My eyes watered a bit when I saw the news cross the wires yesterday that IBM had acquired Linux / Open Source pioneer, Ret Hat RHT, for just shy of $34 billion. This cash acquisition, which will be partially funded by new debt issuance, is over six times larger than the largest of IBM’s previous acquisitions (Cognos, $5 billion in 2008).

The main thing that worried me when I saw the price tag was that Red Hat’s revenues during the last fiscal year (ended on 2/28/2018) only amounted to around $3 billion. This implies that IBM is planning to pay more than 11 times sales for Red Hat.

Is a price-to-sales ratio of 11x too high? This article details what I’ve found and I also include a valuation model so you can tweak the assumptions.

Revenues

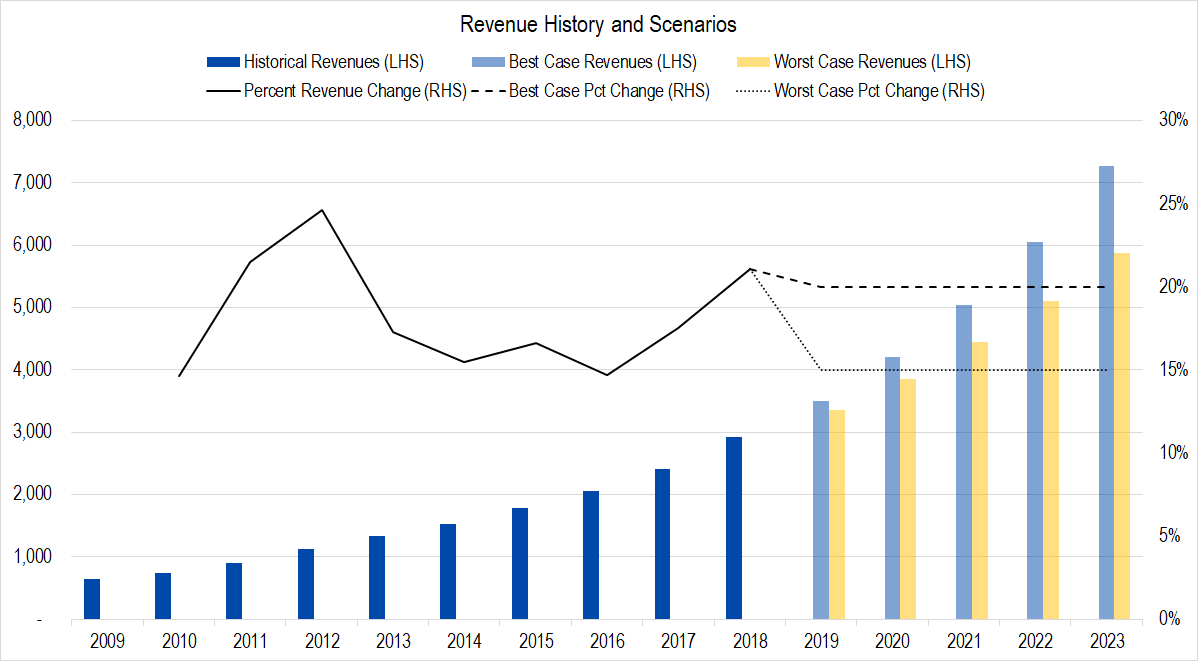

Regarding the King of Value Drivers, Red Hat is experiencing consistent strong demand, which has propelled year-over-year revenue growth to the mid-teens to mid-20% level.

Figure 1. Source: Company Statements, Framework Investing Analysis

In my model, I’ve pegged best- and worst-case revenue growth over the next five years to 20% and 15%, respectively. However, considering IBM’s client base, this range may actually need to be scooted up over time.

Listening to an interview with Ginni Rometty (IBM) and Jim Whitehurst (Red Hat), they make the excellent point that Red Hat’s open source software appeals to many enterprises that feel trapped by the proprietary code used by Amazon’s AWS and Microsoft Azure cloud products. As I have long written, Hybrid Cloud — an enterprise that keeps some of its data and processes on premise while using the public Cloud for others — represents the logical future of technology.

Red Hat is a trusted name in the public Cloud; IBM is a trusted name for enterprise security and applications. Together, I believe they can build a juggernaut in the Hybrid Cloud world.

