The railroad pricing environment is changing.

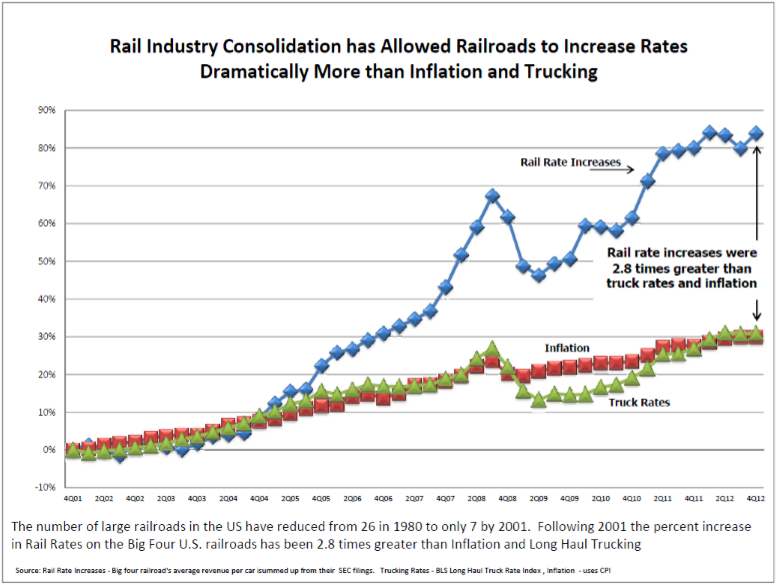

Over the last decade and a half, railroads have been able to raise shipping rates very aggressively thanks to industry consolidation and a regulatory body that seemed more focused on improving the health of the railroads than on restricting rates in a monopoly environment.

Figure 1. Source: Analysis of Freight Rail Rates for U.S. Shippers, Escalation Consultants

I have written about this trend both in public forums and in our research presentations to Framework Investing members.

As I dug in deeper to the pricing issue, I was fortunate to meet Jay Roman, an industry insider with years in the business. Jay is the CEO of Escalation Consultants, a firm that helps rail shippers negotiate rate contracts.

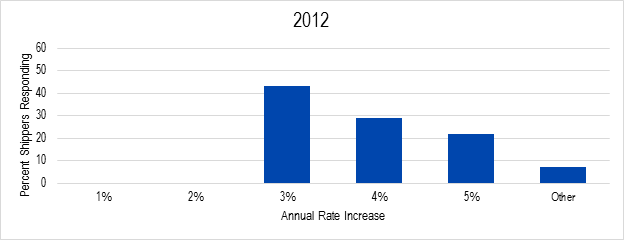

Each year, Jay takes a survey of around 100 very large rail shippers across all industries to find out how much the railroads raised rates. I found that a time-lapse view of rate changes told an interesting story.

On these graphs, the number of shippers who responded is on the vertical axis and the annual rate change is on the horizontal one. Let’s look at Roman’s data over the past five years and compare that to what has happened this spring.

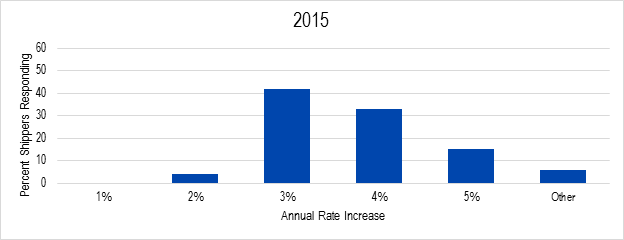

Figure 2. Source: Escalation Consultants Survey, Framework Investing Analysis

During most years, most of the rail rate increases fall into the four to five percent buckets.

