It seems inconceivable that 2017 is already half over, but my calendar and the humid Chicago weather both confirm that fact. As we head into the July 4th weekend, my thoughts turn to a tweet from the President of the United States. It’s probably not the tweet of which you are thinking – the one that caught my eye was related to the negotiations over the sugar trade with Mexico. Here it is in all its glory:

Those of you who have kept up with our comments on the great sugar negotiations will know that nearly every contention in that tweet is false.

- The US and Mexico had a sugar agreement that was in the midst of renegotiation

- The deal is not favorable to Mexican sugar producers or refiners, and

- The deal is unfavorable to American consumers of sugar.

The ones who made out well in the deal are a pair of Cuban-American sugar barons who are personal friends with the Secretary of Commerce, and who distribute political contributions around like…candy.

Here is a curated list of important stories outside the main headlines that caught our attention this week.

How An Entire Nation Became Russia’s Test Lab for Cyberwar (Wired). I listened to a terrific interview by NPR’s Teri Gross with the author of this sobering article about what appears to be the first large-scale cyber attack by one nation directed at the general infrastructure of another. (Stuxnet, a computer virus likely created by the US and perhaps Israel, was unleashed on Iranian nuclear research facilities, but was designed to damage Iran’s weapons research, not to cause suffering to the population). This article, and an earlier one detailing a smaller, more targeted attack by Russia on Ukraine – Inside the Cunning, Unprecedented Hack of Ukraine’s Power Grid – opened my eyes to how devastating and disruptive a well-coordinated, state-sponsored computer attack could be. The author concludes that the US and other Western democracies are similarly vulnerable to such an attack.

Walgreens halts plan to buy Rite Aid after regulatory concerns (Financial Times). In our research on pharmacy benefits manager (PBM) company Express Scripts ESRX, we mentioned that Express Scripts’ management probably nursed a hope over the last few years that their company would be acquired by Walgreens Boots Alliance WBA. Walgreens’ announcement in late 2015 that it would instead purchase smaller pharmacy retailer Rite-Aid RAD – making it financially unlikely for it to acquire Express Scripts – and a few months later that it would enter a joint venture with another PBM must have come as an unpleasant shock to Express Scripts’ C-suite.

This week, Walgreens announced that it would withdraw its bid for Rite-Aid, perhaps due to antitrust concerns signaled by the Federal Trade Commission. Has our view on Express Scripts changed? No. We still think that this business is destined for difficulties. Walgreens may buy Express Scripts eventually, but they can afford to wait until the price falls significantly.

Saudi Prince Is Said to Be Confined to Palace (NY Times). Sometimes life comes at you fast when you’re a prince. Last week, we highlighted a story about the big shake-up in King Salman of Saudi Arabia’s succession planning. This week, the New York Times reports that the new heir apparent, Mohammed bin Salman, has placed the old heir apparent, Mohammed bin Nayef, under house arrest (“palace arrest” I guess) in the costal city of Jeddah. When he was removed from the line of royal succession, Nayef was also deposed from his position as Minister of the Interior, a position that holds much greater meaning in Saudi Arabia than in the US. In the US, the Department of the Interior looks after our national parks and refuges; in Saudi Arabia, the word “interior” refers to the interior of a prison. The Minister of the Interior is the spy-master for the domestic intelligence apparatus of the Saudi Kingdom, and with the threat of Salafi radicals and a disaffected Shiite minority especially acute in the Kingdom, the position brings with it enormous power. Bin Nayef was in charge of Saudi intelligence operations in Syria and was chair of the council that has executed the war on Yemeni Houthis. Bin Nayef is well-respected among Western intelligence services and probably knows more than one or two skeletons are buried.

Bin Nayef, who is 57, lost in the succession battle to a 33-year old. This is shameful in a culture that usually respects age-based seniority. To add insult to injury, he was replaced as Minister of the Interior by a 34-year old nephew. Bin Nayef’s daughters are also said to be under house arrest with their father. I am not an expert in Saudi politics, but it seems to me that these events are a sign and perhaps a product of regional instability and increased domestic friction. By definition, one cannot anticipate a Black Swan event, but I wouldn’t be surprised if there weren’t some Middle Eastern surprises in store over the next few years.

Forget Cars, for One Spaniard the Autonomous Future Is Forklifts (Bloomberg). I’ll be the first person in line to buy a self-driving car, but considering the legal issues involved (e.g., which insurance company pays if two self-driving cars get in a wreck?), I may have to wait a while before my dream of uninterrupted reading while in transit is realized. However, the sorts of issues that make it difficult to put automatic cars on the roads are absent from the realm of a warehouse or factory. Asti, a Spanish company, is innovating the development of mobile robots to carry equipment, tools, or goods in an industrial setting. Of course Amazon’s warehouses run more efficiently because of robotic palates, but it looks like the aspirations of Asti – whose clients are mostly French, according to this article – are larger. Why does an assembly line need to be in a line? Perhaps some of the tasks would be made easier if materials came to the unfinished product rather than having the unfinished product move on a conveyor belt.

Photographer: Angel Navarrete/Bloomberg

Retail hype vs retail facts (FT Alphaville). I may have access to this column because I was allowed in as a professional analyst. If you can’t view this story, drop me a line and I’ll send you a soft copy.

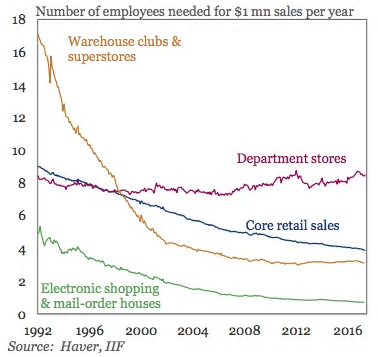

One big meme of the investing world is that traditional retail is dead. Recent decreases in retail employment and high-profile problems at Sears, JC Penney, and other stores seem to bolster this meme with actual evidence. While I do think the retail world is changing, it is nice to see some hard data on employment trends and on the competition between brick-and-mortar retailers and online. This article provides those data in the form of excerpts from a sell-side report.