After publishing my valuation of L Brands, I spoke again with Tod Schneider, CFA, CPA (Inactive) about the company and the risks facing it.

Schneider thought that my valuation assumptions and scenarios seemed reasonable. He also thought that the biggest business risk is that the US would experience a recession before L Brands had completed its reorganization and had got its commercial engine running again. As mentioned in previous articles, the company is more highly levered than some competitors (it was the subject of a leveraged buy-out by Sun Capital in the years 2007-2010), and financial leverage has a disproportionate negative effect on companies when revenues drop.

The firm is generating enough profits now to more than cover interest payments, but if the economy were to suffer a shock, frilly underwear and scented candles might be two classes of extravagances that consumers would pull back on.

It’s worth pointing out that even in the depths of the Great Recession, L Brands still managed to generate profit son an Owners’ Cash Profits (OCP) basis.

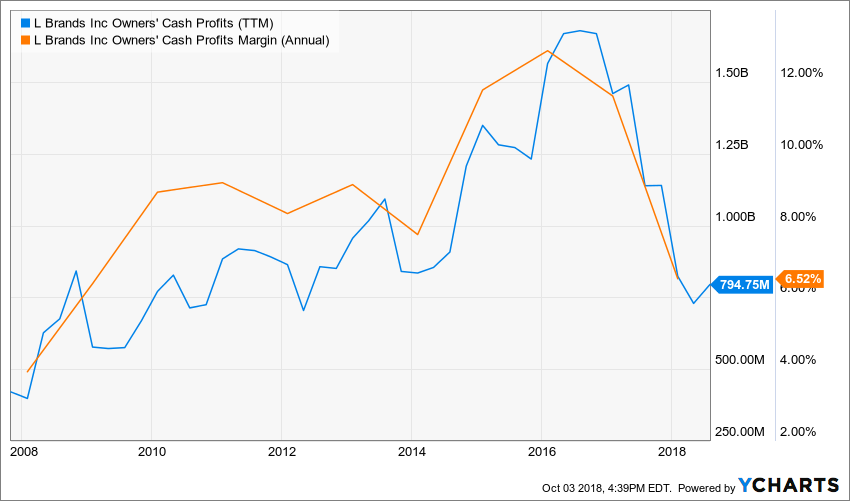

Figure 1.

As you can see from the figure above, trailing twelve-month (TTM) OCP — which is measured after interest and tax payments are made — never fell to even the $250 million level and annual OCP margin recorded its lowest value at 4%.

That said, the competitive position for L Brands is different from that during the Great Recession and its balance sheet is weaker.

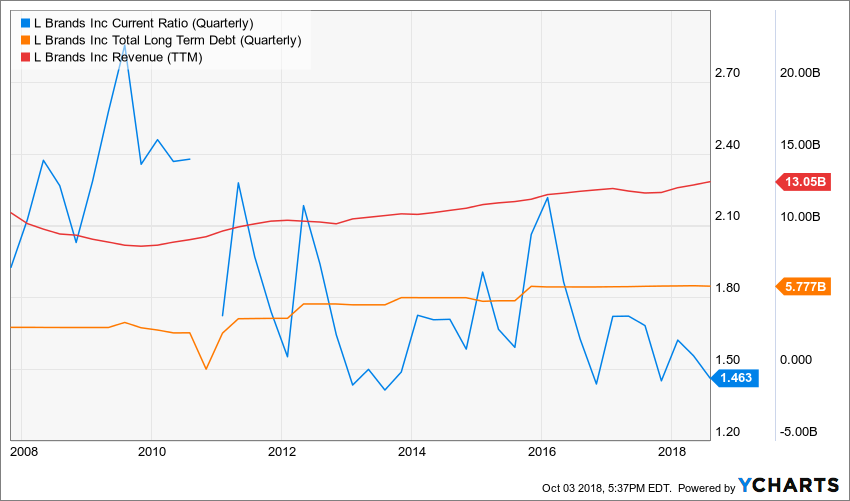

Figure 2.

The figure above is busy, so let me unpack it. The red line is TTM revenues; revenues are higher now than they were back in the 2009 trough, but the debt level — the orange line — is higher still. In the quarter ended in October 2009, the value of debt was 34% of TTM revenues, compared to about 44% now. Also, the blue line, which represents the “current ratio” (the ratio of short-term assets to short-term liabilities) is scraping near its minimum right now.

None of these numbers are necessarily worrying unless the economy heads south and people decide they can live without Victoria’s Secret yoga pants or underwear.

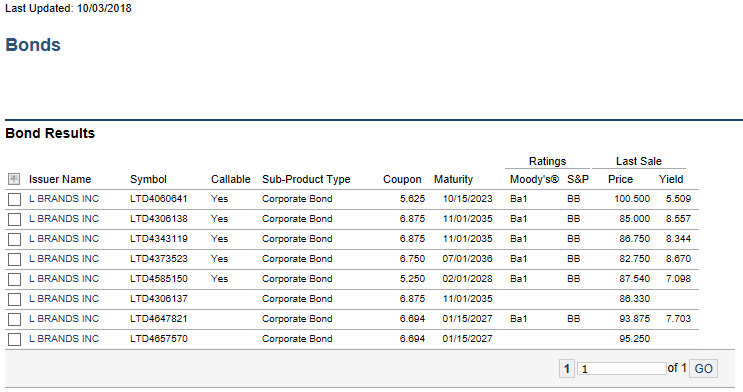

A more superficial risk is that, in order to shore up the balance sheet by paying some debt down, L Brands might elect to cut its dividend (presently yielding over 8%). Investors typically do not like dividend cuts, but Schneider thinks that a dividend cut may actually be a signal to short-sellers (over 7% of the firm’s shares outstanding are sold short) to take profits on their trade. Schneider points out that L Brand’s bond yields have stabilized at just about the current dividend yield (see figure below), suggesting that the bond market is more sanguine about L Brand’s prospects.

Figure 3. Source: finra-markets.morningstar.com

The last issue is that of Chairman and CEO Les Wexner’s age. At 81 years old, Wexner is no longer a spring chicken, and reports of ill-health may cause equity market participants to worry. Wexner is certainly a retail genius and his influence looms large at the firm.

The shares continue to trade at roughly the same level as when we began publishing on the company, and Schneider believes it may be a long haul for the company. Still, the balance of risk and reward seems favorable.