We were hard at work on the income portfolio so a lot has changed since we made our diary entry last week. While we’ve made some progress against our goals of simplifying, consolidating, and boosting yield there is still more to do. Let’s take a look at the changes.

The Portfolio

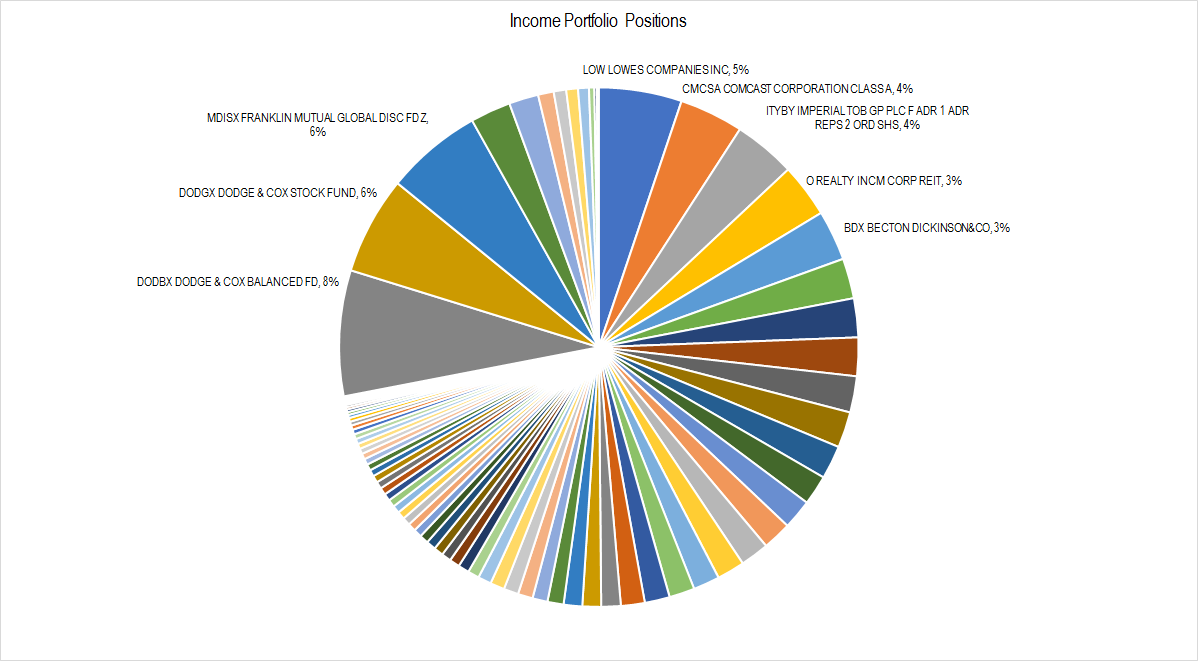

As a reminder, here is our original pie chart.

Figure 1.

This portfolio had 86 separate assets, 73 of which were individual stocks, one was cash (a very small allocation), and the rest are mutual funds. The average yield of the portfolio sat around 2.6% – well shy of our 7% – 8% target payout ratio (to meet the client’s required minimum distribution payments).

Last week, I talked about my plan to:

- Sell the very small positions that pay poor yields. There are a few stocks with higher yields and small allocations, and I’ll look at those to see if the allocation can be bumped up.

- Look through the larger positions for opportunities. Very few companies are yielding between 7% – 8% these days, but there may be some companies on which I can sell options to boost yield.

- Start looking for preferred shares. Preferred shares are a little ways up the capital structure hierarchy, pay a higher yield, and have less exposure to overall market volatility.

