Earlier this year, I had the pleasure of attending the Grant’s Interest Rate Observer Conference, at which one of the most impactful speakers was one of Julian Robertson’s proteges by the name of Gilchrist Berg. Among a wide variety of topics, Berg talked about a little firm called Vista Outdoor VSTO, which he presented as a firm making firearm ammunition. I liked what he had to say, so decided to see how the valuation looked to me.

Our valuation framework focuses in on a handful of fundamental drivers, of which there are only three main ones in the short-term and one related one in the medium-term. We’ll work through each one-by-one.

Revenues

The brands Vista sells have been around for a long time, but the company was carved out of a Honeywell spinoff in 2015, so its operating history is short.

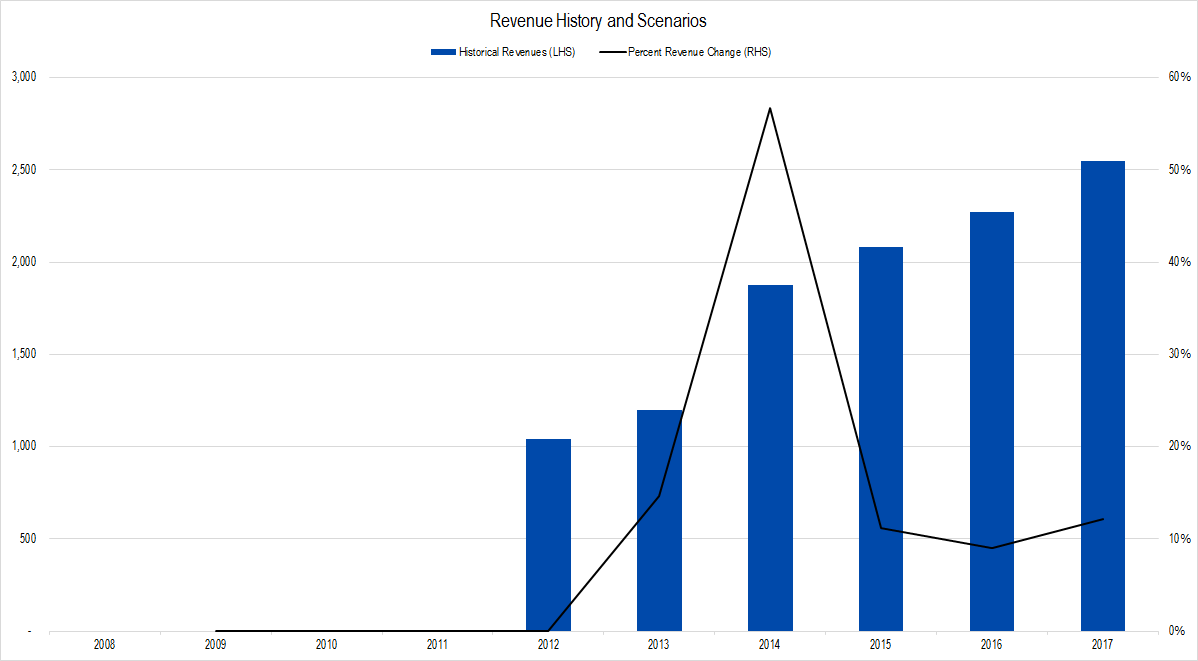

Figure 1. Source: Company Statements, Framework Investing Analysis

In this graph, we can see from the black line showing revenue growth rate that the firm has pretty consistently generated revenue growth in the 10%-15% range, though we will see in a moment that most of this revenue growth is related to acquisitions. In fiscal year 2018 the company’s management has suggested that revenues will be down by from 5% to 7%. The ammo business does much better when gun owners are worried about Democratic presidents imposing restrictions on guns and ammo.

