Pharma companies have been in the news a lot lately, and while people say there is no such thing as bad press, it seems like some firms like specialty drug maker Allergan (AGN), may disagree.

Three different IOI members have asked me about Allergan recently, and the interest has been so intense that I have started working with a private coaching student on a valuation of the company.

Just this morning, yet another mail about Allergan came in from a new reader – Kevin T. Kevin is an owner of Allergan and, in his words, is “spooked” about the company’s stock price declines. He read an article on a popular financial blog implying that the way Allergan represented its profits might run afoul of SEC rules, and asked me for my opinion.

As I was responding, I realized that the question actually encompasses all three elements of the IOI Training Courses.

- The article writer is trying (and succeeding in at least one case!) to trigger an emotional reaction among readers – the topic of behavioral biases and structural factors is the topic of our IOI 101 course.

- The author does bring up an interesting point about the accounting charge of “amortization” which brings up the topic of the capital needed to maintain a business as a going concern – this is central to our measurement of profits which we discuss in the IOI 102 course.

- Last, one of the reasons Kevin may be spooked about the position is that his investment allocation is uncomfortably large – the issue of structuring is something we discuss in detail in the IOI 103 course.

Here is our exchange.

Reader Question

Erik,

I read this [SeekingAlpha] article about Allergan. It sounded believable to me and concerns me, but I’m neither trained nor experienced yet in accounting & accounting rules so I don’t have the full skill set to properly evaluate & verify the argument presented. I’m long AGN. Anyhow I’m spooked. A cursory look and any feedback would be greatly appreciated.

Thanks, Kevin T.

Erik’s Answer

Hi Kevin,

First, I’d like to start off by saying that IOI Investor Services, LLC is not a registered investment advisor and I am not a registered representative of any firm. My intent is to offer what information I have been able to glean about Allergan and its financial statements regarding your question, but nothing I say should be construed as an offer or as advice to buy or sell securities. Thanks for your understanding about this.

Regarding this article, the first thing I would say is that the author of this article has disclosed that he is “short” the shares, so stands to profit from a decline in price. It goes without saying that he would be happy to find and publicly announce some information that would be damaging to the firm.

Regarding the point he brings up about Non-GAAP EPS, honestly, this is an arcane rule that I only heard of after reading this article. I have no idea of how to judge whether Allergan might be in breach of some SEC rules and, if so, whether that breach would have a material economic impact on Allergan or legal ramifications for its employees.

The author is careful to associate Allergan with Valeant (VRX) and this association may be inappropriate. First, I’m not sure the extent to which the issue at Valeant was legally serious. The SEC and companies have disagreements like this all the time and both sides field teams of lawyers to debate the minutiae of the regulations. From the posted SEC letter excerpt, it looks as though the SEC formally informed Valeant that they considered the firm’s use of Non-GAAP earnings metrics “inconsistent with Commission and staff guidance…” I know that Valeant has had some legal and regulatory trouble, but I don’t know if it was due to this issue, and in fact, doubt that to be true.

The association with Allergan and Valeant is, however, only one made by the author, (who is short the shares). In our IOI 101 course, we talk about the behavioral biases born from human’s peerless ability to recognize patterns. In this case, I think that the author is purposely trying to trigger a behavioral response from investors that would serve his own interests by appealing to a pattern that is in fact, invalid. The facts as I can see them are this:

- Allergan has not received a letter from the SEC.

- Allergan does use Non-GAAP measures.

- Many companies use Non-GAAP measures.

- The SEC challenged Valeant’s use of Non-GAAP measures.

In my opinion, the author is attempting to manipulate readers (and perhaps reassure himself) by making the connection he is making. He states that “…Allergan’s “non-GAAP EPS” metric appear[s] to violate the SEC’s rules and guidance governing such measures.” [emphasis mine]

The metric appears to violate the rule to the author, but there is no indication I can see that the author has the qualifications to make a determination about arcane SEC rules (e.g., the author’s profile does not say that he or she is a securities lawyer or a former advisor to the SEC). Keep in mind that securities rules are complex and even well-trained professionals in this field can reasonably disagree.

Now, one thing that the author points out which I have found to be true is that the issue of amortization is crucially important to Allergan. This is one area which my private coaching client and I have been looking at as we analyzed the firm.

Our measure of Owners’ Cash Profits (OCP) uses Cash Flow from Operations as its starting point and deducts an estimate of the amount of capital needed to maintain the business as a going concern. For most companies, our estimate is based on an accounting line item called “Total Depreciation and Amortization”. We talk about why we look at profitability in this way in our IOI 102 course and discuss why amortization should be considered a cost of maintaining the company in some instances and why it should be excluded as a cost in other cases.

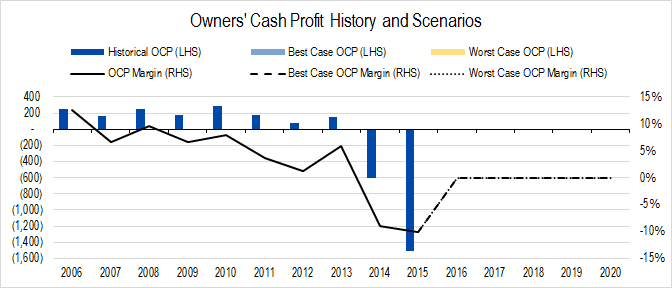

In Allergan’s case, this distinction makes a big difference. Here is a graph of Allergan’s OCP and OCP margin assuming all amortization should be included as a maintenance cost:

Figure 1. Source: Company Statements, IOI Analysis. (No projections input for years 2016-2020)

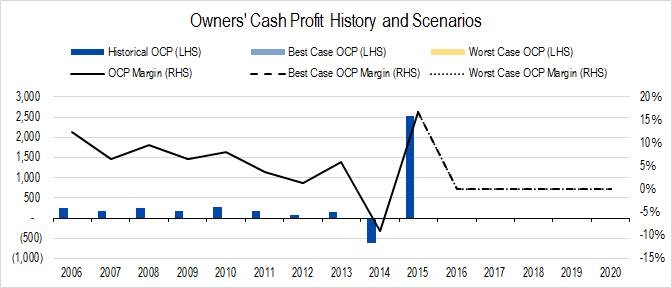

Here’s the same graph, excluding some of the charge for amortization in 2015:

Figure 2. Source: Company Statements, IOI Analysis. (No projections input for years 2016-2020)

It’s like night and day!

We have not dug deeply enough into this question yet to provide a definite answer yet. What I can tell you is that the average OCP margin for the company over the years 2006-2013 was 7%. This profitability surprised me as being on the low side, and the longer term growth of profits was also fairly weak. This is not to say that the company is over- or under-valued. From an investment perspective, it’s not important whether a company is generating 7% profitability of 27% profitability, but rather how much the market is paying for that stream of profits!

As we start digging down into the numbers and get more comfortable that we understand Allergan’s business model, we’ll publish a valuation for the firm. Stay tuned!

I hope this has response has helped ease your mind. There are a lot of lessons here from both a behavioral perspective and a valuation perspective. You didn’t mention about the size of the Allergan position in your portfolio, but likely, there are also lessons to be had about structuring! This covers each of our courses – IOI 101, 102, and 103, respectively!

Thanks for writing in.

All the best,

Erik