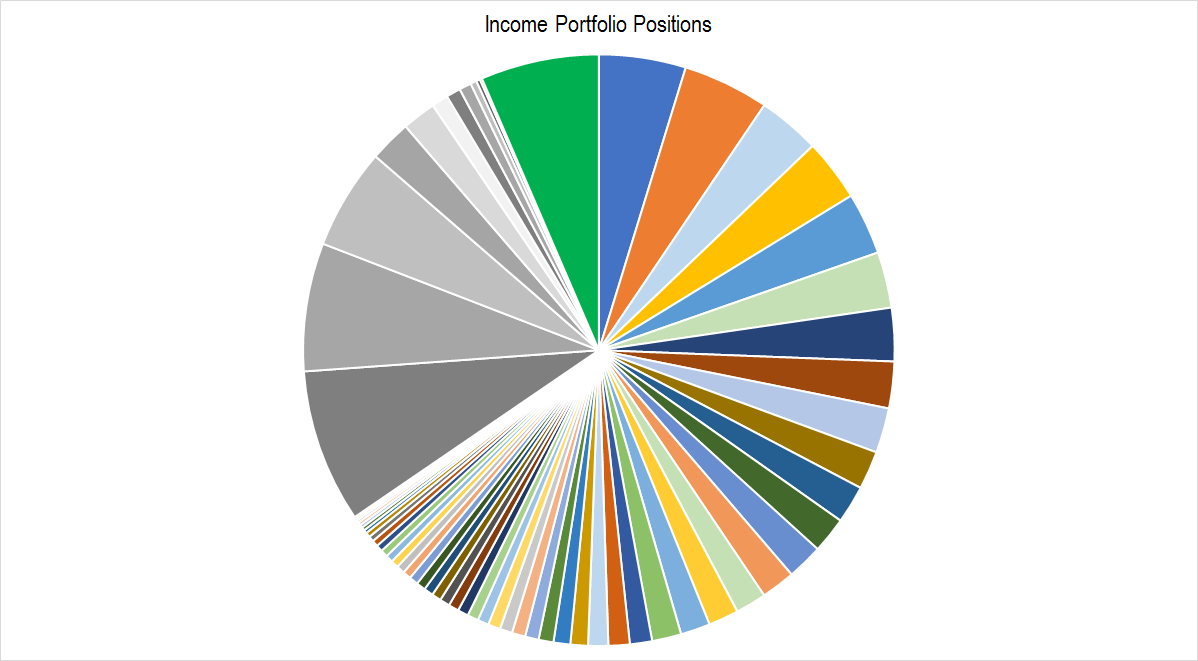

In fact, I actually sold a few of the larger positions as well as some of the low-yielding small ones. Here is a view of the portfolio today:

Figure 2.

Okay – you might think that there’s not much change or improvement between figure 1 and figure 2, but actually a few things have happened.

- I brought the total number of assets down to 65 from 86 – selling off one larger allocation and many small low-yielding assets. In a few cases, I increased allocations to some higher-yielding assets.

- I entered into two “bond replacement” investments which I discuss more below.

I didn’t touch the funds yet – honestly, I don’t know how those trade, so I’d rather do things that I understand relatively well first. The funds are all shaded in gray in figure 2 above.

