The following?is an excerpt from IOI’s most recently published Institutional Report on Express Scripts Holdings (ESRX), which was originally commissioned as a piece of bespoke research from one of our institutional clients. It covers the competitive dynamics not only for ESRX, but also for the Pharmacy Benefits Managers industry in general.

Executive Overview

- Thanks in part to PBM success, the growth of prescription drug expenditures has slowed to the low- to mid-single digit level, so organic growth for ESRX is not likely to be much above that level.

- The industry has consolidated, so the opportunity for acquired growth is also limited.

- The best chance for more rapid revenue growth is through the zero-sum game of poaching another PBM’s client.

Organic Growth

According to the Centers for Disease Control, spending on prescription pharmaceuticals represents roughly 9% of U.S. healthcare expenditures. This equates to roughly $900 per capita per year.

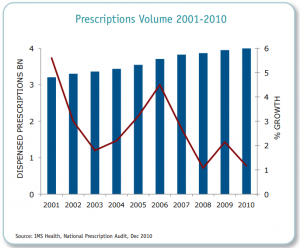

As shown in figure 1 in our company and industry summary article, revenues generated through prescription drug sales has increased in the low- to mid-single digit range over the last few years. Cross checking this against the growth in the number of prescriptions over this time tells much the same story as shown in figure 3 below.

Considering these two data points, we think it unlikely that the PBM industry in general will be able to increase revenues at much more than this low-single digit rate. (The possibility for Express Scripts to achieve organic growth significantly higher or lower than this rate is discussed later in this section.)

Other Sources of Growth

Given this low rate of likely organic growth, it makes sense to ask next about the possibility for acquired growth. However, after a flurry of acquisitions (CVS and Caremark in 2006, Express Scripts and Medco in 2012, and OptumRX and Catamaran in 2015), somewhere around three-fourths of all PBM business is controlled by three firms ? Express Scripts being the largest of these three ? leaving little room for additional consolidation.

For a firm in any other business, international expansion would also serve as a potential growth source. However, the structure of overseas drug markets are much different than that in the U.S., and given that many overseas markets feature a single-payer system, it is not clear that the present PBM business model would translate well abroad. Indeed, Medco attempted to expend into Europe and China, but after acquiring those assets, Express Scripts made the decision to divest them.

This leaves one last possibility for significantly changing revenues ? namely the zero-sum game of attracting another PBM?s customers.

Express Scripts has two customers that in FY 2014 generated greater than ten percent of revenues: the U.S. Department of Defense and Anthem Healthcare. The latter contract (representing 14% of 2014 sales) is as a result of an acquisition Express Scripts made in 2009, and is up for renewal in 2019. The DoD contract, which was renewed in 2014 for a duration of seven years represented 12% of Express Scripts? revenues in 2014.

While these contracts are locked in for a few more years, considering the nature of Express Scripts? business, there must be more customers that, while not being large enough to break the 10% of revenues threshold, do represent a material proportion of sales (in FY2013, the last year for which we found data, its top five clients represented 38% of revenues). It?s no wonder that Express Scripts? most recent earnings announcement press release discussed client retention as a key point.

In the company overview article, we mentioned the possibility of regulatory risk, but in fact, a greater risk exists due to a large customer defection. Considering the degree to which all PBMs in general find ways to boost profits that arguably come at the detriment of their own clients? interests, it is possible that some revelation regarding unfair or manipulative business practices will be enough to sway a large client away from Express Scripts. (Obviously, the possibility that the reverse may happen also exists.) This scenario came to the forefront in 2013 when one of Express Scripts? large clients, United Health, decided to bring PBM functions in-house rather than renewing its contract with Express Scripts.

This customer defection actually had an even greater deleterious impact on Express Scripts, since United Health?s PBM business unit became with OptumRX ? the competitor which just announced the acquisition of Catamaran, to form the third largest PBM in the U.S.

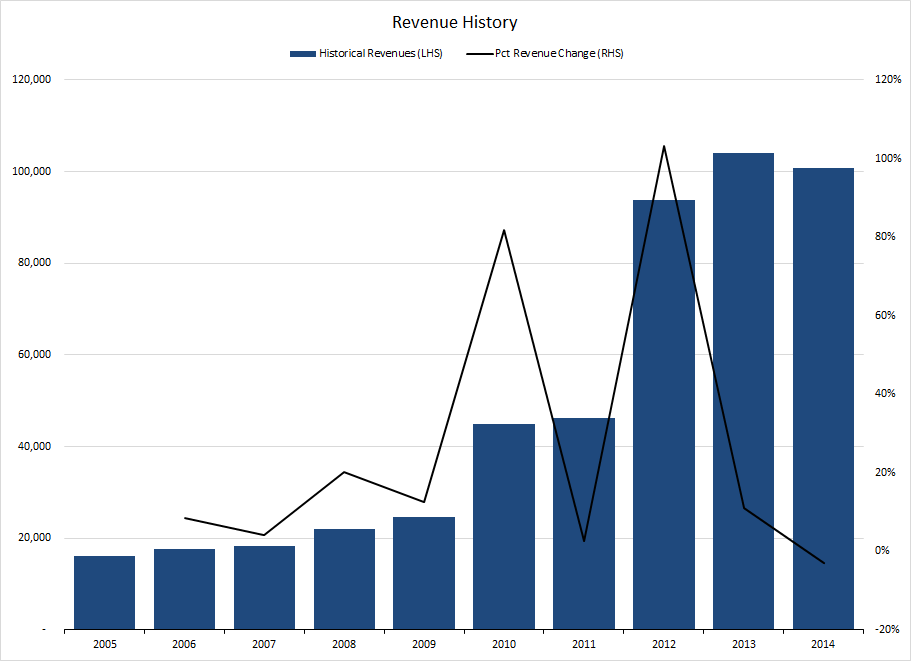

On an aggregate basis, revenues at ESRX over the past 10 years have looked like this:

Here, we can see clearly the effect of the 2009 acquisition of WellPoint?s pharmacy unit (the transaction that led to the Anthem contract) and the 2012 Medco acquisition. The drop off in growth from 2013-2014 is due to the loss of United Health?s business.