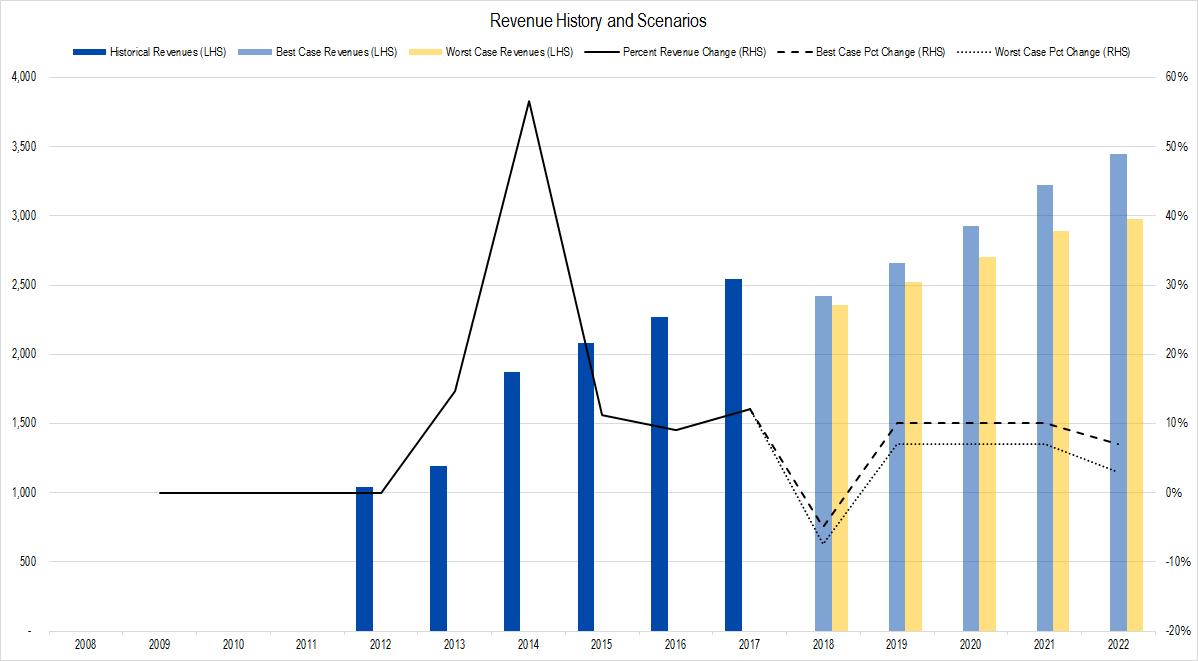

We incorporate the firm’s revenue guidance into our revenue projections, and think that, including acquisitions, revenues are likely to grow at a rate of between 7-10% most years, generating average annual growth of 6% in the best-case and 3% in the worst-case.

This is what our graph looks like now – light blue columns being best-case, yellow columns being worst.

Figure 2. Source: Company Statements, Framework Investing Analysis

Profits

Our preferred metric is called Owners’ Cash Profits – OCP – which is based on the firm’s cash flows.

