Each month, we screen for attractive “bond replacement” investment candidates by looking up the reports of investments purchased by “Superinvestors” covered by the Dataroma site. Dataroma follows 64 managers that are all using value-based strategies.

In our February screening process we witnessed two things leading us to the following conclusion: sometimes it is best to sit on your hands.

First, the equity markets have experienced a recent bout of indigestion resulting in dramatically elevated volatility. We are going to discuss some of the reasons behind this in our Office Hours this weekend and Erik’s post to Forbes.com (What We Know about Market Crashes) lays out our initial thinking.

Turbulent markets have made option prices spike and spiking option prices are normally good for investors looking to sell. However, often times market turbulence is preceded by an environment in which prices have disconnected from value; we believe this is the case at present. Investors have bought the dip time after time, piled into “short vol” investments, and grasped for yield in increasingly creative ways.

If prices are high compared to values, accepting downside exposure is not a wise strategy. We had more and more trouble last year as time went on finding Superinvestors putting money to work on the long side. Our Covered Call Corner makes the assumption that Superinvestor purchases contain some usable information regarding stocks’ price-value relationship. If a Superinvestor is buying some stock, we figure that’s a good signal that there is some value in that stock.

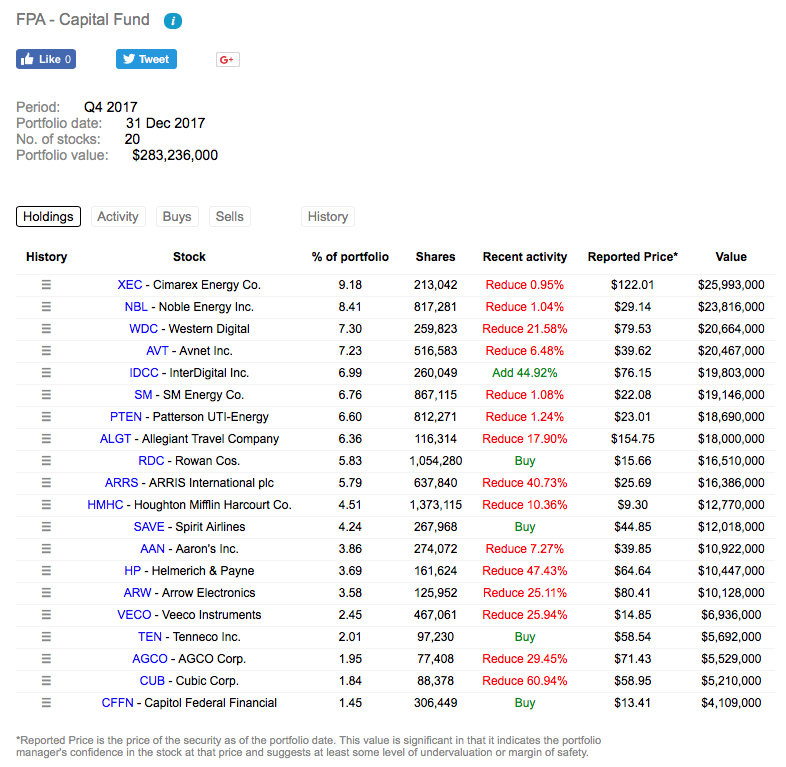

As we started looking through the Superinvestor portfolios, it was clear that no one was buying into the year end. Dataroma’s updates for January show either reductions — and sometimes substantial reductions — in managers’ positions. Indeed, only ONE fund in the January updates had any material position additions that met our screening criteria for possible new buys.

- Stocks listed represented more than 2% of the portfolio’s value

- Stocks listed had been bought by the fund in the reported quarter

That fund was the FPA – Capital Fund and you can see from the image below that they were making these buys while raising cash from nearly every other position in the portfolio.

So, after talking this out with Erik and looking at the market environment we are currently facing, we could produce a Covered Call Corner worksheet for February but we would be doing so for the sake of keeping up appearances, not because we’d actually look at doing this in our own portfolios.

Since our investing thinking and the content on Framework is entirely bound by our eating our own cooking, there will be no CCC for February.

If after looking at FPA-Capital’s track record and the current market you want to look at the three to four companies above, we would recommend using the same principles to set up these income strategies as usual – selling at-the-money (ATM, as close to 50 VOL as possible) puts/calls at 3 to 6 month tenors.

Let’s see where March takes us. As Erik points out in his What We Know About Market Crashes piece, no one REALLY knows where we go from here.