Passive investing and the use of index and other ETFs (Exchange Traded Funds) to enable it is currently all the rage among both the wealth management and the regulatory crowd overseeing retirement accounts in the United States. The advent of algorithmic investing (robo-advisors) has only added fuel to the raging fire. My grandfather gave me a piece of sound advice as a kid that I’ve forgotten to my own detriment at times – “Joe, everything in moderation…including moderation.”

Before I go any further, IOI is an advocate of the use of cheap index ETF’s as a core element in our own portfolio thinking. It IS really hard to beat the market consistently over long investment horizons. So, it makes absolute sense to us that a core holding of a broad, liquid US-based1 market index is a good starting point for any investment portfolio.

But something has been bothering us about the “Passive Investing Revolution” in concert with the explosion of ETF instruments available to investors. Historically in the financial markets, when everyone is all in, there is only one way for things to go. And this lead’s me back to the warning in my grandfather’s quote.

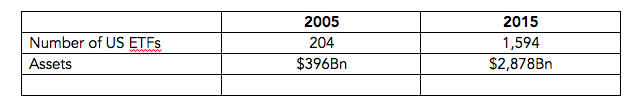

This revolution does not appear to be an example of thoughtful moderation. Indeed, for investors and market participants alike, it appears more like the scene from Despicable Me 2 where the minions are having a giant, blowout party fueled by ice cream and bananas (Kanpai!). The table below highlights the size of the party and the growing number of participants.

Source: Horizon Kinetics, Statista

But just like in the movie, when you stop and start looking around there appears to be a series of hidden agents that threaten the participants’ very existence.

Hidden Risks

Remember, markets go down. We don’t always see it coming and we don’t always know why in hindsight – we’re still trying to figure out the Crash of ’87 and Black Monday, for example. What we know from the last two crises is that the hidden connections underpinning our financial system’s plumbing tends to exacerbate downdrafts into a full-blown crash (LTCM, The Asian Financial Crisis, The Tech Bubble and The US Housing/Financial Crisis and Great Recession). And there are certainly some of those hidden, unknowable connections in the financial structures of ETF’s and index funds that undermine the “low risk”, “high liquidity” marketing stories being propagated in the world of passive investing. And it is in this context as intelligent investors, that we must sharpen our pencils on ETF’s and the rush to passive.

ETF’s = low risk, high liquidity (Ummm, maybe not)

For IOI, one’s level of risk is directly reflected in one’s ability to absorb losses on a position and then the relative probability that a loss will be the outcome. Naturally we try to avoid investments where a loss appears to be a probable outcome and we do this through a disciplined, repeatable valuation process (outlined in IOI 102 – Valuation). The key to our valuation approach is to keep it simple and focus on the big drivers of value – revenue growth, profitability and investment level & efficacy.

Interestingly, if we apply this same risk and valuation discipline to looking at the ETF world, it becomes clear very quickly that there are some elements of the ETF structures that should give us pause. The first thing to note is that an ETF is a structured financial product, just like a Collateralized Loan Obligation or Credit Default Swap.

ETF’s can be assembled either through physical replication of the target index (or sector, commodity, bond, etc.) or synthetically through complex swap structures. When the components of an index are heavily traded (liquidity is deep), physical replication is both achievable and cheap. However, when an index is not particularly heavily traded and its components are similarly “illiquid” then most ETF sponsors replicate the target using a swap arrangement with a “counterparty”. Interestingly, the collateral supplied by the swap counterparty may or may not have anything to do with the actual index in question – it’s value just needs to be within 10% of the actual Net Asset Value of the index. Also, the instruments in that collateral basket are eligible for securities lending. What’s important to realize here is that in a period of stress, the value of the collateral assets and/or the counterparty itself could swing wildly away from the index itself.

ETF sponsors are incentivized structurally to use these swap arrangements because they can leverage their investment banking asset inventory and substantially reduce their costs. The concern here is the lack of transparency for the investor as to what assets are actually behind the investment they have made – sound familiar? This problem arose in spades during the mortgage crisis. Indeed, the swap counterparties are incentivized through cost savings to use less liquid assets in these collateral baskets.

In “backing” these swap arrangements, investment banks run the risk of mingling the risk in their trading book with the risk they absorb in having to supply the index return to their ETF sponsor – further deepening the lack of transparency for investors. If the investment bank underperforms or has some tracking error in their investment approach, that is new risk for the bank that is not transparently accounted for and certainly that the ETF investor does not realize. This can become particularly acute in times of high volatility and/or fund redemptions where the investment bank must deliver liquidity to fund redemptions while attempting to keep their tracking error to a minimum.

ETF’s often are not as diversified an instrument as you think. Let’s take a simple example from a presentation by Horizon Kintetics to the Grant Investor Conference in September. The iShares US Energy ETF is presumed to be a diversified basket of US energy companies. In fact, if one lifts the hood on the prospectus, as of end June 2016, ~50% of that ETF was allocated to 4 large cap energy companies. This top heaviness exists across the board to varying degrees for such “targeted” ETF’s. Investors here are actually buying the idiosyncratic risk they sought to avoid.

ETF’s and index constructions confound transparent price discovery because they artificially inflate demand for shares of their components. Indices and ETF’s that track them are being created faster than ever and the demand for these “open-ended” instruments (there is no cap on the number of shares they can issue) places a corresponding demand on shares of companies that have a finite float – thereby driving up prices. The more liquid the stock, the more demand there is for that stock as part of an ETF or index. This creates a sort of “automatic bid” underneath the prices for these most liquid equities.

These five structural risks seem important to us as investors. I think the following steps are just a few things intelligent investors must do when using indices and ETFs.

- Know what the ETF / index is holding and compare it to your objective. The holdings should fit with the investment outcome/intent you have in mind. If the goal is a diversified basket of companies directly linked to the Spanish economy, then the corresponding top 10 holdings of the target index /ETF cannot comprise 80% of the fund and the 60% of the revenues originate outside Spain.

- Know how that ETF is structured and assembled. If you cannot figure that out or it’s opaque to you, you should consider this in your investment decision. Don’t invest in things that you don’t understand.

- Cash is always king, so ensure you are getting a real liquidity benefit from your ETF investments.

- Understand the effects of your ETF’s structure on tracking error. Inverse, levered and commodity ETF’s are all structured using derivatives and this has a real effect on how the ETF or ETN (Exchange Traded Note) mirrors the returns of the thing it is attempting to track. These tracking errors can be greatest as volatility rises.

To be clear, this is not an indictment of the ETF instrument, but it is a bit of an indictment of a blind rush into “passive” investing. One has to at least know the risks and implications embedded in one’s portfolio and to align those risks with his/her financial goals and objectives. It’s not enough (at least to us) to leave this solely in the hands of an advisor or algorithm – both get paid long before you do! Ask questions and get answers. Not knowing is a sure way to a future loss.

ETFs are a super way, in many cases, to gain broad market exposure cheaply. Just be sure you are buying the investment returns and the risks that you think you are.

In the meantime, Invest Intelligently.

NOTE: In assembling this article, IOI found the information from both the Bank of International Settlements Working Paper #343 and the presentation given by Horizon Kinetics at the September 2016 Grant’s Interest Rate Observer Conference to be extremely helpful.