(You might ask where Oracle is in all of this. In my opinion, Oracle’s Cloud offering represents a finely-tuned hardware / software combination that allows for the best performance for highly critical applications.

I noted the recent article that attributed the root cause of one of Amazon’s recent “Prime Day” outages to the fact it had moved one data warehouse off of Oracle’s platform. In my view, Oracle will own a high-performance niche that serves customers in need of private and public Cloud computing.)

Profits

I was blown away by the consistency of Red Hat’s profitability. The company consistently generates Owners’ Cash Profit (OCP) margins in the 30% range. Rarely does profitability stray out of this range.

Figure 2. Source: Company Statements, Framework Investing Analysis

While IBM has said that it will operate Red Hat as an independent business, it is not hard to imagine that at least some overhead will be able to be trimmed. In addition, if IBM is successful in increasing sales at Red Hat through its long and deep client connections, operating leverage may actually push this range up as well.

Investment Spending

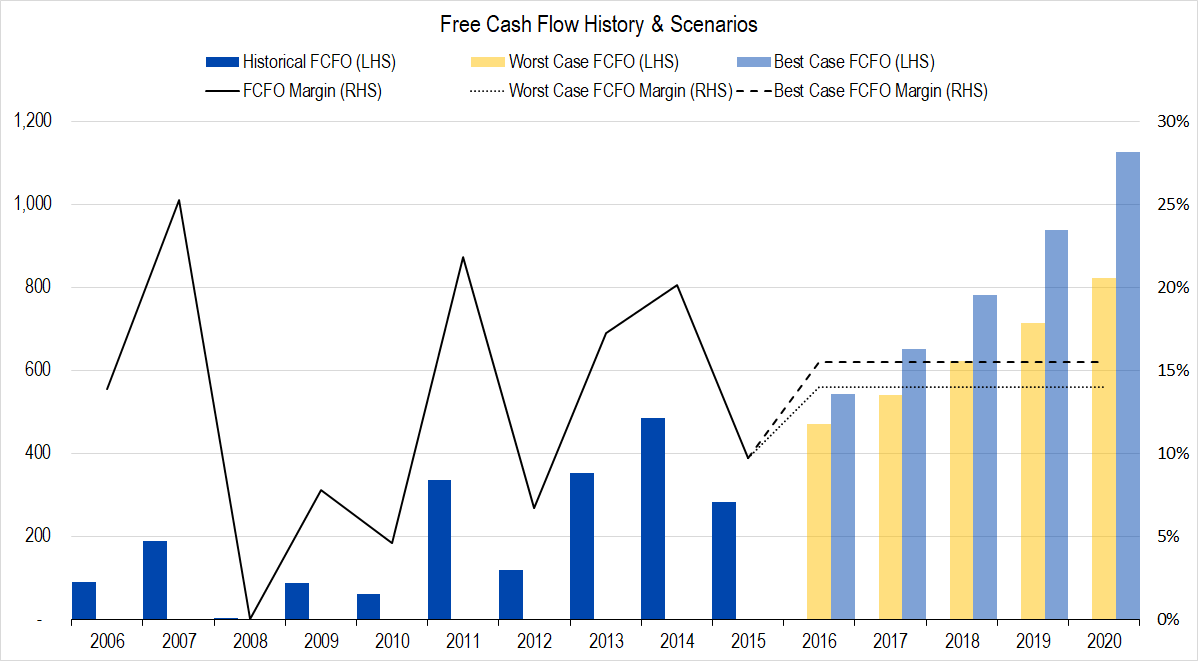

While Red Hat’s investment spending is especially saw-toothed due to its use of acquisitions, over time, the Free Cash Flow to Owners (FCFO) margin is amazingly consistent.

Figure 3. Source: Company Statements, Framework Investing Analysis

It is not clear to me that Red Hat will need to spend as much to grow its business in the future either. The scale born of the ties to IBM may allow the firm to spend relatively less on acquisitions. Even without this assumption, though, if revenues are growing in the high-teens and profits are consistently around 30%, FCFO should grow fairly rapidly over time.

Medium-Term Growth

Rometty’s comment that the lowest-hanging fruit has already been plucked when it comes to Cloud transitions, rings true.

Right now, even with phenomenal growth rates over the last decade, only an approximate 20% of data and applications live in the Cloud. Recently, growth rates have been dropping off. This drop off likely does suggest that moving the remaining 80% of applications will require a heavier lift.

