Five Busted Myths About Investing

“There is a mismatch in the complexity of financial decisions we have to make … and our own financial knowledge. The world has changed. It requires new skills, and we require that basic knowledge to live in today’s society.”

– AnnaMaria Lusardi – George Washington University School of Business

Here, we bust five myths to help you develop the kind of knowledge Dr. Lusardi is talking about.

- You know what you’re buying when you buy an ETF.

This is first in my mind because my partner, Joe, just wrote an article about ETFs – the derivative most commonly used by individual investors – detailing how complex and convoluted they can be. His reading of a Bank of International Settlements white paper about ETFs opened his eyes to the real possibility that ETF investments would exacerbate problems when we are faced with the next 2008-style liquidity crisis.

- Stocks are risky.

By “stocks,” here I mean a broad equity index that you could gain exposure to using a low-load mutual fund or index / sector ETFs (a kind of ETF that mostly gives you what you think you’re getting).

Investing in anything means you are risking your capital, so to that extent, stocks are risky. That said, investing in stocks as an asset class implies you are accepting risk in the belief that the economy will expand in the future.

While this bet can sometimes be poorly timed, investing in human progress has been a good one to make since roughly the Renaissance at least.

Modern technology – including petroleum fertilizers, water treatment processes, and medicines – have enabled the world population to grow, and the globalization of trade has raised incomes and standards of living in the developed and developing world alike.

Risk, as academics define it – price fluctuation over a discrete period – is almost meaningless to real investors. A hedge fund manager worries a lot if his or her returns are volatile over a given year because that volatility is tied to his or her income level for that year. However, for someone in their mid-thirties, with thirty-five years to go before retirement, one year’s worth of volatile returns is simply not very important.

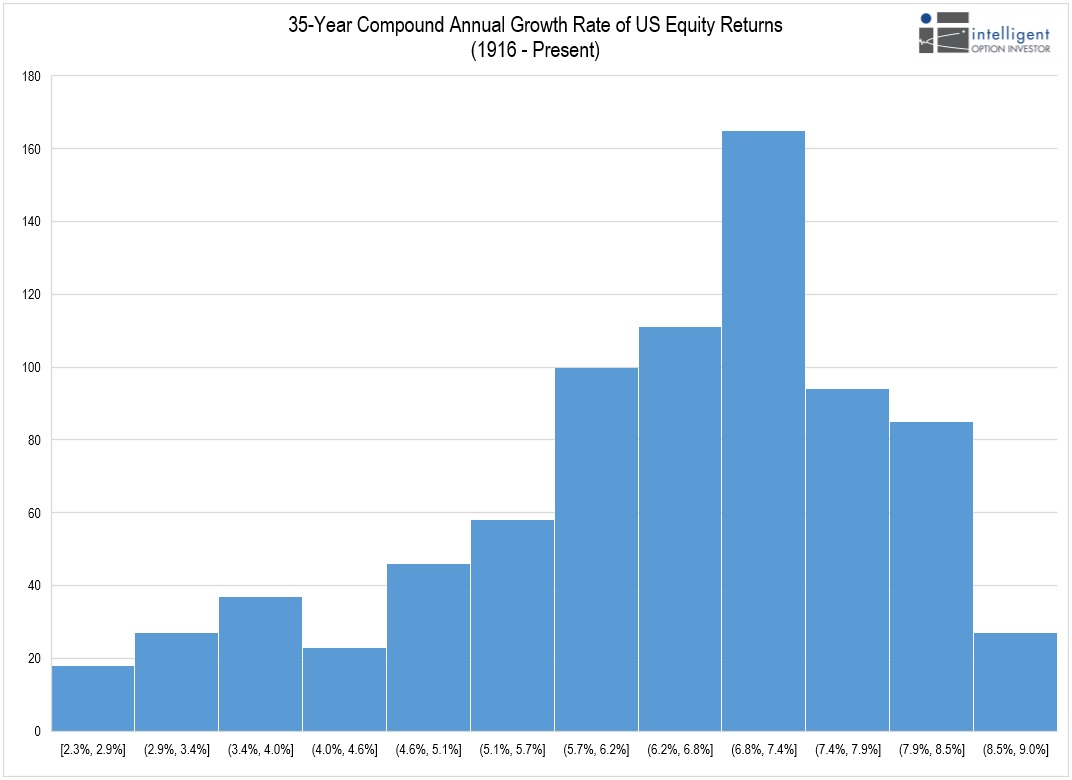

Figure 1. Source: Professor Robert Shiller, IOI Analysis

The chart above shows 35-year compound annual growth rates for every month between January 1916 and the present. Even through two World Wars, the Great Depression, the Cold War, presidential assassinations, stock market crashes, and all the rest, there has not been a single period with negative returns.

You might think the returns are low, but this asset class is phenomenally hard for even the best investors to beat over time – Warren Buffett famously bet $1 million that hedge funds couldn’t do it, and he himself has lagged the market over the last 10 years.

- Bonds are safe.

By “bonds,” here I mean a broad corporate bond fund like you might buy from Pimco, Janus, or Blackrock, for instance.

Investing in anything means you are risking your capital, so to that extent, bonds are risky. Investing in bonds as an asset class implies you are accepting risk in the belief that the company to which you’re loaning money is financially strong enough to pay you back. In the case of bonds, you are not investing in growth, but simply betting a company’s operations will not fail.

Bond prices fluctuate based on the current market yield, so if you speculate on what the future market yield is likely to be, you can suffer a realized loss if you sell at a price below that at which you bought. If you hold a bond to maturity, you won’t lose principal, but you may suffer an “opportunity loss” in that you have earned, for instance, 1.4% on your investment, and might have earned 7.4% if your capital was at risk in a stock fund.

- Stock investing is easy.

By “stocks,” here I mean investing in a single-name stock like Alphabet (GOOGL), General Electric (GE), or Apple (AAPL).

Newsletter authors and television personalities want to make you think you can “trade your way to financial freedom” but you can’t.*

Private equity firms (professionals that invest in companies before they are listed on public stock markets) might analyze 40 companies before deciding to invest in one. Out of ten companies in which they invest, maybe one of them will be a huge success, most of them will be duds, and a few will be failures.

Investing in public stock markets has less abject failures, but it has a lot of duds and not very many smashing successes. Still newsletter companies and television pundits pump out “Top investing idea” lists like there was no tomorrow.

There are opportunities to invest in good businesses and generate better returns over time, but in my 20 years of experience in the investing business, I’ve found these businesses are usually few and far between. In a hedge fund at which I used to work, if you could come up with three decent ideas in a year (working 50 50-hour weeks), you were the Golden Child. It always amazes me when individual investors are so anxious for new ideas.

In my opinion, if you don’t understand how a company creates value and don’t know a specific business well enough to make a reasonable estimate of its intrinsic value, you should not be invested in it, you should save your time and heartache and invest in the lowest-cost index fund you can find.

- Options are speculative and dangerous.

There is nothing dangerous about options. They are simple, directional instruments that allow an investor much greater flexibility in expressing investment choices than stocks or bonds.

The greatest danger is not the tool you use, but the way you use it. Options do not have to be used to implement “levered” strategies, but they often are, and it is the leverage rather than the option that leads people to problems.

If you don’t understand leverage, you shouldn’t invest in levered strategies, whether those strategies involve options, mortgages, stocks or bonds.

This article originally appeared in Forbes

NOTES:

* Statistically, if you do trade your way to financial freedom, there are 10,000 people just like you who couldn’t, and the difference between you and the other 10,000 is down to just pure randomness.