“Schadenfreude” is a German word meaning “the pleasure derived from someone else’s sorrow.” And with the announcement of its first revenue decline since 2003, Apple has been the subject of a good bit of schadenfreude lately.

And because the stock is so widely held, everyone seems to have an opinion. Both Apple haters and lovers point to their own pet anecdotes and data tidbits (e.g., “The smartphone market is dead”, “Apple’s car will be a game-changer”, etc.) to back up their point of view.

But facts trump opinions, so let’s take a hard look at the facts Apple’s business and work to value the company that way. The only axiom you need to accept is one I call “The Golden Rule of Valuation.”

The value of a company is equal to the cash it will create on behalf of its owners throughout its economic life.

If you accept that axiom as true, there are only three things which can affect the value of a firm:

- Revenue growth

- Profitability

- Investment level and efficacy

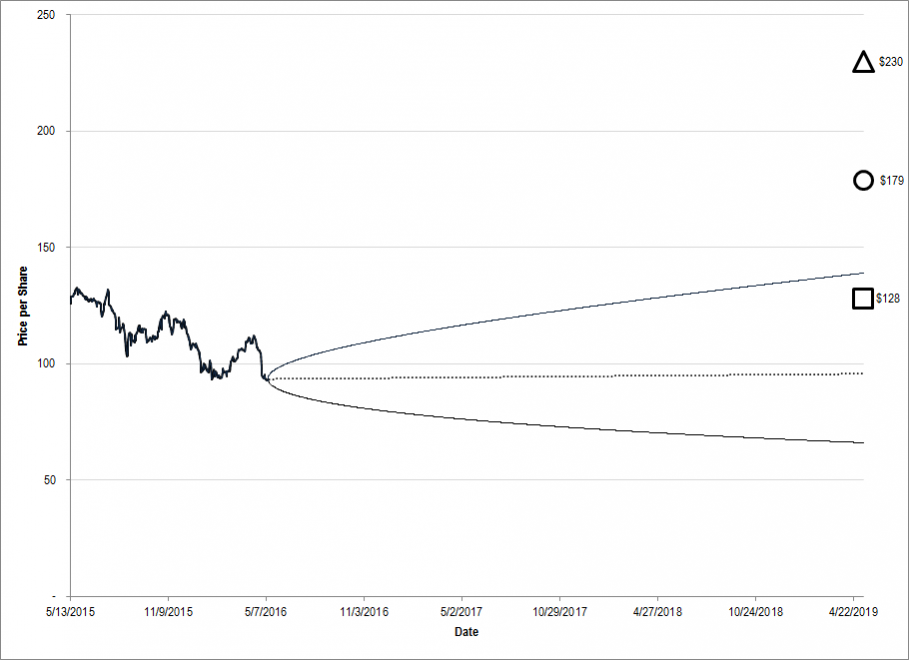

Analyzing these key valuation drivers and projecting best- and worst-case scenarios for each, we find Apple to be materially undervalued right now. Our valuation range, shown below, extends from $128 to $230.

Figure 1. Source: CBOE, YCharts, IOI Analysis. The cone-shaped region represents the option market’s best idea for the future price of the stock. The geometric shapes to the right of the diagram represent IOI’s estimated valuation range.

Last week, we published a one-page Tear Sheet detailing a “bond replacement” option investment in Apple. This week, we published a more detailed report that included the three things an Apple owner should know. Here is an overview of our valuation analysis.