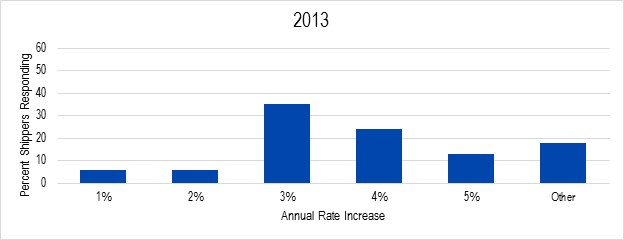

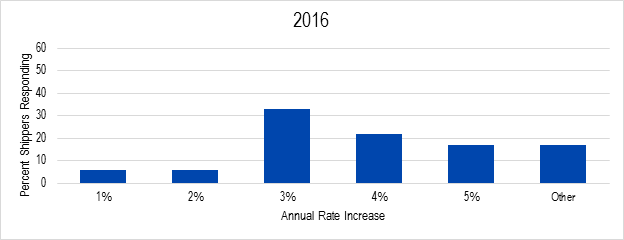

Figure 3. Source: Escalation Consultants Survey, Framework Investing Analysis

A few years, rate increases fall into the one to two percent buckets, but the proportion of cases is small.

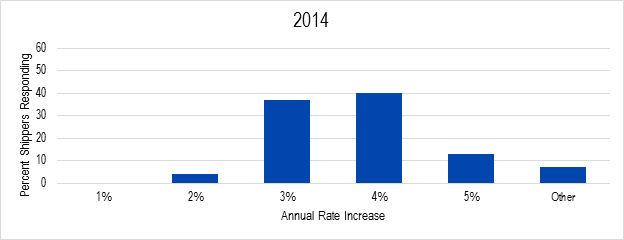

Figure 4. Source: Escalation Consultants Survey, Framework Investing Analysis

Figure 5. Source: Escalation Consultants Survey, Framework Investing Analysis

Figure 6. Source: Escalation Consultants Survey, Framework Investing Analysis

Figure 7. Source: Escalation Consultants Survey, Framework Investing Analysis

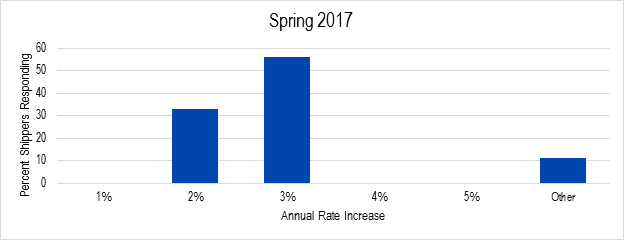

Contrast this with what we see in the spring of this year. There were no rate increases in the 4 or 5% buckets. For the first time in this series, the majority of rate increases were 3%. And one third of respondents reported a 2% rise – the largest proportion of sub-3% rate increases in the history of this series.

What does this mean for railroad investors and specifically for investors in Union Pacific?

The king of value drivers is revenues and revenues are generated by selling a volume of goods or services at a given price.

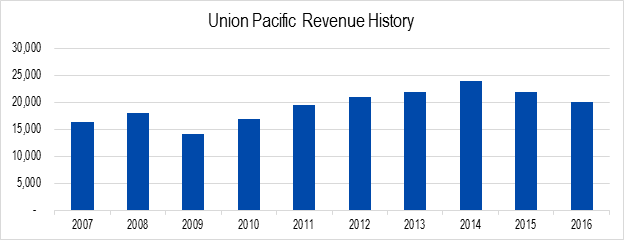

While Union Pacific’s revenues have dropped over the last few years due to weak volumes, in general, the company’s revenues have seen robust growth over the past decade.

Figure 8. Source: Company Statements, Framework Investing Analysis

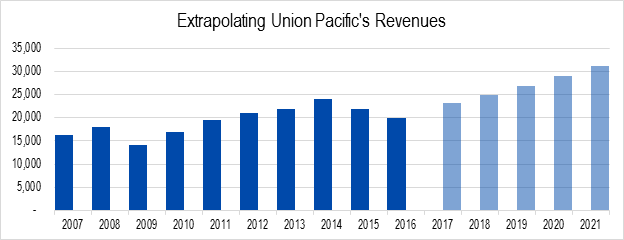

Now that volume trends look as if they are turning positive, investors are, we believe, valuing Union Pacific by a simple extrapolation of the prior revenue trend.

Figure 9. Source: Company Statements, Framework Investing Analysis

However, revenue increases are not only a function of volume, but require consistent price increases as well, so a simple extrapolation of prior trends is unwise.

In expectation of a boost to revenues, Union Pacific’s share price has gotten a lift over the last year. We think this price rise is unfounded and that the stock is trading considerably above a reasonable intrinsic value range.

This is one reason why we decided to use option contracts to structure a bearish investment in the shares of Union Pacific.