As I was researching Union Pacific (see our UNP articles and reports in the IOI Dashboard), I was struck by the company managers’ defense for hiking fees to shippers by 200% – 300% in some cases. UNP, like other railroads, measures capital efficiency by Returns on Invested Capital (ROIC), and managers claimed that under legacy contracts, the firm’s ROIC did not even exceed its cost of capital.

Regulators bought this argument hook, line and sinker, apparently, because they refuse to step in even while UNP charges shippers through the nose to get their products to market.

Company management claims that under present contracts, they are just now scraping by – earning above the firm’s cost of capital. I would love to see those calculations, because by my preferred profitability metric – Owners’ Cash Profits (OCP), UNP’s profitability is just shy of that of Apple’s (AAPL)!

Just as I was thinking about UNP’s ROIC scam, a friend passed along a Wall Street Journal article entitled The Hottest Metric in Finance: ROIC.

Aswath Damodaran

One of my favorite comments in the article is one by Aswath Damodaran, a valuation guru (the valuation guru, according to many) who teaches at NYU:

New York University finance professor Aswath Damodaran said ROIC is a lazy shortcut for executives, because companies should have visibility into the cash flowing from projects on a more granular basis.

“I could write a paper on perverse ways you could destroy your company by raising your ROIC,” he said.

This, in a nutshell represents my perspective on this popular metric. Looking at actual cash flows at a company (like those represented by OCP) is much more meaningful than trying to figure a return. This is true for all return statistics that are based on non-cash accounting estimates (e.g., Return on Assets, Return on Equity, etc.).

This criticism is doubly true for ROIC because not only does ROIC use accounting estimates in the numerator and denominator, it uses theoretically-adjusted non-cash accounting estimates. Accounting conventions are an abstraction from reality in the first place; theoretically adjusting those abstractions makes talking about ROIC similar to Medieval cardinals’ discussions of how many angels could dance on the head of a pin.

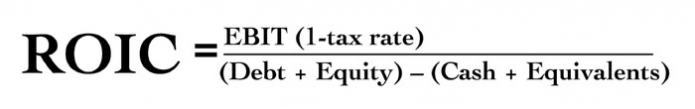

Here is the equation the WSJ shows as the formula for ROIC:

The numerator contains EBIT (Earnings Before Interest and Taxes) and adjusts that for taxes. This is supposed to show what the operations of the business is generating in terms of profits before taking into consideration interest payments (which are classified as “non-operational”).

The first problem is that EBIT is an accounting estimate that may or may not relate very closely to the actual profitability of any given firm. It contains all sorts of non-cash charges including those for Depreciation and Amortization and share-based compensation. In a phrase: EBIT does not equal Profit.

The second problem is knowing what tax rate to use. Should you use the statutory rate for the U.S.? If so, you are ignoring whatever foreign taxes the company is due to pay. Should you use the tax payable listed on the Income Statement? This figure often has very little to do with the actual taxes a company is paying (this FactCheck.org article does a good job of describing the case involving GE, for instance). Should you use the average actual tax payments over some time period? If so, what’s the right time period to pick?

You get the idea – the numerator is not a hard figure of profitability by any means and can be manipulated by company management in any number of ways.

What about the denominator?

The first problem I see is the use of “Equity,” an accounting estimate that has little economic meaning especially for older firms. IBM has been in business since 1911. I have no idea if it made a profit or a loss in 1912, but whichever it was, the value is included in IBM’s Equity. Why would that number matter to an investor today? Sometime in the 1920s, it’s likely that IBM bought some property that it still owns. Let’s say it spent a princely sum of $1,000 for that property and that if it wanted to sell it today, it would get 100,000 times that price. Again, it’s the price paid in 1922 that is recorded as an asset on the balance sheet, so Equity is understated by the difference in value between purchase price and present price.

Cash

The second problem is the use of “cash.” You might think that cash is unambiguous, but in fact, in the world of finance theorists, there is an argument that some of the cash held by a company is “operational” and some is “excess”. The “operational” cash (i.e., that used to pay for inventory, salaries, etc.) should not be included in the “Invested Capital” calculation. As such, you find analysts trying to arbitrarily determine what cash on a company’s books is operational and which is excess. For anyone who has ever run a company, this is the most ridiculous distinction in the world. The amount of cash that is necessary for operations differs at different times and in different economic environments. Trying to pretend that a company has a store of “operational cash” separate from its “excess cash” implicitly assumes you have perfect predictive ability of the economic environment coming in the next few quarters. Certainly, Dickie Fuld would not have been so anxious to use “excess cash” to buy back Lehman Brothers stock to try to hurt short sellers in the months leading up to the collapse of his firm.

Dick Fuld is not happy about his use of “excess” cash

It’s clear that ROIC is flawed in many ways. The amusing thing is that a lot of professional analysts compare this flawed ROIC metric to a flawed and contradictory calculation of a firm’s “cost of capital” to decide if the company is “generating value” or not.

When an analyst or a management team starts comparing one imaginary, nonsensical measure to another, an investor should take this as a sign to sharpen their pencil and figure out what’s really going on.

My advice? Toss these flavor-of-the-month metrics in the bin and figure out for yourself how much cash wealth the firm which you own is generating on your behalf! To learn how to do that, contact me using the form below!