leverage.

- Either structure can be combined with an underlying position in the cash security to augment the idea’s potential payout.

Options, unsurprisingly, allow an investor many investment options. An investor can select to gain or accept either or both upside and downside exposure and to flexibly determine the investment’s desired leverage level. This flexibility gives an intelligent option investor unparalleled ability to tailor their risk / reward exposure to an investment idea. Here, we discuss two ways to structure a hybrid stock / option investment in HPE.

Put Sale

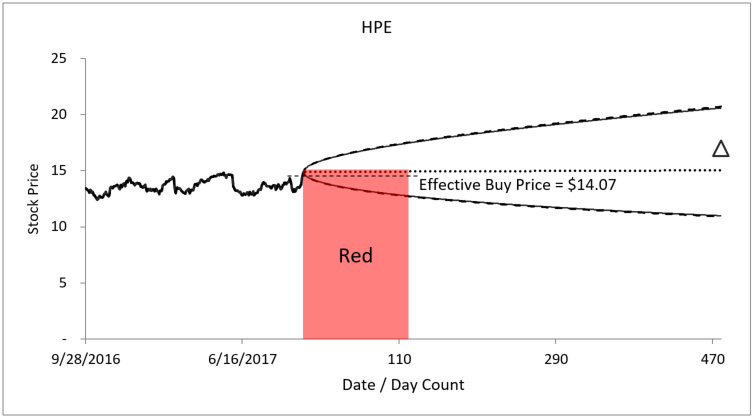

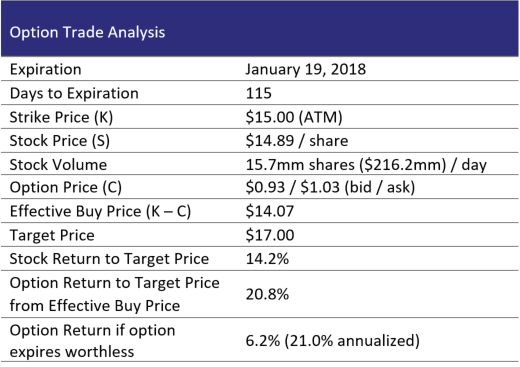

Figure 1. Source: CBOE, Framework Investing Analysis. The cone-shaped region in the diagram above shows the option market’s implied price range for Hewlett-Packard Enterprise over the next three years. The option market’s pricing implies that there is roughly a 16% chance of HPE hitting the $21.00 / share target price by January 2019. The shaded region above represents the sale of an At-the-Money (ATM) call option struck at $15.00 / share.

Using this structure, an investor accepts downside risk in exchange for a cash payment of option premium. If the stock moves above the $15 strike price at the time of expiration, the full amount of the premium is realized. In the case of HPE, if the stock closes higher than $15 / share on January 19, 2018, the investor keeps the $0.93 in premium and thus realizes a period return of 6.2% for 115 days (21.0% annualized return).

If, on the other hand, the option expires when the stock is trading for $15 or less, the investor has the obligation to buy the stock for $15 / share, but can think of the premium received on the option contract as a deduction from the buy price that generates an “effective buy price” of ($15.00 – $0.93 =) $14.07. Were this to occur, the return to the Spinoff Research target price of $17 / share is a respectable 20.8%.

This option structure is unlevered as long as the investor places the full $15 value of the strike price in collateral, and can be combined with a plain vanilla long stock position as well. If the stock moves directly to the $17 / share target price, the investor realizes the profit from the stock position and the entire option premium. If the option expires In-the-Money (ITM), the effective buy price of the shares purchased due to the option transaction simply are calculated as part of the VWAP [N.B. “Volume-Weighted Average Price”] for the investment.

Bullish Split-Strike Combination

[N.B. Most of the time, we call this structure a “Bullish Diagonal.” “Split-Strike Combination” is the name it is known by in the investing world, but post-Madoff, it doesn’t have a very good ring to it.]

