[This article originally appeared on Forbes.com. A slightly longer version appeared on Seeking Alpha]

It must be a law of nature that an analyst spends most of his or her time on the investment ideas that aren’t working out. I find myself returning again and again to my problem-child investment from last year, IBM.

Since recommending what I call a “bond replacement” investment in IBM in July, 2015, Big Blue’s stock price has fallen about 14%. (The reason that this magnitude of a loss is so emotionally painful is a topic we discuss in our IOI 102 courses when covering a behavioral bias known as the ‘disposition effect.’ Importantly, we teach a methodology and tactics that help to avoid this and other biases as well!)

At Thanksgiving, I wrote a Forbes article outlining my valuation argument for IBM – an argument that boiled down to three things: revenue per share holding up well, profits heading toward my best-case scenario, and good uptake of IBM’s Cloud products (suggesting healthy medium-term growth).

But two months later and the stock price still languishing, I again found myself worrying that I had missed something. It turns out that I had – but the something I missed gives me comfort that this investment is still on the right track, no matter what the temporary read of the tape is telling me.

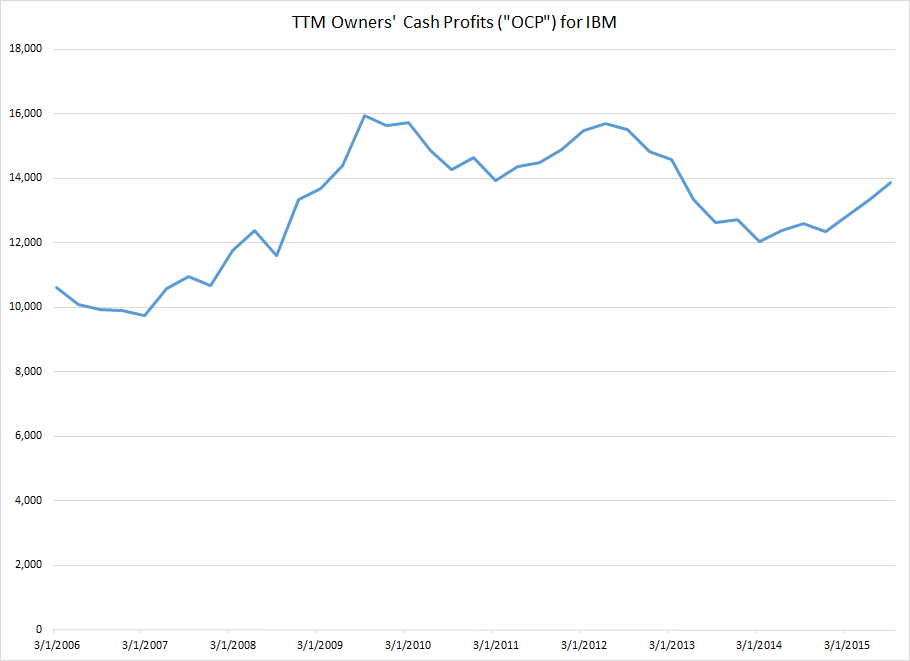

Figure 1. Source: Company statements, IOI Analysis

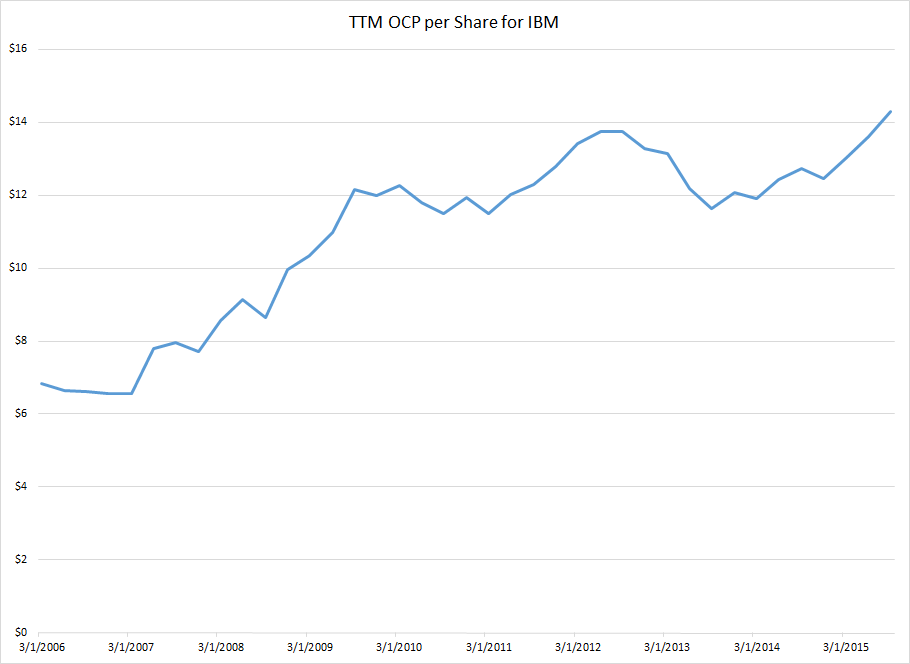

Figure 2. Source: Company statements, IOI Analysis

Outstanding! In fact, IBM’s profit per share increase works out to roughly a 9% compound annual growth rate of profits since 2006 and the most recent trailing twelve-month figure is the highest in the company’s history.

There are two factors leading to this improvement, both of which are good news for investors.

First, IBM is getting rid of low-profitability businesses. Any time a company cuts out a low margin business, it’s an arithmetic certainty that the company’s margin on its remaining businesses will go up. However, in this case, it’s not only the margin going up, but also the share of profit to which every owner can lay claim. IBM is using proceeds from the sale of businesses as a source of cash to buy back shares. As you can see from a video I did about share buybacks, I’m generally suspicious of the motives of these programs, but in IBM’s case, rising profits per share demonstrate an example of buybacks actually generating value for long-term shareholders.

Second, my preferred profitability metric, OCP, is calculated in a way that takes improvements in “asset efficiency” into consideration, and IBM’s asset efficiency has increased substantially with the divestment of its semiconductor fabrication plants (“fabs”) and the sale of its “x86” server business to Lenovo .

“Asset efficiency” might sound like a bit of accounting minutiae, but it does have a big impact on investors. For a company that must maintain a large asset base, a relatively large proportion of the cash flow that would have otherwise flowed through to become profits must be redirected to maintain the assets in working condition. As assets that must be maintained decreases, more of the company’s cash flow can make its way through to owners’ pockets or to investments that will help the company expand profits more quickly in the future.

Revenue losses – especially those in the company’s middleware franchise – still make me a bit circumspect about my investment in Big Blue overall, but the improvements that Rometty’s IBM has shown on the profit side give me an indication that the $209-$218 fair value estimate I published in November still holds up.

I guess I need to find something else to worry about for a few months.

If you want to learn more about the stepwise methodology behind my analysis above, including the OCP metric, join me in Tampa, Florida for my Introduction to Intelligent Option Investing Course on January 23-24. You can do this kind of analysis to uncover value yourself and I can teach you how to take and manage risk in your investment carefully. Learn more about our investor education here.

Learn More!