Each month, we screen for attractive “bond replacement” investment candidates by looking up the reports of investments purchased by “Superinvestors” covered by the Dataroma site. Dataroma follows 64 managers that are all using value-based strategies.

In our December screen, we saw the two patterns from November persist; these value-based managers seem to be trimming large positions much more than adding to them or doing nothing / making just a few purchases.

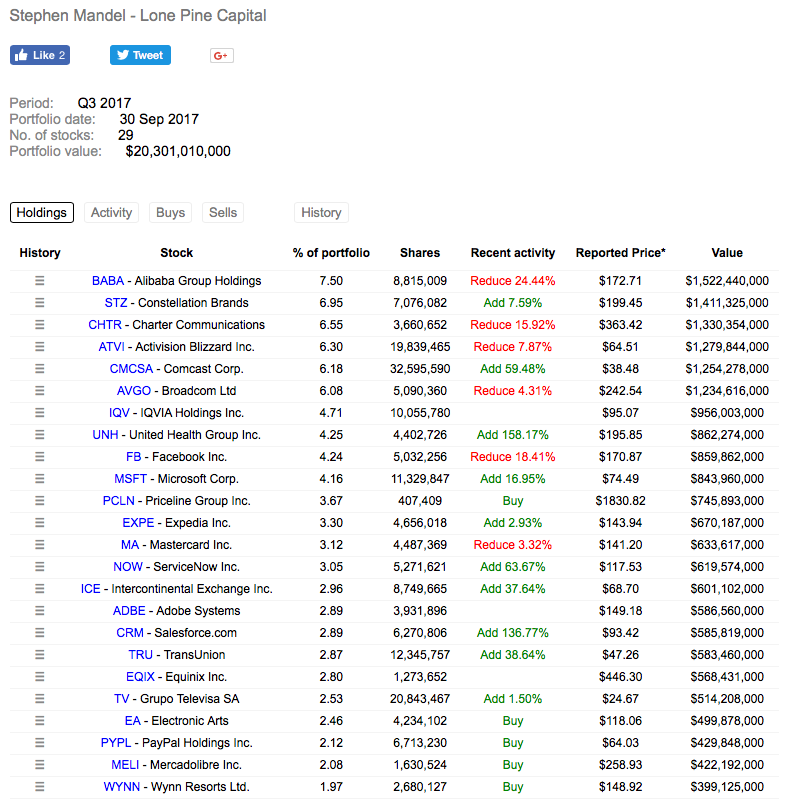

A Hedge Fund showing some appreciable third quarter 2017 purchases is $20.3 billion Lone Pine Capital, managed by Steve Mandel. This fund had a total of five securities that met both of our criteria:

- Stocks listed represented more than 2% of the portfolio’s value

- Stocks listed had been bought by the fund in the reported quarter

These conditions were to screen for the stocks in which the managers had demonstrated the most confidence (by portfolio weight) and about which they had made an active decision to invest. As we explain in our video introduction to “Bond Replacement” investments, we are using these portfolio managers’ actions as an indication of undervaluation.

Mandel’s fund was initiated in 1997. Prior to founding Lone Pine, he was Senior Managing Director at Tiger Management Corporation. Yes, that makes him/his fund a “Tiger Cub”. Steve is an alum of Dartmouth and his fund’s name is derived from a tree there that survived a lightening strike! Interestingly, Lone Pine is a long-short hedge fund with a focus on value strategies. His strategies have shown to generate relatively high position turnover.

Two of his new BUY positions caught my eye: Priceline PCLN and Electronic Arts EA. Both companies have dropped in price rather materially since their purchase by Lone Pine in Q3. If we believe in the value-based approach of the manager, then these look like pretty good opportunities. Certainly these and the rest of this month’s ideas are worth a look just on the return front.

Please reach out if you have any questions about this spreadsheet!