Last week, I publishing an article detailing my conversations with Ken Bond, Oracle’s ORCL Senior Vice President in charge of Investor Relations.

Frustratingly for both Bond and myself, we seemed to be talking past one another — I see data suggesting that 2017-2018 compensation (including the imputed value of shares issued to employees) rose sharply; Bond maintains that this rise is an artifact of the means of issuance and that Oracle’s policy regarding economic compensation of employees has not changed.

Surprisingly, after I took a closer look at Oracle’s filings, I found that we were both partly right. What I discovered made me more optimistic about Oracle’s future.

The Optimistic Medium-Term

Of the 304 million stock options granted to Oracle employees and still outstanding, roughly two-thirds have vested. These options have a strike price about $17 per share lower than the present stock price and have an average of just under four years left before they expire.

These historically granted options function as a potential source of dilution, but until the option holder exercises and receives a share, we do not calculate any cash flow associated with them.

In addition, the firm started issuing RSUs to employees a few years ago — the total number of RSUs outstanding is 89 million. RSUs vest over a period of four years, and as soon as one tranche vests, one quarter of the entire grant’s worth of stocks are issued and transferred into the employees’ accounts. Because stocks are issued to employees as soon as the tranche vests, we calculate a cash outflow equal to the price of the stock multiplied by the number of shares issued.

Since there is a difference between when a grant of either options or RSUs is made and the time when the associated shares are issued, we must make the distinction between the amount of shares being granted now to be issued later versus the amount granted historically and that are being issued now.

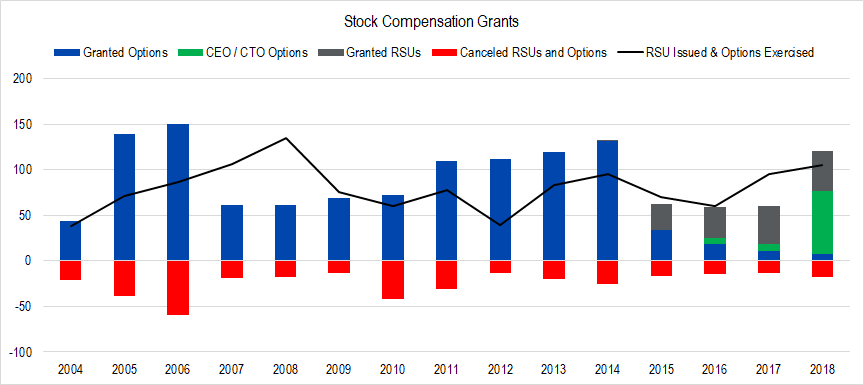

Figure 1. Source: Company Statements, Framework Investing Analysis

In this graph, columns represent options and RSUs granted or canceled, and the line represents grants that were converted into shares.

There are three things to note. First, note that option grants (blue columns) have fallen off a great deal since 2015 and RSU grants (gray columns) have not completely offset this fall.

Clearly, Bond is focusing on this dynamic when he says that the value of stock-based compensation is falling at Oracle.

Second, note that because Oracle employee stock options have an economic life of 10 years, the current level of RSUs vesting and options exercised (the black line) is related to grants made over the past decade. Because the grant level picked up in the 2011-2014 time frame, it is natural that issuance has picked up over the past few years.

Third, note the green bars over the last three years. These are special options granted to Larry Ellison (Oracle’s founder and CTO) and to Safra Katz and Mark Hurd (Oracle’s co-CEOs). There were a large number of these options granted in 2018, and suffice it to say that if Ellison, Katz, and Hurd receive these shares, current shareholders will be pleased. You can find the exercise requirements for these options in Oracle’s most recent proxy statement but the gist of the agreement is posted here:

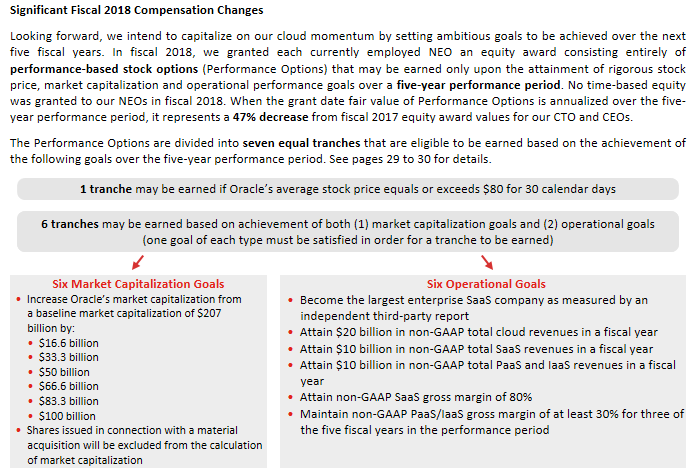

Figure 2. Source: Company Statements

In short, Ellison, Katz, and Hurd cannot simply show up to work for the next five years to be gifted billions of dollars worth of options. The earning of these options depends on the company making significant strides to increase the company’s share price, market capitalization, its share in the SaaS market, and its share and profitability in the PaaS and IaaS markets.

(By the way, Oracle’s current market capitalization is just shy of $191 billion, meaning that the company’s share price would need to increase by about 17% before the lowest of the six market capitalization goals is reached.)

