In addition to reading through hundreds of pages about railroad pricing and learning something about the economics of airports and air carriers, I couldn’t help keeping up with the news out of Washington. Also, Ray Dalio published a report about populism, calling it a factor that was more likely to affect markets than fiscal or monetary policy over the next few years. Here’s my list for this week.

What FBI Director Comey said on Trump, Russia and wiretaps (BBC Video). Lots of testimony, only two substantive bits of information: 1) the FBI is investigating the connections between Russian intelligent operatives and members of the Trump campaign / administration, and 2) There is absolutely no evidence to support Trump’s claim of President Obama ordering the “wire-tapping” of Trump’s phones.

Impact of Panama Canal Expansion on the U.S. Intermodal System (USDA). This report is dated, but gives some good information about transporting goods in the US and on some of the stress points in the system. This relates to our work on Union Pacific.

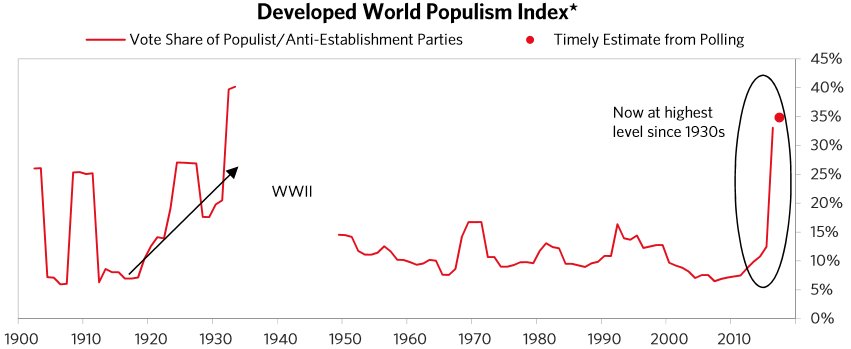

Ray Dalio Says Populism May Be a Bigger Deal Than Monetary and Fiscal Policy (Bloomberg). This was one of the big take-aways from the Grant’s investment conference as well. Normally conservative-leaning fund managers and high finance types are becoming increasingly concerned over protectionist policies and attitudes being seen in the US and abroad. Here is the full Bridgewater report, which I haven’t had time to read yet.

Why Planes Don’t Fly Faster (Wendover Productions). A mention about physical limits to the number of planes flying by Gilchrest Berg at the Grant’s Conference led me to this interesting video about transit times for airplanes. This company also does a very good video about the economics of different classes of seating in airplanes.

Stocks may stay overpriced for a while — but not forever (FT.com). This is an opinion piece, but lays out, I think, the conundrum facing investors right now: the market looks expensive on a ratio basis, but what, if anything, will force it to become cheaper?

As I mentioned in the introduction, I spent a lot of time this week reading about the rail industry and looking at various sides of rail industry pricing. These articles are wonky, but I found them helpful in learning about how railroads keep pricing high!

- Surface Transportation Board Seeks to Impose Backdoor Railroad Price Controls (CEI – Libertarian think tank)

- Federal Policies Need Reform (Freight Rail Customer Alliance – Shipper lobbying group)

- Analysis of Freight Rail Rates for U.S. Shippers (Escalation Consultants, Inc., 2014)