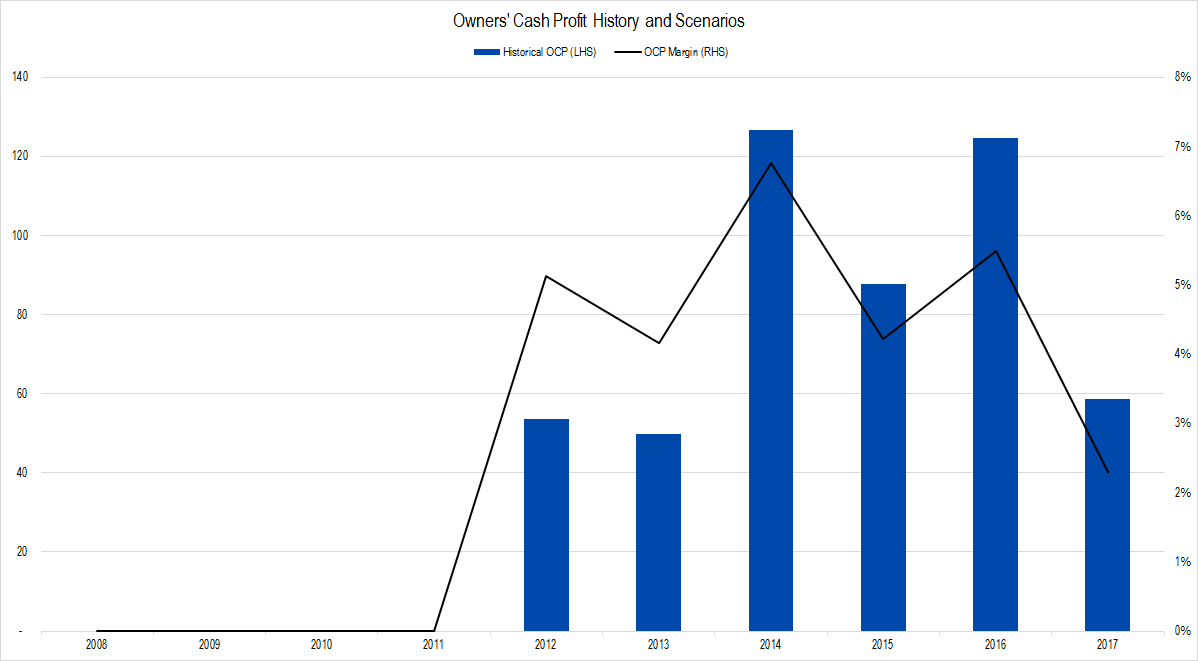

Figure 3. Source: Company Statements, Framework Investing Analysis

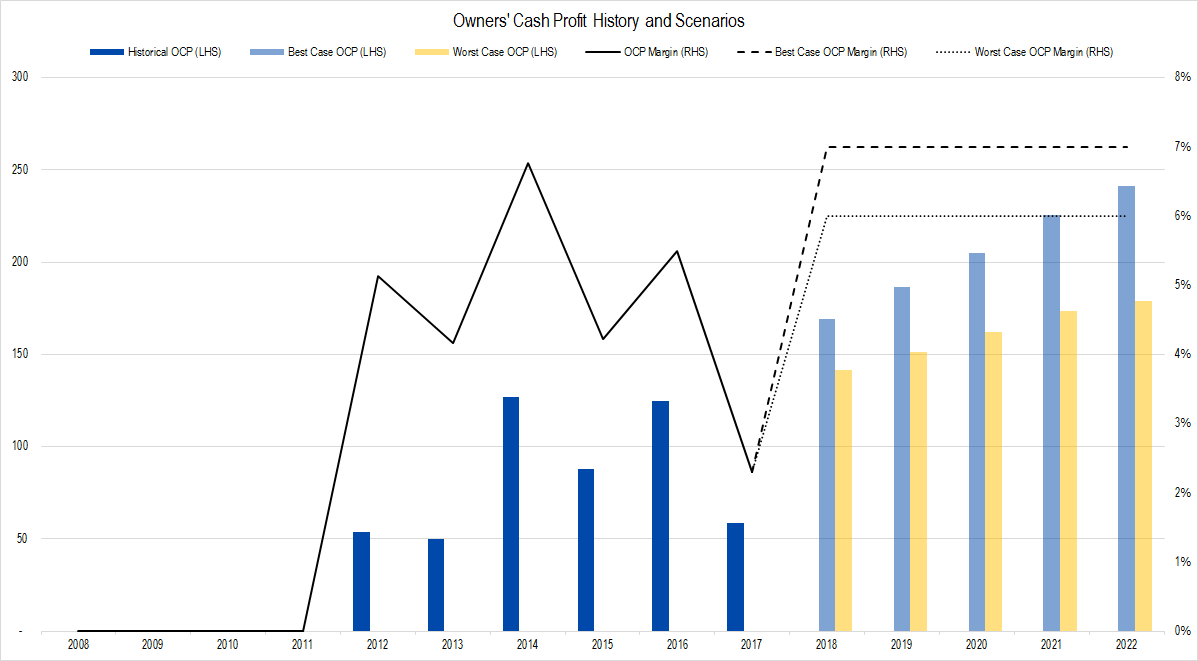

While profitability fell last year, to sub 3% OCP margin levels, most years, it is in the 4.5% to 7% range. These years have included a lot of acquisition activity, which usually has a negative effect on profitability, so I’ll give Vista the benefit of the doubt and assume it can generate stable profits averaging between 6% and 7%. Making the change in our model creates a graph like this.

