Several days ago, the analyst covering General Electric for Deutsche Bank downgraded his rating on the company from “Hold” to “Sell.” Shares have fallen heavily and are lagging the market for this year, and since this company is one of my cornerstone positions, I wanted to take a closer look at the analyst’s criticisms, see if they have merit, and adjust my position accordingly.

Analyst Comment

While most sell-side research is geared toward short-term earnings trends, the Deutsche analyst’s downgrade of GE actually made points that would be concerning to a long-term investor.

The analyst, John Inch, commented:

“GE’s weak cash flow has become worse in recent quarters … The company appears to be operating relatively ‘close to the line’ in terms of sufficient cash generation to continue to fund such a robust dividend and share repurchase program.”

Inch pointed out that without a dividend paid to the Industrial segment by the GE Capital segment, the Industrials segment alone would not be able to sustain the dividend, so the next CEO would have to reduce guidance on future earnings and cut dividends.

His conclusion was:

“We believe GE to be overvalued given weak earnings quality and the wide gap between non-cash and cash earnings.”

Let’s apply our valuation framework to this analyst’s comments – when you understand how value is created by companies and have a sensible framework to measure that value, this is an easy and essential step for an investor to take.

Framework Analysis

Inch compares cash and non-cash earnings, and since our primary measure of profitability is Owners’ Cash Profits (OCP), a cash-based metric, we can compare OCP directly to what the company is reporting as accounting profits.

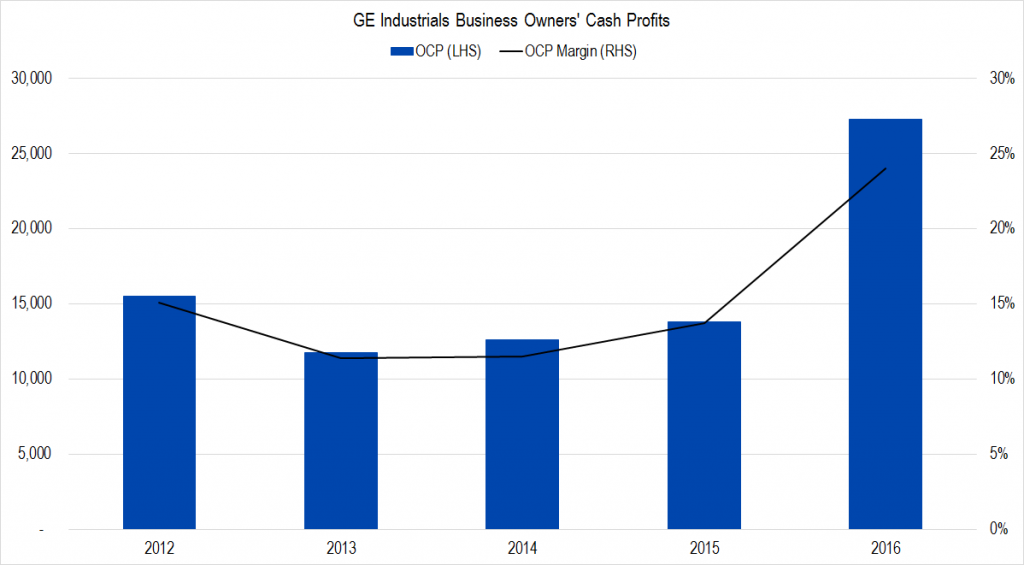

Let’s first look at Owners’ Cash Profits for only the Industrials segment. Luckily, GE reports separate Statements of Cash Flows for its Industrials segment and its Capital segment, so calculating OCP on a segment level is possible.

Figure 1. Source: Company Statements, Framework Investing Analysis

We will talk about the outlier of 2016 in a moment, but the important thing to realize is that, GE is generating in the neighborhood of $12 – $14 billion worth of OCP each year.

This is ample profits to cover the dividends, which usually run in the $8 – $9 billion per year range.