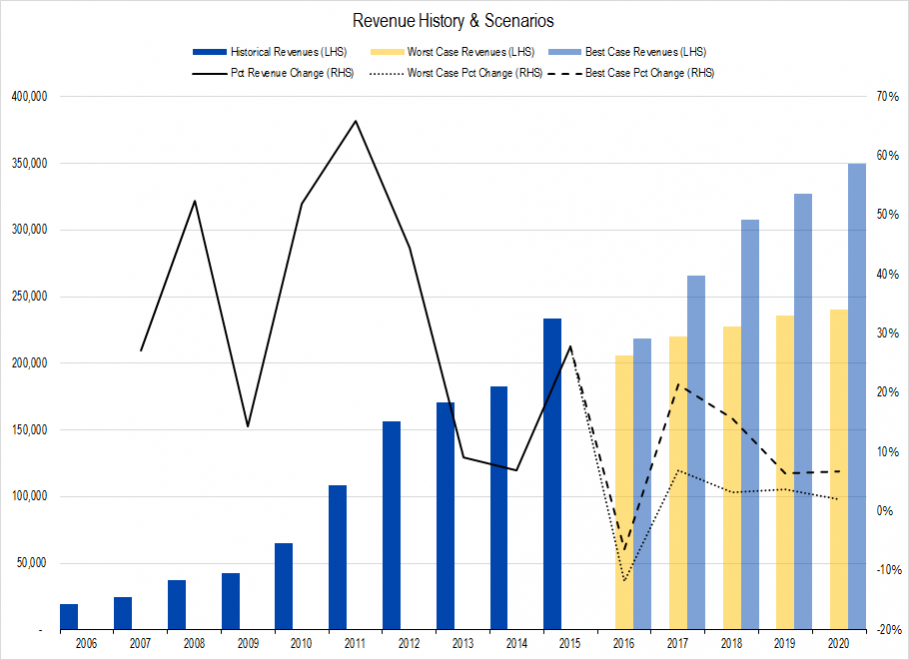

Revenues

As we cover in our training sessions, revenues are the factor to which the best directional investors pay closest attention. And with nearly three-fourths of its 2015 revenues coming from the iPhone line, Apple’s position in the smartphone market is the critical revenue driver. Long story short, Apple needs to make sure that its iPhone releases are big wins. That process involves two things:

- Convincing current iPhone owners to trade up to the newest model (i.e., maintaining the line’s installed base)

- Convincing current owners of competitor handsets to make a switch (i.e., boosting market share)

In developed economies, Apple increases client “stickiness” and maintains its installed base partially through its services like iTunes, which run seamlessly over multiple devices. Considering the smartphone saturation level in developed markets and barring some catastrophic error in Apple’s product offering, we believe its future revenues in the developed world will be stable but slow-growing.

In emerging economies, many users participate in the digital world using only a single device, making cross-platform switching is much easier. Most smartphone purchase decisions are made by users answering the question “What is the highest functioning device I can afford?” Because Apple prices its products at a premium and because its products are no longer always the highest functioning ones, we think that growth in emerging markets is likely to be difficult for Apple.

Taken together, we estimate an average annual near-term revenue growth of 9% in the best case and 1% in the worst case.

Figure 2. Source: Company Statements, IOI Analysis

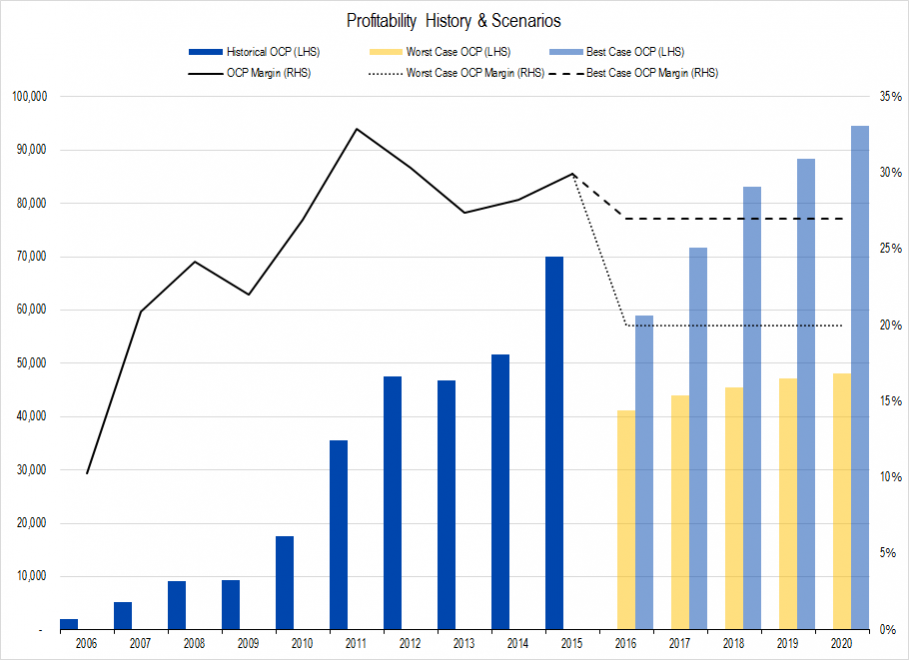

Profitability

Our preferred profitability metric is one that I introduce in my book, called Owners’ Cash Profits (OCP). This measure is similar to what Buffett has called “Shareholder Earnings.”