Figure 4. Source: Company Statements, Framework Investing Analysis

Investment Spending

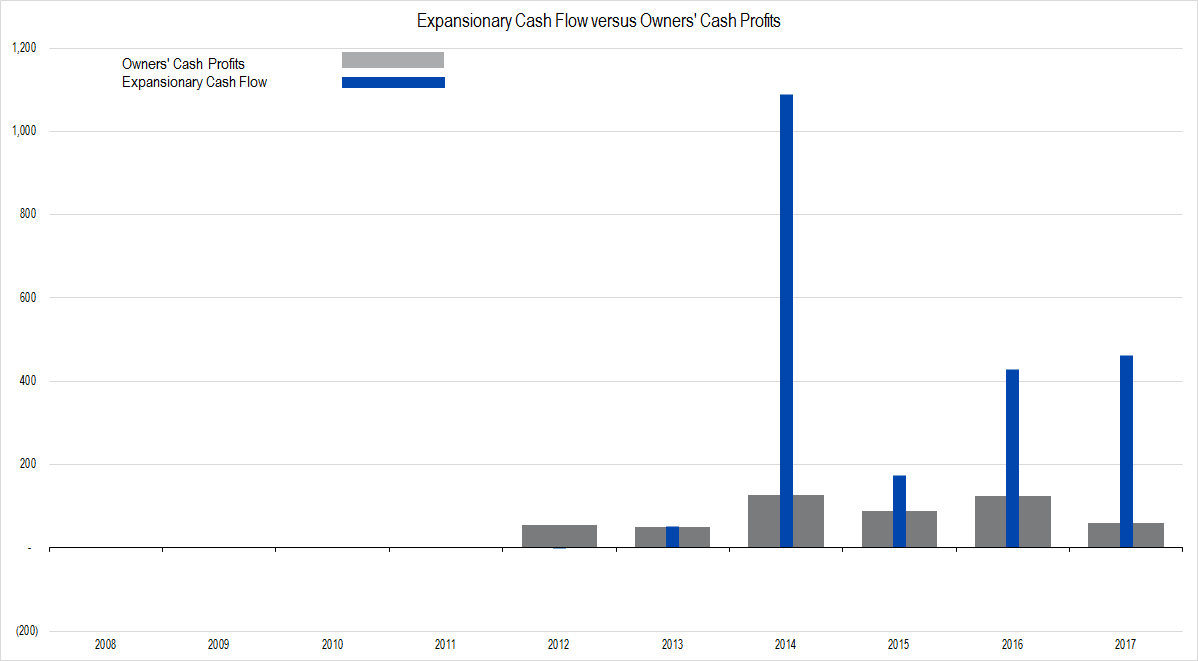

Here is the clearest view of how much Vista has been spending on acquisitions. The gray columns represent the profits the firm generated; the blue ones, how much the firm spent on investments, most of which was the acquisition of other sporting good brands.

Figure 5. Source: Company Statements, Framework Investing Analysis

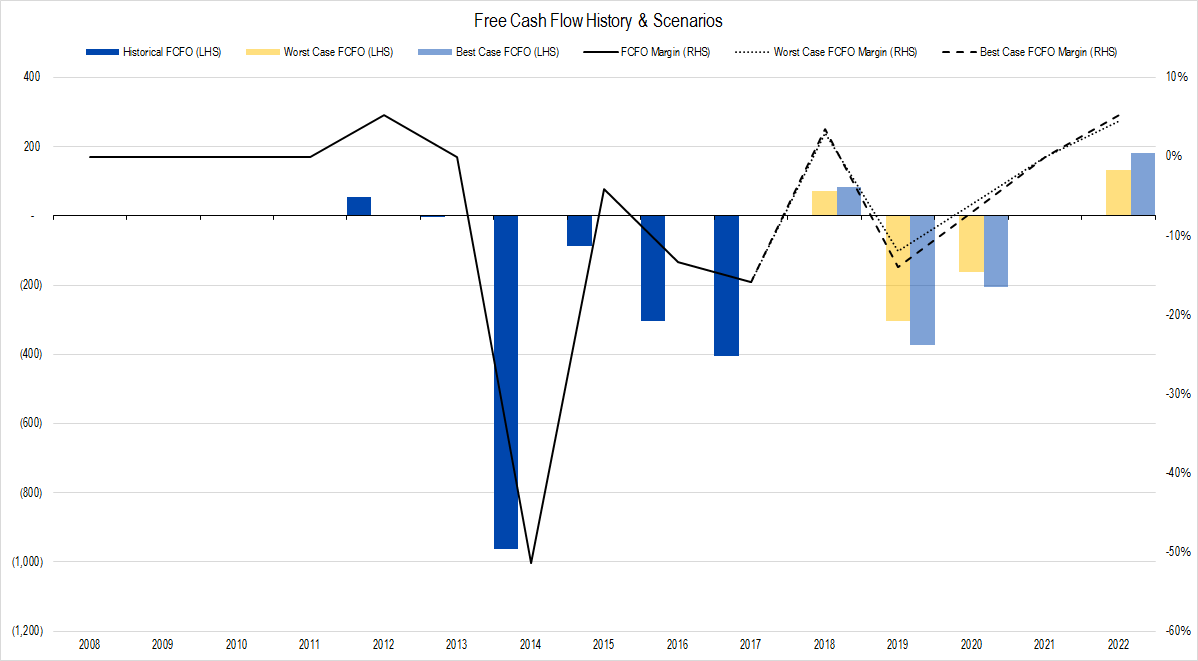

We will assume that the firm’s investment spending over the next few years is similar to that over the past few, but that it cuts way back in 2022 – the last year in our short-term forecasting range – so that it will be able to generate about a nickel of Free Cash Flow to Owners (FCFO) for every dollar in revenues generated.