A “heavier lift” is hard for young companies that have become used to building the best applications for a green technical field. However, IBM — a company that has made a name for itself in the “middleware” that ties disparate legacy systems together and whose machines are at the heart of many critical business processes — is used to “heavy lifts.”

We think that as the transition to the Cloud becomes more difficult and nuanced and present customers get frustrated with the proprietary systems that lock them into Amazon or Microsoft, companies like IBM and Oracle will begin to look particularly good. This is to say nothing of the impetus that retailers feel to drop Amazon’s services because they are sick of paying money to the killer that is bleeding them dry through online competition.

All things considered, a long period of relatively rapid growth for Red Hat’s business under the aegis of IBM is not impossible to imagine.

Valuation

If Red Hat’s future revenue and cash flow growth are tepid, IBM has vastly overpaid for its investment. On the argument laid out here, however, that does not seem to me to be the case.

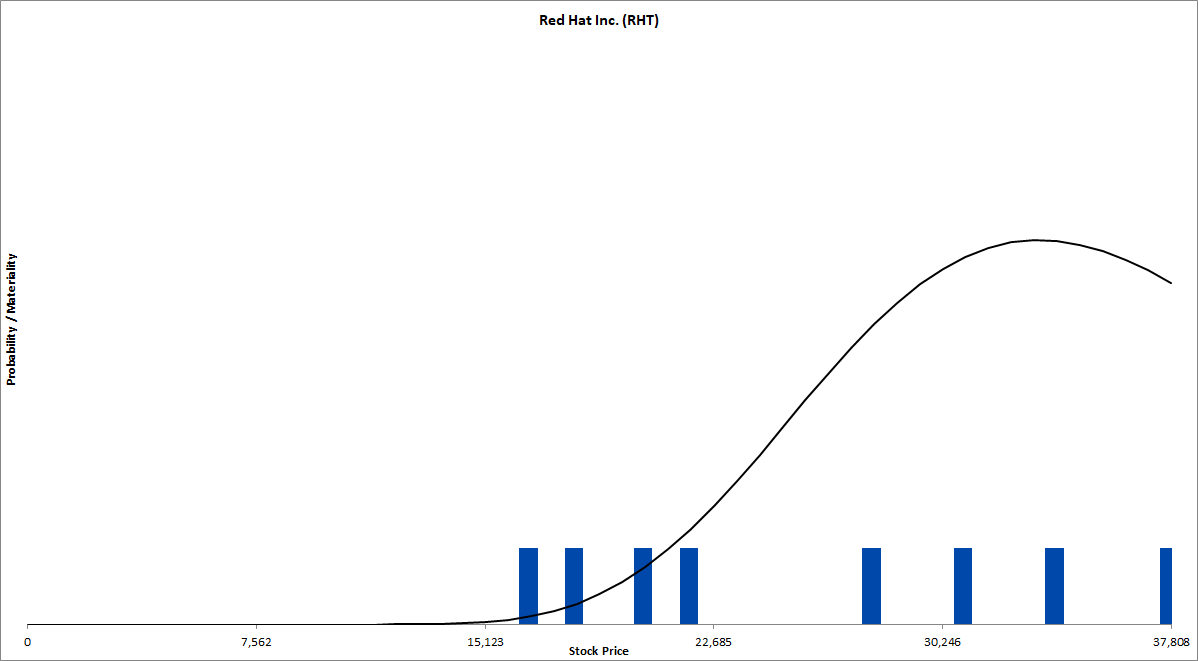

The average of the four scenarios with relatively long and fast medium-term growth is $33 billion — about what IBM paid. The average of the four scenarios with relatively long, slow medium-term growth is $19 billion, considerably below IBM’s purchase price.

Over all eight scenarios, IBM’s purchase price represents an acquisition premium of on the order of 30% — typical for these types of corporate events.

Figure 4. Source: Company Statements, Framework Investing Analysis

All things considered, IBM’s acquisition of Red Hat strikes me as at least a neutral event and most likely slightly value creative.

In light of this analysis, IBM’s stock price drop to sub-$120 / share looks like a good opportunity to me, and I will be increasing the allocation to this position opportunistically over the next few weeks.

Please feel free to look through the attached valuation model and let me know where I am off base on my analysis.

Framework Integrated Valuation Model – Red Hat Inc (RHT) ![]()