“No one makes money in grocery” is a pretty common investor rule-of-thumb. Margins are razor thin, even more so than in other areas of retail. Focus must be 110% on operations and wringing every last point of return out of each dollar spent (a good mindset for any business operator, honestly). The industry is relatively mature and we know the key players.

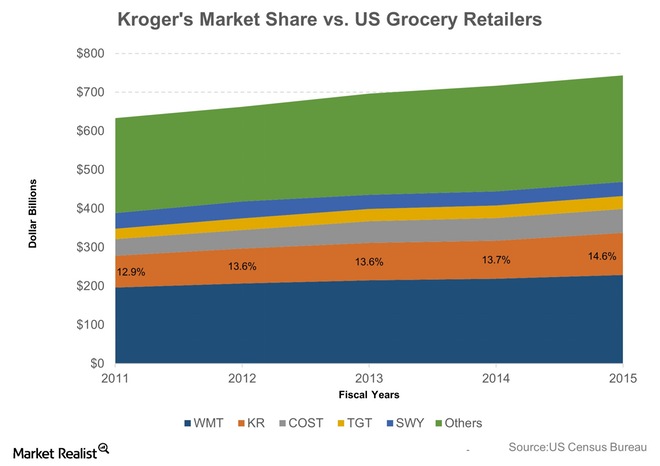

Figure 1. Source: U.S. Census Burea via Market Realist

However, even though the names on the graph may be familiar, like much of the retailing industry, grocery is undergoing a series of dramatic changes as people’s lifestyles and attitudes have evolved over the last 5-10 years. The pace and impact of these changes will make for some real winners and losers in the grocery business battleground and those kind of outcomes make for good investment opportunities – particularly when no one else is paying attention.

Here we lay out the cultural trends and resulting grocery insights that will make or break investments in the grocery space in the coming 5-7 years.

There are four core lifestyle trends that are impacting how we think about grocery shopping from the top down. Grocers that see and understand these cultural shifts will be well positioned to capture excess returns from them. In all cases, consumers are willing to pay more to have these needs met.

- An attitude of “My time must be spent on things that add value to me” is pervasive across demographic boundaries.

- The idea of “I want to be healthier and have a better sense of overall wellness” is also pervasive across demographic boundaries.

- Grocery shopping isn’t the sole domain of married, stay-at-home moms anymore.

- The Internet is redefining our relationship with buying all manner of products in terms of both product information and the outlets used for purchase.

None of the above cultural dynamics should be a surprise. These trends have been in place for some time, but they have had a dramatic impact on how we, as consumers, think about food and, as a result on the “food supply” business in total.

How These Trends Affect Grocery

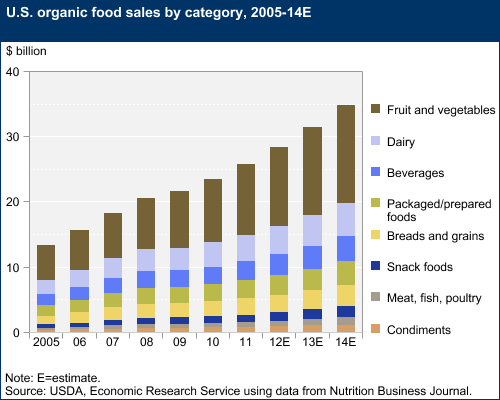

Demand for fresh, natural and organic foods has exploded. In fact, the explosion of this need has given rise to entire new categories of food, food suppliers and grocery entrants. However, value remains a key consideration for the vast majority of food shoppers, including in this growing subcategory. Just look at the launch of Whole Foods’ “365 Marketplace” store concept in 2015-16 for clear evidence of this.

Figure 2. Source: USDA

Food itself is a source of entertainment. While we have seen this in the restaurant industry for decades, this consumer requirement is now entering the grocery space and even our own homes. Consumers continue to use food as a core element supporting the family dynamic and a source of bonding. The stories behind the food’s source – from the supplier to the preparer(s) – are core to the entertainment value.

Food supply must meet varied needs on the continuum spanning value-add and convenience. There are consumers that love to go to the grocery store and there are consumers who would prefer to never set foot in one. The former love the inclusion of food theater and the latter love the concept of online ordering and delivery.

Men are a growing segment of grocery shoppers and food preparers. Men shop differently. Additionally, men are often assuming this job voluntarily because they enjoy food and the end result of cooking further emphasizing the importance of the shopping experience. Men are less likely to spend as much time in stores and are less likely to be driven by or use coupons.

Check out this US Grocery Shopping Trends infographic from the Food Marketers Association from 2014. You will see all these core trends represented.

Figure 3. Source: FMI

The Future of the Grocery Business

Based on these changing consumer needs, what will the best grocers of tomorrow do well? What will those entities “look like”? How are these consumer needs showing up in the best stores of today. Here are four things that will be required for food supplier success in the future.

Quality prepared food(s) / “Grocerants” will be a key source of improved margins and customer acquisition and retention. Local markets have taken advantage of this growing trend for years. Major players like Wegman’s in the Northeast have made their reputation on it. The need is ubiquitous and so grocers are beginning to adapt to meet it. There is more room margin expansion as well as the opportunity to create relationships over food items people and families love.

Online ordering and fulfillment will add value for consumers while creating a stickier customer-supplier relationship through technology enabled ordering and recommendation platforms. Retailers should be able to command some pricing flexibility and margin out of charging for picking and delivery.

Figure 4. Source: A.T. Kearney

Alternative food supply formats will be smartly consolidated to drive value out from supply chains. The list of new offerings in the food supply space is almost endless; WFM 365, Peapod, AmazonFresh, Blue Apron, Fresh Thyme Markets, Plated, etc. In India, their local version of Uber has launched a food delivery service! The chart below shows how alternative format food suppliers are growing materially. While we expect this trend to continue driven by innovation and consumer need, we also expect some consolidation in order to leverage food supply chains.

Figure 5. Source: Willard Bishop

Grocery will remain a very local business at the operations level. This is both in terms of creatively leveraging “attractive” food suppliers as well as having a product offering mix that best meets the needs of the consumers each store is serving. Much of that will depend on a site’s specific location relative to suppliers and customer demographics.

Given these changes in food supply needs among consumers, we expect the grocery business to evolve materially into something that doesn’t look much like what we know grocery to be historically. Imagine Kroger expanding home delivery and including “Blue Apron” type offerings in their mix? Will we keep going to grocery stores or can we learn to rely on pickers in giant warehouses? In that model, are grocery stores just places where we can purchase or order quality prepared foods for family meals? In the end, we cannot know. What this does tell us is that it will be an industry ripe with investment opportunities. Innovation and reinvention will be core requirements for success.

For more insight on how this kind of analysis impacts our investment thinking, check out our analysis work on Whole Foods Market and be on the lookout for an investment analysis of Kroger coming later in July. Learn how to consistently invest more intelligently here.

In the meantime, Invest Intelligently…