Figure 6. Source: Company Statements, Framework Investing Analysis

Medium-Term Growth

It’s really hard to know how long companies like this – that essentially roll-up related brands under a single corporate umbrella – can keep acquiring before it doesn’t find any more attractive buying opportunities. For now, I’m going to peg medium-term cash flow growth at between 7% and 15% per year. I honestly don’t have a sense for whether the medium-term period should last for five or 10 years, but I’ve left it at five.

Valuation

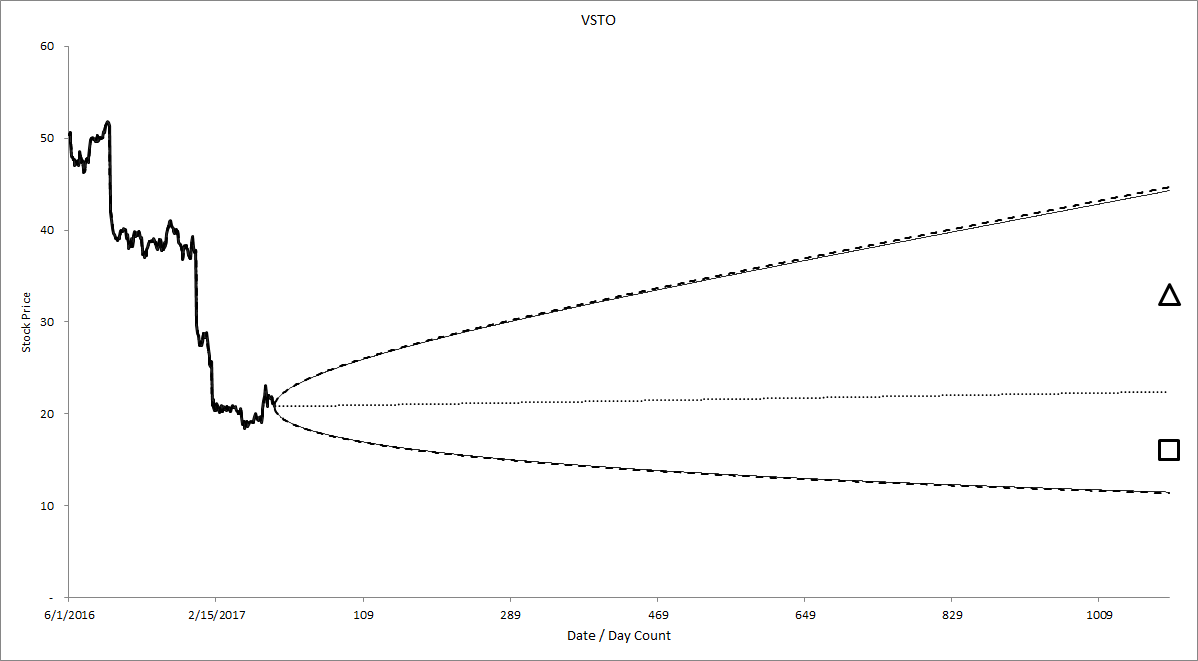

Pulling this all together gives us a best-case valuation of $33 and a worst-case valuation of $16 per share with an equal weighting of all our eight valuation scenarios at $24 per share.

Figure 7. Source: Company Statements, Framework Investing Analysis

Comparing this to what the option market is forecasting, we see that our valuation range, as marked by our worst- and best- case valuations, fit neatly within the price forecasts of the option market. The BSM Cone may be so wide because of the big drop in stock price over the last year.

To make a firmer valuation I would want to understand three things:

- Would Vista’s revenue’s soar with a foreign war? About 10% of Vista’s revenues are government ammunition contracts, so this assumption is sensible.

- What does the industry look like and how much room does Vista have to acquire competitors and complementary brands?

- In a spin-out like this, I always wonder about inside ownership and what their exit plan is.

Gilchrest Berg’s Grant’s speech was good, and I got excited about this company. But when I looked at it more closely, I realized that what I had thought it was – an ammunition company that had been hurt by temporary political issues – was only part of the story. It’s actually a sporting goods retailer, and thinking about whether there’s opportunity in that business might take more time.

Resources

- Download PDF Transcript

- Framework Investing Valuation Model for Vista Outdoor

- Framework Investing BSM Cone for Vista Outdoor: The new data source did not have VSTO data, so I manually input price data into this worksheet.

- Vista Outdoor Investor Relations site