September 15, 2017…Amazing…The year seems to be flying by. With Erik’s trip to Latticework last week and the big GE re-analysis this week, we’ve sparred nary a moment. Honestly this is the benefit to having a Framework for our investment process. As the bullets start flying at times, we can come back to that and hang the new information on it, test our biases to ensure we’re leaving them behind and think carefully about the road ahead. The news that caught our eyes this week remained focused on the hurricanes with the Fed making its view of the recovery known, as well as an article on Buffett’s effects on Capitalism from the FT and an academic piece from the Bank of International Settlements (BIS) on demographic effects on trends that have been driving the global economy.

We had a few other things on our list as well (how could we pass up talking about the iPhone X, you ask?), but we prefer to keep this a focused space.

Here is a curated list of important stories outside the main headlines that caught our attention this week.

Broken Window Theory: Does Destruction Help The Economy? (posted by TimeMoney). Following on from some of our reading last week, we have continued to try to get our heads around the REAL economic effects of these two hurricanes. It is at least unusual to have two such destructive storms so close to one another in time and so large affecting some of our largest cities and states. In this short piece, the folks at TimeMoney example Fed President Bill Dudley’s comments on how these weather incidents affect the economy and what he expects to have happen now that these two disasters have passed and recovery has begun.

Severe Weather Threatens Businesses. It’s Time to Measure and Disclose the Risks (Jean-Louis Bertrand, Miia Parnaudeau) Bertrand and Parnaudeau are both professors of finance at ESSCA School of Management, and members of the Weather Risk Management Association. Who knew, right? This is a different and very interesting look at the nascent thinking around “weather risk management” as a tool for businesses, particularly large multinationals, to protect themselves on a going basis from catastrophic outcomes. Their research into the effects and risk goes beyond GDP effects down to individual small businesses. Solutions then go beyond insurance to look at how weather risks might be prepared for and possibly hedged by business.

How Warren Buffett Broke American Capitalism (Robin Harding in the Financial Times). One of our few luxuries at Framework Investing (we’re a small company, after all) is our “corporate” subscription to the FT. Along side the Economist, the FT is one of the most balanced news outlets going. Harding looks at the dark side of Buffett’s success through an interesting and true lens. He writes, “But however much you admire the man, his influence has a dark side because the beating heart of Buffettism, celebrated in a thousand investment books, is to avoid competition and minimise capital investment in the real economy.” If we think about that and hang that on our Framework, Buffett’s approach maximizes the demand environment (revenue) and minimizes the investment (Net Expansionary Cash Flows a % of OCP). Harding’s point is that this approach is bad for consumers as well as bad for business in the long run due to lack of investment. An interesting take, indeed, on the folklore surrounding Uncle Warren.

