Each month we comb through the Dataroma.com data for candidates for our Covered Call Corner list, I realize how much information we are discarding in the process.

Our search criteria is meant to return a handful of potential bond replacement investments, but looking through the activity lists for renown value investors offers the potential for numerous interesting insights.

We will publish our August 2018 Covered Call Corner worksheet tomorrow, but in preparation for that, I am posting a summary of the data that I sifted through to find the eight names we will publish bond replacement strategies on tomorrow.

These data do not represent all of the stocks owned by each manager, but instead focus in on only those with an allocation of 2% of the respective portfolio. We use the 2% value as our cut-off to demark a “high-conviction” position.

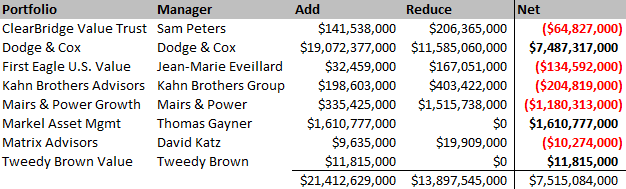

One interesting statistic I collected was aggregate buys versus sells, which is shown in this table:

Table 1. Source: Dataroma.com, Framework Investing Analysis

Portfolio additions represent $7.5 billion more value than portfolio reductions, though it is worth pointing out that this is solely due to the bullish stance taken by Dodge & Cox.

Thomas Gayner, whom I heard speak at the Latticework Conference last year, did not sell any position with an allocation of 2% or above. Tweedy Brown only took one action during the quarter ended on June 30, 2018, adding to its AutoZone (AZO) position by 60%, pulling the full allocation to just over 2.4% of the portfolio.

Aside from those three net adds, the remaining eight funds were net reducers during the reported quarter (note that only one fund reported on the quarter ended 4/30; all others reported for the quarter ended 6/30).

August Covered Call Corner Statistics ![]()