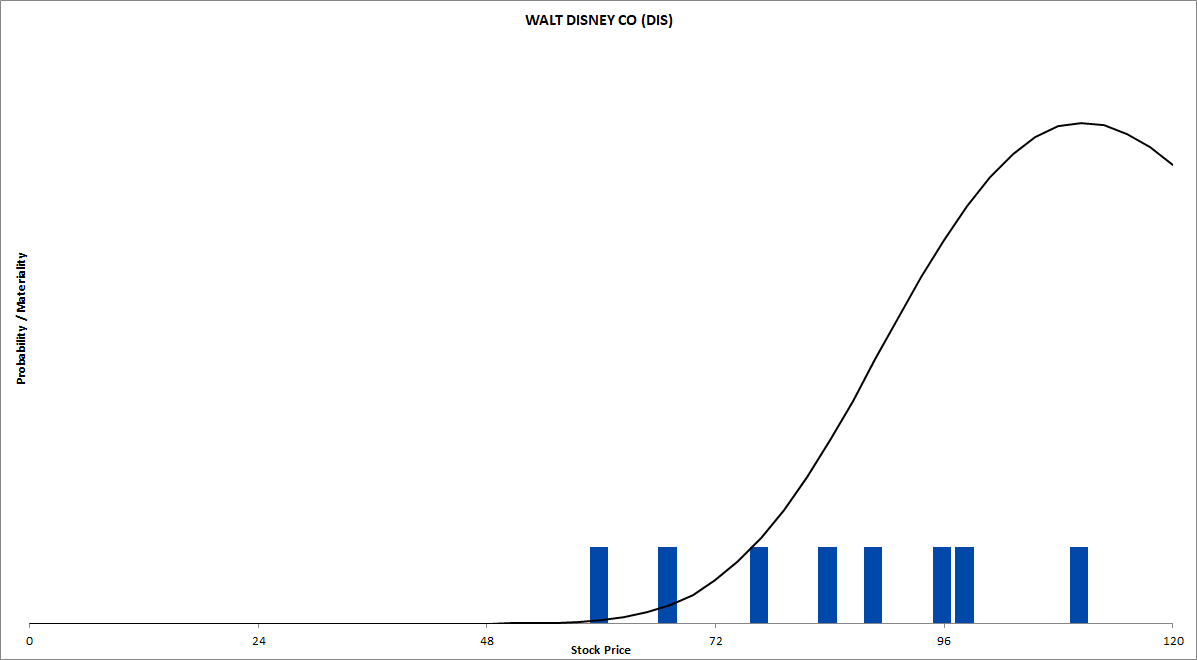

Last month, prompted by long-time Framework member, Wilson M., I worked with our new analysts to do a valuation waterfall of Disney DIS. Since that time, the company reported its annual earnings, so I wanted to refresh the model and take another brief look at our valuation assumptions.

We posted a Five-Minute Valuation video for Disney yesterday, and below you’ll find the updated Valuation Waterfall and Framework Valuation model.

The negative cases have gotten slightly more negative (due to a lowered assumption of worst-case growth) and the positive cases have gotten slightly more positive. The end result is the same equally weighted average price for all our scenarios.

Figure 1. Source: CBOE, Framework Investing Analysis

Here is a copy of the model – feel free to download it and check our inputs!

Framework Valuation Model – Disney (DIS) ![]()

Also feel free to comment on the Framework Forum thread on Disney, so please post your questions and comments there!

Here’s the Valuation Waterfall for Disney:

Loading...

Loading...