Due to the maturity of the industry and the competitive dynamics in both developed and emerging markets, we believe Apple’s profitability has already reached its peak and is now more likely to weaken. Like most firms, Apple can try to drive faster revenue growth by dropping prices. While we think this scenario is unlikely, our worst-case profitability projection reflects this dynamic.

Figure 3. Source: Company Statements, IOI Analysis

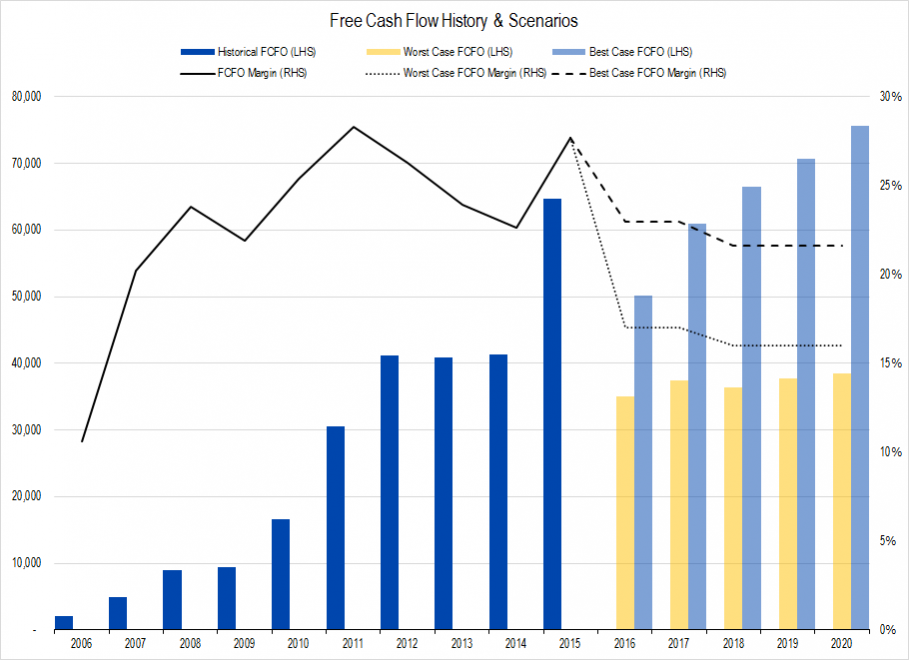

Investment Level and Efficacy

Apple designs and markets phones, but because it outsources production, so it has only had to invest a median of 7% of OCP on investment projects over the last 10 years. We believe, and management has stated, that it is likely to make larger investments in the coming years. We forecast Apple’s investment level at 15-20% of its OCP, which implies a Free Cash Flow to Owners (FCFO) margin of between 16% and 22%.

Figure 4. Source: Company Statements, IOI Analysis

Investment efficacy — the factor that influences how fast profits will grow in the future — has been phenomenal, thanks to Apple’s game-changing advances in portable digital time-wasting technology (i.e., iPod, iPad, and iPhone, successively). Apple now must try to effectively invest its considerable cash hoard and this is an area about which we are circumspect.

While Apple lovers believe the next big advance is hiding just within the product pipeline, we think the chances for an iPhone-magnitude hit are slim to none. As such, we forecast medium-term (i.e., years 6-10 of our model) cash flow growth of 3% (worst-case) and 7% (best-case).

Final Valuation

Combined, our best- and worst-case scenarios for the three valuation drivers generate our fair value range of between $128 to $230 per share. This value also includes a tax-adjusted measure of its net cash position (cash and investments less debt) of roughly $80 billion.

Haters may hate, but Apple is still worth more than what it is trading for today.