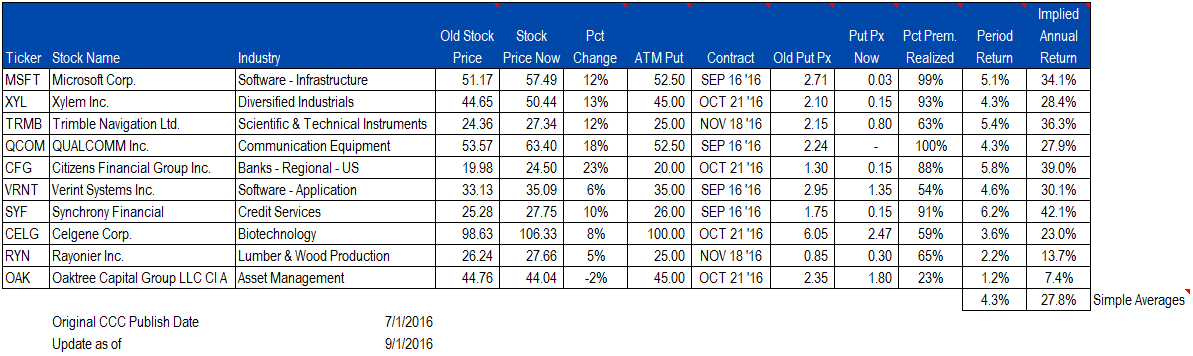

Each month, we publish a list of “bond replacement” candidates to our subscribers. Our June selections have continued to shine – generating an average return of 4.3% over two months, or about six times higher than a typical investment-grade bond portfolio.

A summary of the investments we highlighted in our June spreadsheet is shown below in figure 1. Note that we are only showing the cash-secured put transactions because they are identical from a risk / return to covered call transactions. Also keep in mind that even though these strategies use options, all of them are structured to be zero-leverage investments, so the returns mentioned above are not boosted through leverage. IOI Members may download this record-keeping spreadsheet from the Research section of the IOI site.

Figure 1. Source: CBOE. IOI’s June 2016 Bond Replacement Investment Summary

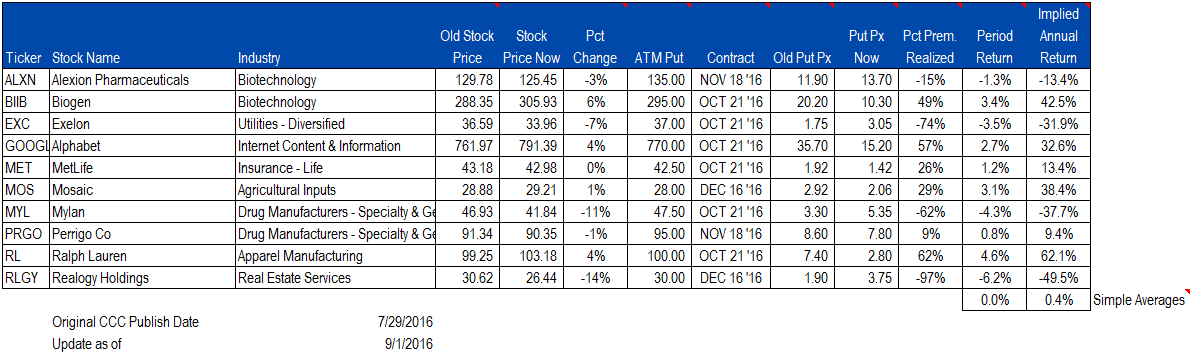

Figure 2. Source: CBOE. IOI’s July 2016 Bond Replacement Investment Summary

The following graphs show the price performance of each stock since the publication of our Covered Call Corner spreadsheet.

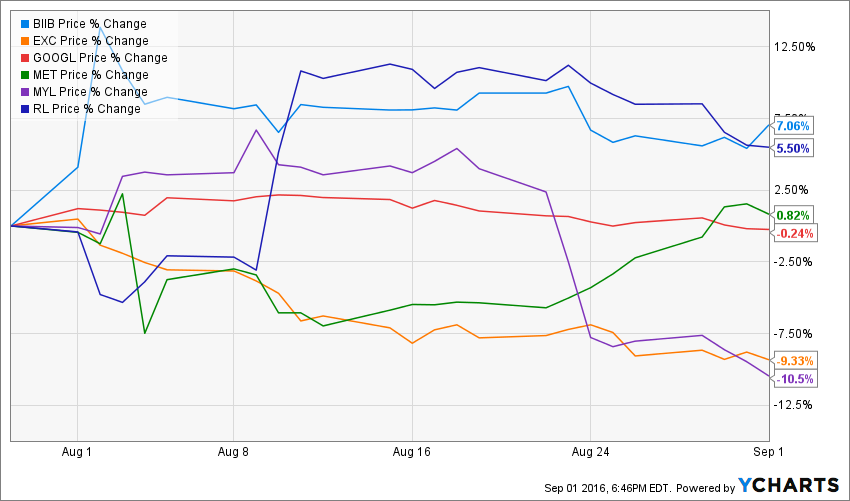

October Expirations

Excelon and Mylan pulled down what would have otherwise been decent returns from the options expiring in October.

November Expirations

Alexion took a hit toward the end of August, but we can see no particular news that would explain the decline.

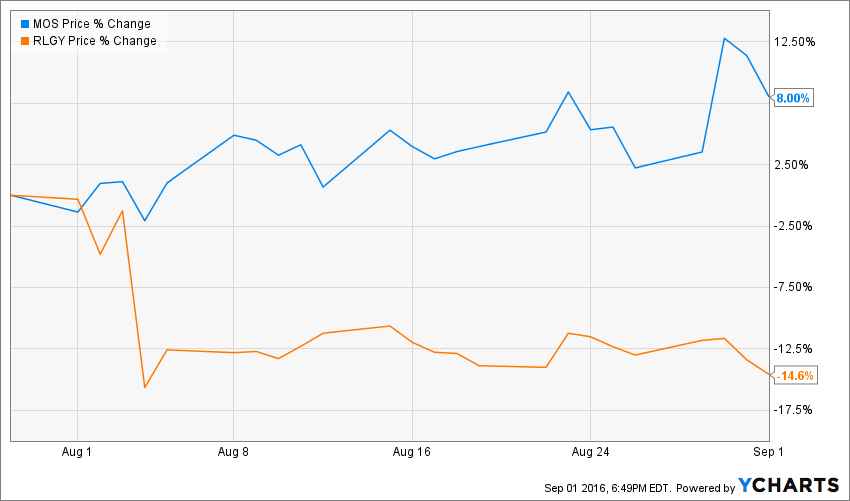

December Expirations

Realogy fell early in the month, after reporting earnings that missed Wall Street expectations. Mosaic’s positive returns almost offset Realogy’s negative ones.