There is likely some way to “game” some of these goals, but in general, they seem to be set up in such a way to truly align upper management’s incentives to owners’ best interests.

Setting aside the 2018 CTO / CEO options, the total number of options and RSUs granted to Oracle employees in 2018 fell to 52 million — the lowest grant total since 2004.

The fact that grants have fallen so much suggests that, as long as this lower grant level is maintained, share issuance in the future will eventually drop. If this is true, cash outflows associated with antidilutive stock buybacks should also fall — driving Free Cash Flow to Owners (FCFO) higher.

The unfortunate fact is that the improvement in FCFO is not more immediate.

The Pessimistic Short-Term

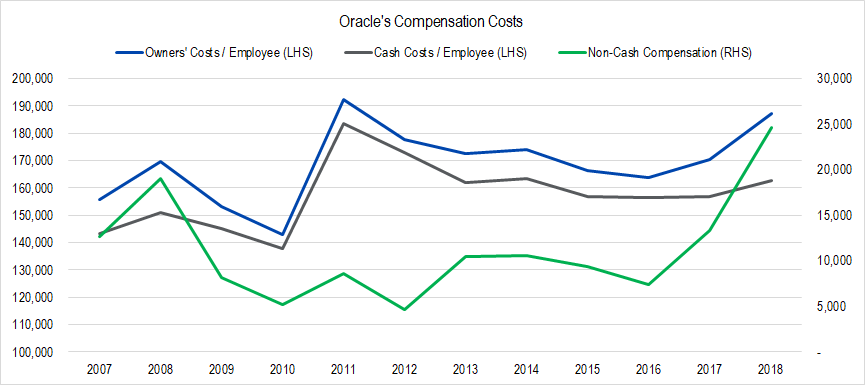

If we look at compensation costs at Oracle at present, we can see they are indeed soaring, with all-in costs per employee at an historical high of $190,000 per year.

Figure 3. Source: Company Statements, Framework Investing Analysis. Note that the left-hand scale (LHS) has an origin of $100,000 / year rather than $0. We represented it this way to more clearly show changes in the compensation level. The notable jump in compensation 2011 is likely an artifact of the mid-year acquisition of Sun Microsystem in 2010. Only a half-year’s costs of Sun are included in 2010; 2011 represents the full year’s worth of Sun’s costs on Oracle’s books, and 2012 and beyond represent Oracle’s gradual rationalization of this shrinking business.

The Cash Costs / Employee number — the gray line above — represents Income Statement line items related to the direct costs of providing products and services, less the Statement of Cash Flow line item showing the amount of stock-based compensation.

The Owners’ Costs / Employee number — the blue line above — represents the cash costs per employee plus the imputed value of buying back shares issued to employees in the form of vested RSUs and exercised options.

Cash costs have come down since 2011 and the annualized increase since the local minimum value (2010) is on the order of 2% per year — roughly the level of CPI increase over this time.

The notable uptick in the green line (which represents the difference between Owners’ Costs and Cash Costs per employee) is driven by the fact that a lot of historically-granted options are being exercised and that the present stock price is high relative to that of the last few years.

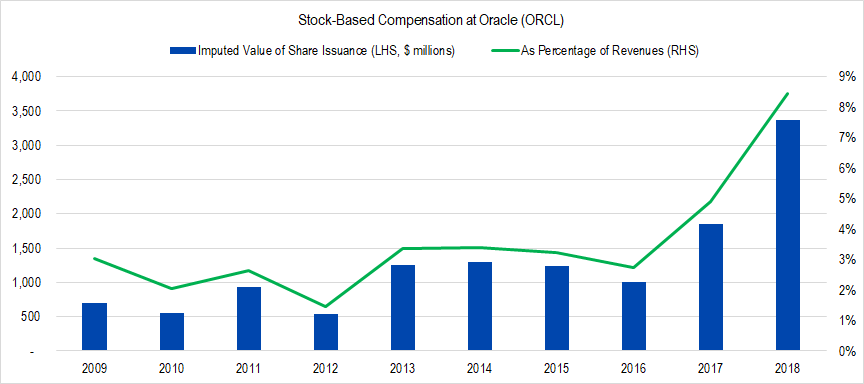

The uptick in compensation costs is the dynamic that surprised and worried me as I looked through the annual filing. Who would not be worried when looking at the following graph?

Figure 4. Source: Company Statements, Framework Investing Analysis

Valuation Impact

While the topic of share issuance is an important one from a valuation perspective, there are other elements to our valuation that we are taking this opportunity to revisit.

As I mentioned in my QuickTake article after Oracle announced fourth quarter earnings in late June, the company’s results were good and management was upbeat about sales momentum in 2019. At the same time, the firm changed the way it represented its business segments in a way that many analysts took to represent an attempt to obfuscate a slowing Cloud business.

Since our valuation model uses best- and worst-case revenue growth rates of the older business segments, we now have the chance to rethink growth rates when we update the model to incorporate the new business segments.

We will post an updated valuation model to members this week that incorporates both our lessons learned regarding share issuance and our updated revenue growth model.

In the meantime, here is the updated workbook with share issuance calculations and graphs.