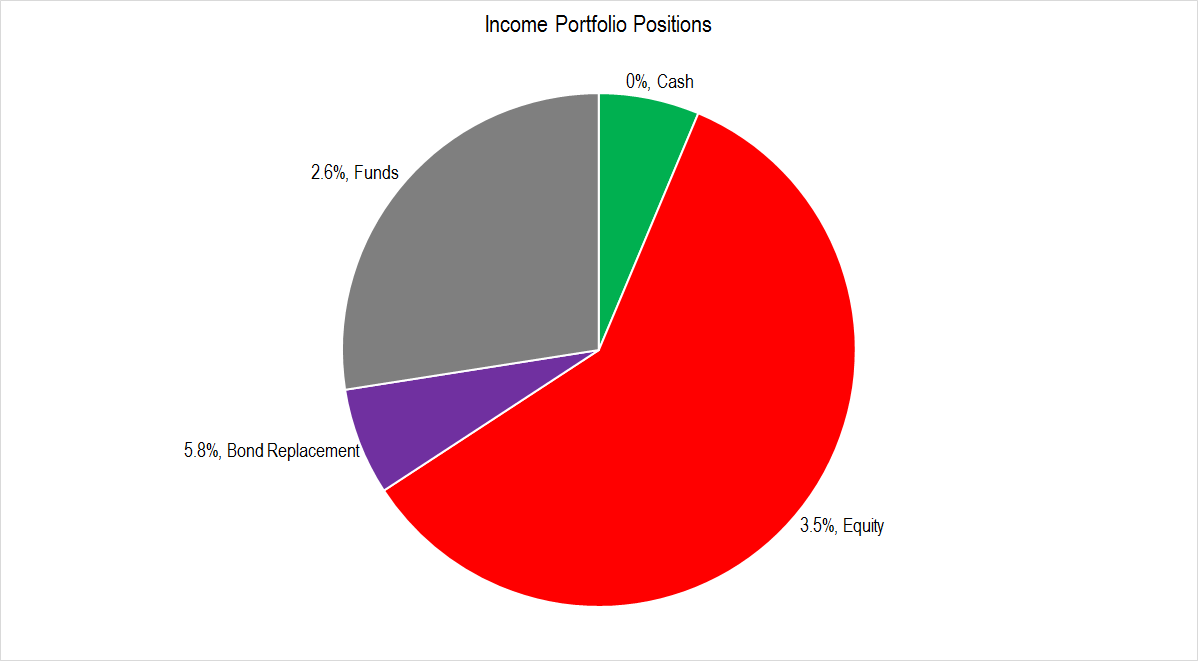

Looking now at classes of investments rather than individual assets, the portfolio looks like this.

Figure 3.

The number before each of the category names shows the average yield from that allocation. Even with around 6% of the fund’s assets sitting in cash now earning essentially nothing, the overall yield of the portfolio has increased by 60 basis points to 3.2%. This increase in yield is much less about financial engineering than it is about simple arithmetic. I sold off lower yielding instruments and modestly increased allocation size to higher yielding ones. This naturally brought up the yield, even considering the drag from cash.

Seeing this diagram, what is your first thought? Mine was “I’d better figure out what to do with the funds pronto.” Just over a quarter of the portfolio is invested in these funds, so if I can increase the yield of that allocation to, let’s say 3.5% (i.e., the same as the Equity portion), my yield should rise by (27% * (3.5% – 2.6%)=) 0.24%. Okay, not huge, but… baby steps…

Bond Replacement Investments

(For those of you who have not watched it yet, I recommend the explanatory video on bond replacement investments I did last year.) I have two bond replacement investments:

- A covered call on IBM struck at $155 per share with a notional value of 4.6% of the portfolio overall.

- A short put on AES Corp struck at $12 per share with a notional value of 2.2% of the portfolio.

The “yield” of a bond replacement investment is different from a dividend yield or from a bond yield. Specifically option premium received is revenue, not income, because if the stock price falls, the fall may offset the amount of premium received.

In the best case – taking IBM for example – the stock will be trading at $149.99 when the option expires. In this case, I still own the stock (so can receive the $6 per share of dividends this year) and a get to realize all but $0.01 of the premium I sold (about another $6 per share). In this case, the yield from my investment in IBM is about $12 / share (I’m annualizing the dividends and using the nominal value for the option) on the $155 strike price for a total of 7.7%.

In the worst case – again using IBM – the stock falls below my Effective Buy Price, making me unable to realize any of my premium revenue as income. Here, I can calculate the dividend yield of my investment from my effective buy price. In this case, I’d be receiving $6 of dividends on $149 per share for a yield of 4.0%. At this time, I would also probably write another covered call that would allow me to extend the tenor of the investment and boost my yield again.

The average of these two yields is 5.9%, and that is the value that I used to calculate the yield shown in figure 3 above.

Cash

Holding cash in a portfolio means one of two things:

- The manager is lazy or not paying attention.

- The manager is positioning for a contraction.

In my case, in this portfolio, the cash probably is indicative of a little of both. Anyone who has read my work on the Trump administration knows that I am worried that the President’s lack of strategic vision, discipline, and knowledge has the potential to create long-term problems for US businesses. Anyone who checks a chart of the S&P 500 since November 9, 2016 understands that my position regarding this issue is either indicative of extreme foresight or of extreme error. While I wake up each day fearing the latter, one glance through my Twitter feed and a review of the morning’s news makes me think it is too early to abandon my belief in the former.

In other words, I’m expecting a contraction, and I want to have some cushion to buy stocks when the price falls. A “hedge” is simply a way of doing this using an instrument other than cash.

The lazy part of me is also probably at work. There were a few interesting names in the portfolio (Macquarie Infrastructure and SeaSpan are two) that are yielding well over my average yield but are relatively small portions of the portfolio (less than 1%). I have not yet had time to analyze these stocks, but may increase their weight in the portfolio once I do; this will whittle down some of the cash.

Goals

My goal is to continue along the same path: decreasing the number of positions held and increasing the yield of the portfolio. I still have not looked into preferred stocks, but perhaps I’ll be able to do that over the weekend.

I’ll try to learn something about funds as well, but in the meantime, plan to concentrate on paring the stocks in the portfolio that have a yield of lower than the average fund yield. After that, I might experiment with selling one of the smaller, lower-yielding funds to see at what price my order is filled.