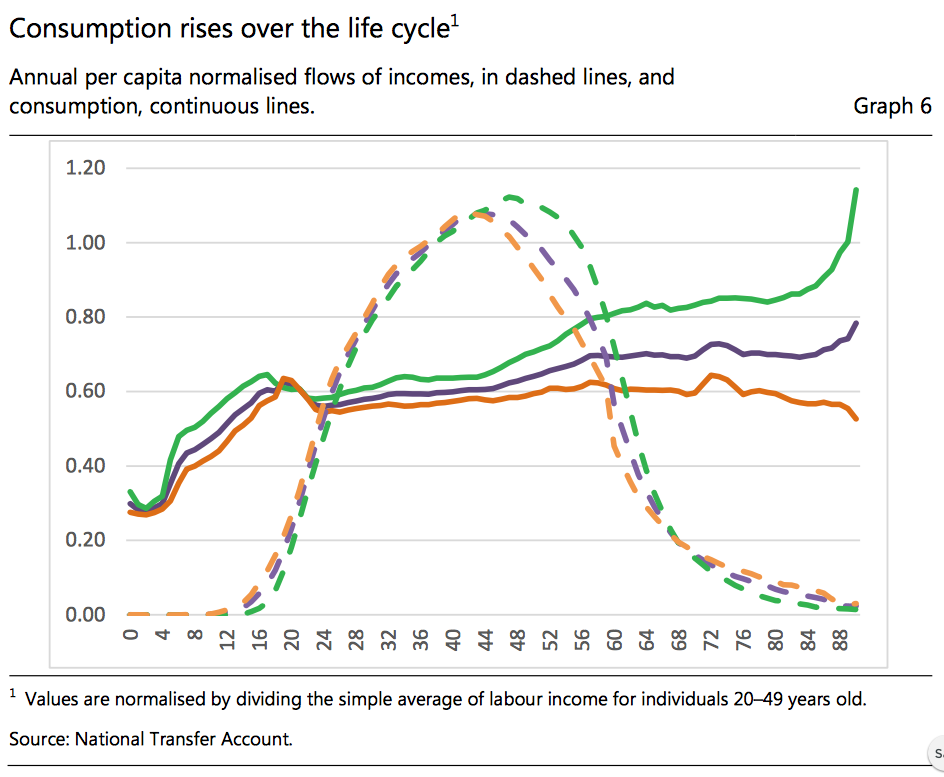

Demographics will reverse three multi-decade global trends (Charles Goodin and Manoj Pradhan at the Bank of International Settlements (BIS)) This is a working paper published this year by the BIS who’s authors are trying very hard to get us back to equity finance from our long caravan in the desert of debt finance. Their basic thesis is that the global economy has undergone a labor supply shock from Asia since 1980 and that this has resulted in “a stagnation in real wages; a collapse in the power of private sector trade unions; increasing inequality within countries, but less inequality between countries; deflationary pressures; and falling interest rates.” They believe this shock is now reversing but the biggest challenge to unwinding the status quo is our low interest rate environment. The paper bravely addresses the social and political changes that will come along with our transition back to equity finance and proposes some policy items that can help get us there.

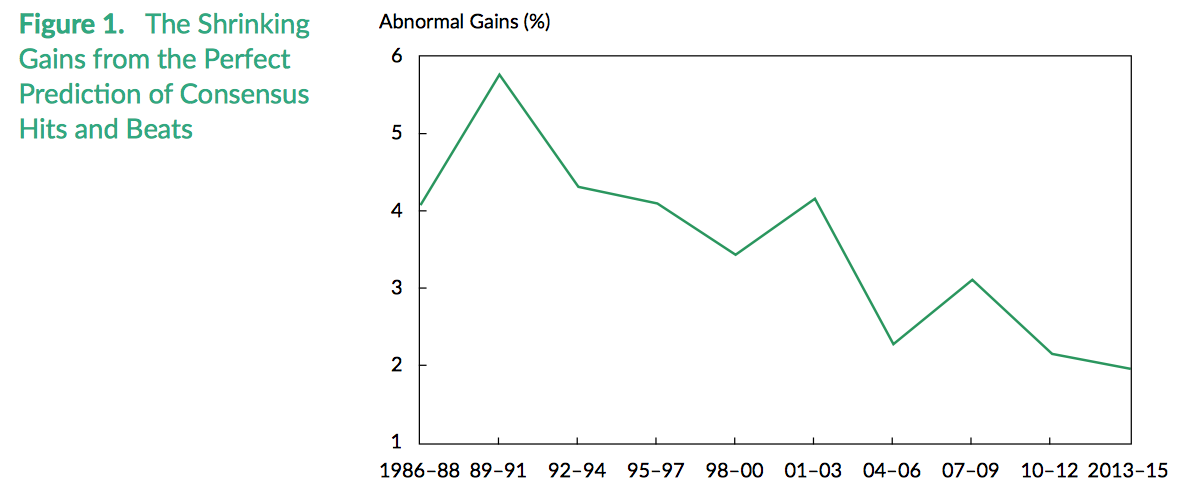

Time to Change Your Investment Model (Feng Gu and Baruch Lev) This study by Feng Gu, a professor of accounting at the School of Management, State University of New York at Buffalo, and Baruch Lev, a professor of accounting and finance at the Stern School of Business, New York University looks at the success of assessing investment opportunities through the lens of “earnings” and concludes that “the gains from predicting corporate earnings, or consensus hits and misses—an activity at the core of most investment methodologies—have been shrinking fast over the past 30 years.” This study was published by the CFA Institute and we imagine it will upset some manager’s investment strategies greatly if it gets out there. Essentially Gu and Lev have quantitatively confirmed what we have long believed, the effects of accounting manipulations and changes in business models have rendered GAAP earnings nearly meaningless as tool to capture a business entity’s performance.