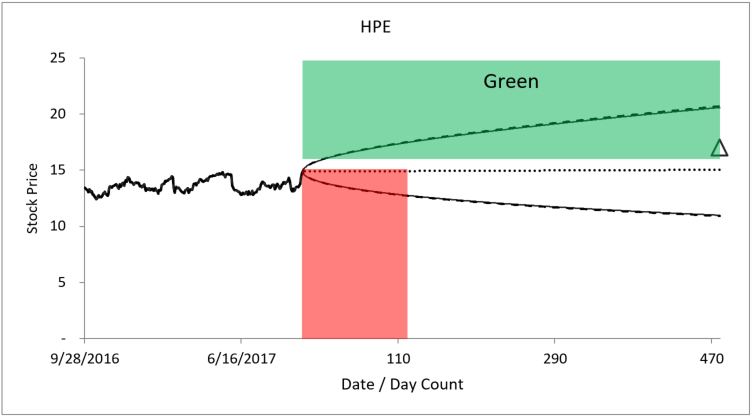

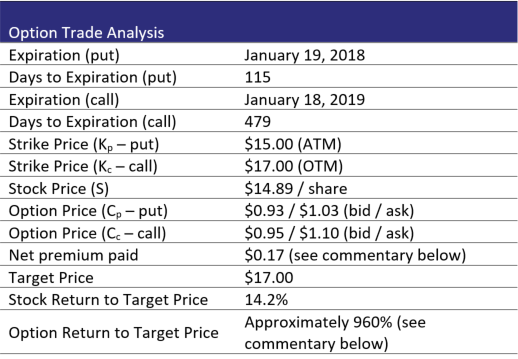

Figure 2. Source: CBOE, Framework Investing Analysis. The green-shaded region in the diagram above represents the purchase of a call option expiring in January 2019. The price of this call is subsidized by premium from the sold put option.

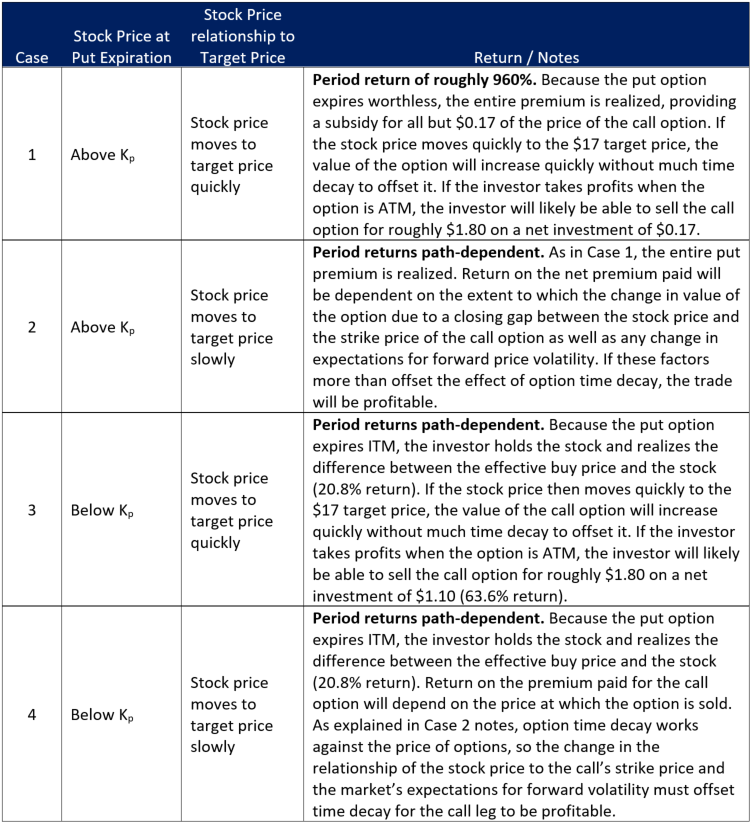

Using this structure, the investor subsidizes most of the cost of a long-tenor call option by selling the short-tenor put option specified in the above section. The payoff for this investment structure is path dependent on the stock price – especially at the expiration of the put option and the speed at which the stock price hits Spinoff Research’s target price. In the best case, the investor profits from a long-tenor call whose net cost is virtually nothing.

This option investment structure is much more highly levered than the moderately geared recommendation for Yum China, mentioned in our earlier commentary. However, this structure can also be combined with a plain vanilla position in the underlying cash security. Depending on how the cash and option allocations are made, the combined structure will be less highly levered.

The risk for option buyers is always that the price of the option never increases enough to offset the amount of time value originally paid for it. Time value decays – slowly for long-tenor options, but quickly in the last three months before expiration. We believe that minimizing the possibility of realizing this time decay-related loss is an important aspect of managing a hybrid stock / option position.

Loading...

Loading...