iPhone 7 – what a bore! Water resistant? Yawn. No headphone jack? What a hassle. More storage space? Give me a break!

But presumably, the new Apple phones won’t blow up your car, nor will the FAA ask users not to use the devices on commercial flights or store them in checked luggage. Thank goodness for little favors.

The biggest problem for Apple as a company and for investors in the tech giant is not that its flagship product is uninspiring and uninspired. Boring products are the natural outcome of a mature industry, and mature is most certainly what the mobile device market has become. No, the biggest problem facing Apple managers and shareholders is that it has been so successful pursuing a single-pronged commercial strategy – all Apple products are essentially accessories for its mobile phone line – that the company has a ton of cash and not a single good idea as to how to invest that money to grow in the future.

This insight was one of the main take-aways from a series of valuation reports on Apple that we recently published to IOI members and which we summarized in a May article in Forbes entitled Haters Will Hate, Apple’s Still Undervalued.

The value of a company is the sum total of the cash flows the company can create on behalf of its owners over its economic life. Apple has created a lot of cash for its shareholders (which sits so invitingly on its Balance Sheet that the EU couldn’t help but try to get a piece of it), but the positive effects of that cash generation is already reflected in the present stock price. In the near-term, Apple’s present iPhone franchise – with a large installed base and a fanatic group of core users – will generate decent enough cash flows to keep the stock price at least stable. Especially as long as its closest competitor continues to release flagship products that have explosive design problems. However, for Apple to become a more valuable company, it must have a plan to expand its cash flows in the future. If you are an Apple shareholder, how Tim Cook et al are planning to do this should be your biggest concern.

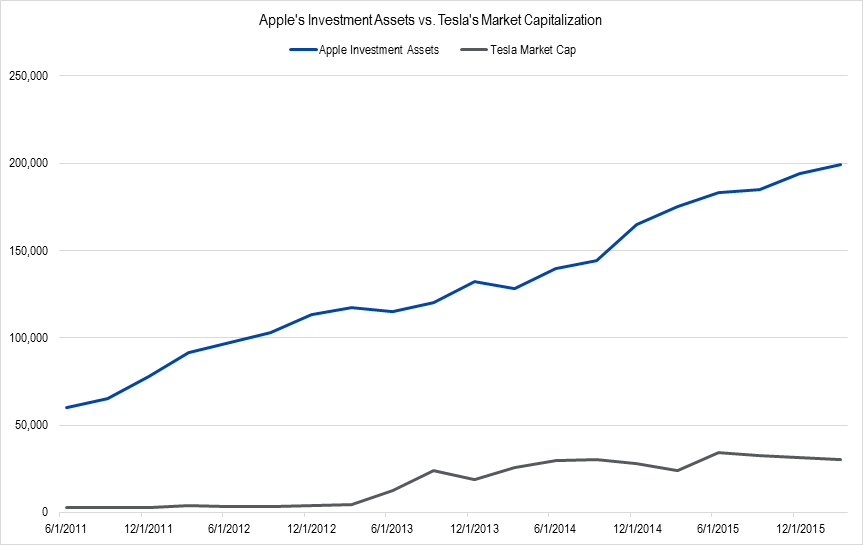

In my book The Framework Investing and in our IOI training classes, we show how the money a company is investing in development projects right now is the key to growth in the medium-term – let’s say 5-10 years from now. That means that the success or failure of a company’s investing projects today are going to dictate the growth of the company’s cash flows in the medium-term, and this medium-term growth rate is the single most important element of returns for long time horizon investors like myself.

Trolling through the Apple fan universe, the company’s semi-secret investment project garnering the most attention is its push into self-driving automobiles. While we think that autonomous cars represent the future of transportation in the developed world, we think that Apple hiring an army of expensive engineering talent to build a self-driving car from the ground up is ridiculous. The alternative? Elon Musk has a company that’s already producing cars today which sport a basic level of autonomous control. Apple has plenty of cash, but its culture of “Not Invented Here” – the bane of technology and engineering firms everywhere – will likely keep it from taking the sensible step.

Source: “IOI Note – Apple’s Investments” (June 3, 2016)

This article originally appeared on Forbes.com