This month, we screen for attractive “bond replacement” investment candidates using new holdings of the Ariel Focus Fund (ARFFX), managed by Charles K. Bobrinskoy.

We have selected the top ten stocks that this fund reported purchasing in the first quarter of 2017, and have limited the list based on two criteria:

- Stocks listed represented more than 3% of the portfolio’s value

- Stocks listed had been bought by the fund in the reported quarter

These conditions were to screen for the stocks in which the managers had demonstrated the most confidence (by portfolio weight) and about which they had made an active decision to invest. As we explain in our video introduction to “Bond Replacement” investments, we are using these portfolio managers’ actions as an indication of undervaluation.

We featured Bobrinskoy’s fund in September of last year, and since that time, he has increased concentration in his fund and increased assets under management by around $12 million. There are two names held by the fund about which we have published research (name link opens Framework article search; ticker link opens YCharts overview page):

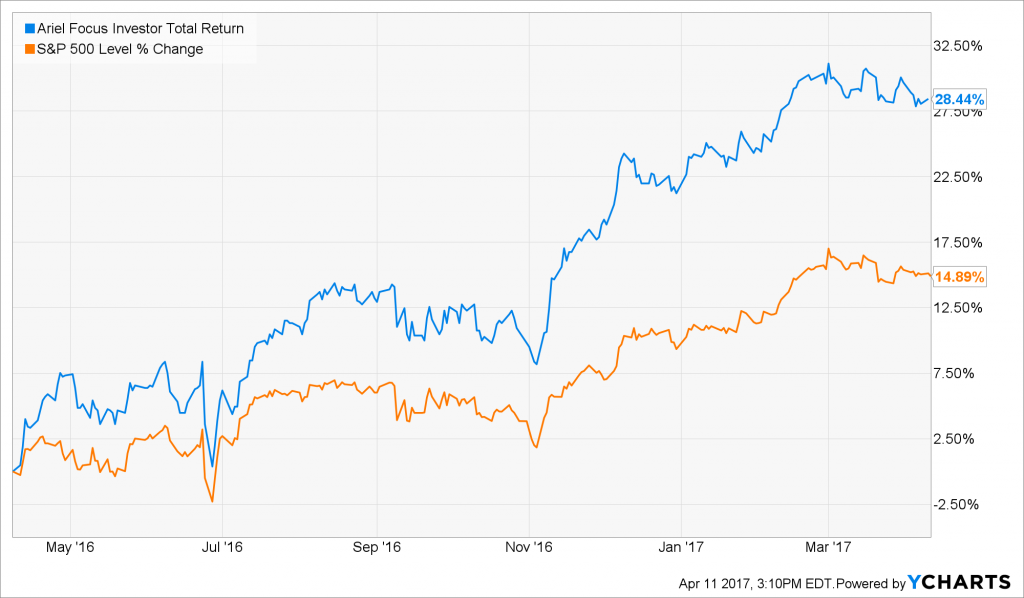

Morningstar’s report on this fund may be found here, and a prospectus for the fund may be found here. Morningstar does not think highly of this fund, and over its life, its performance is about the same as that of the S&P.

However, it has outperformed the index handily over the last one-year period, largely because of its resilience since the late summer of last year.

Unfortunately, many of the stocks owned by this manager have high per-share dollar values, so investors with smaller portfolios may not be able to allocate so heavily to these ideas. The two lowest per-share prices are Barrick Gold ($20.08) and National Oilwell Varco ($38.55), but both of those firms obviously have strong commodity components, so may display too high price volatility for some bond replacement investors.

On the bright side, the Effective Buy Prices for all stocks but one are below that of the price reported paid by Ariel in 1Q 2017.

Please reach out if you have any questions about this spreadsheet!