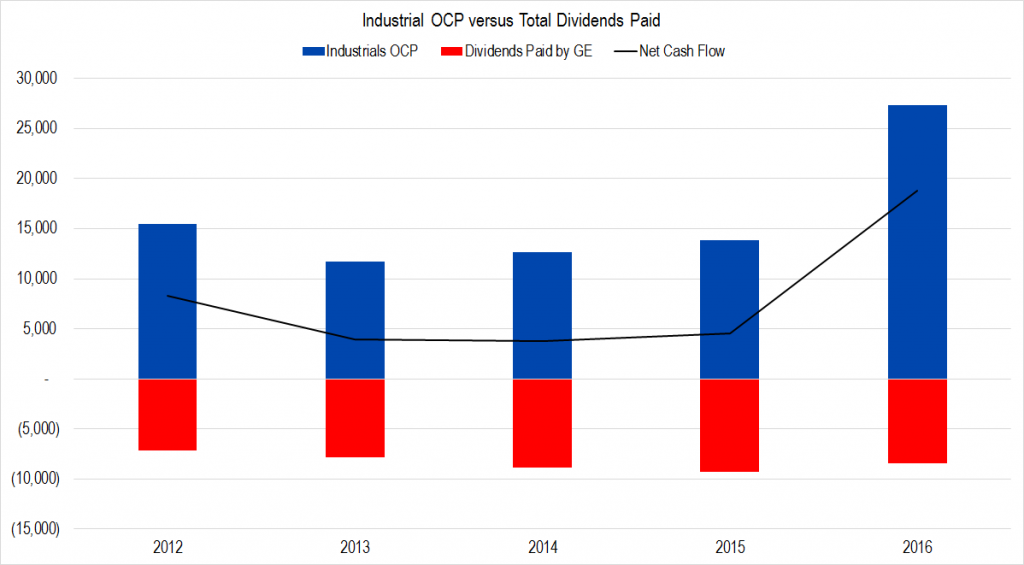

Figure 2. Source: Company Statements, Framework Investing Analysis

I have not included GE’s share repurchases in this chart, but the company has been using funds from divestitures to fund buybacks as well as to reduce debt outstanding at the company. This strategy has allowed the firm to concentrate its owners’ interest by reducing shares outstanding:

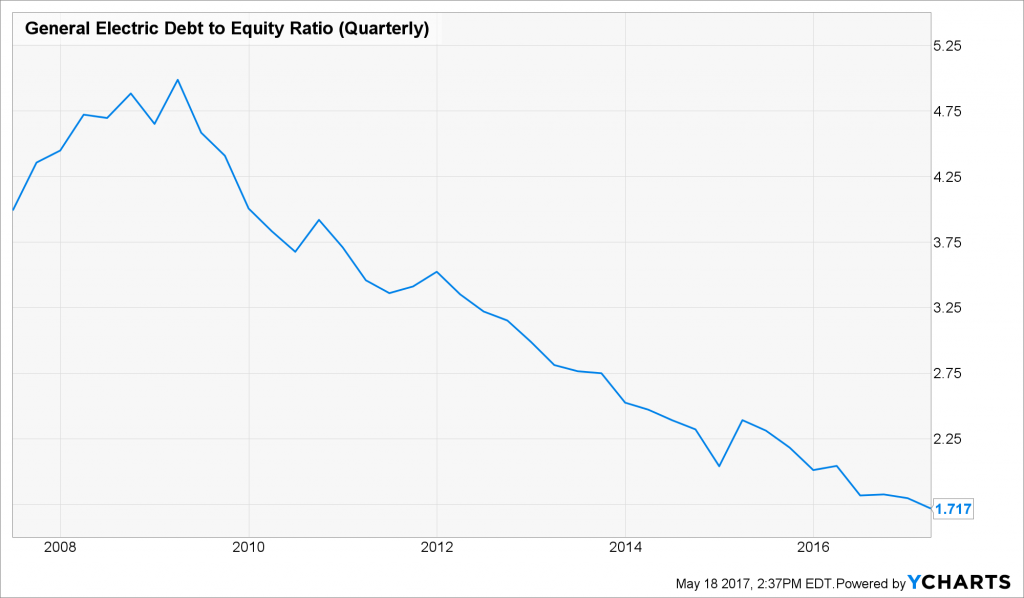

Figure 3. Source: YCharts

And to reduce the financial leverage of the company as reflected in the debt-to-equity ratio:

Figure 4. Source: YCharts

Considering these facts, we find little merit in the claim that GE is in danger of cutting its dividend or in being forced to stop buybacks.

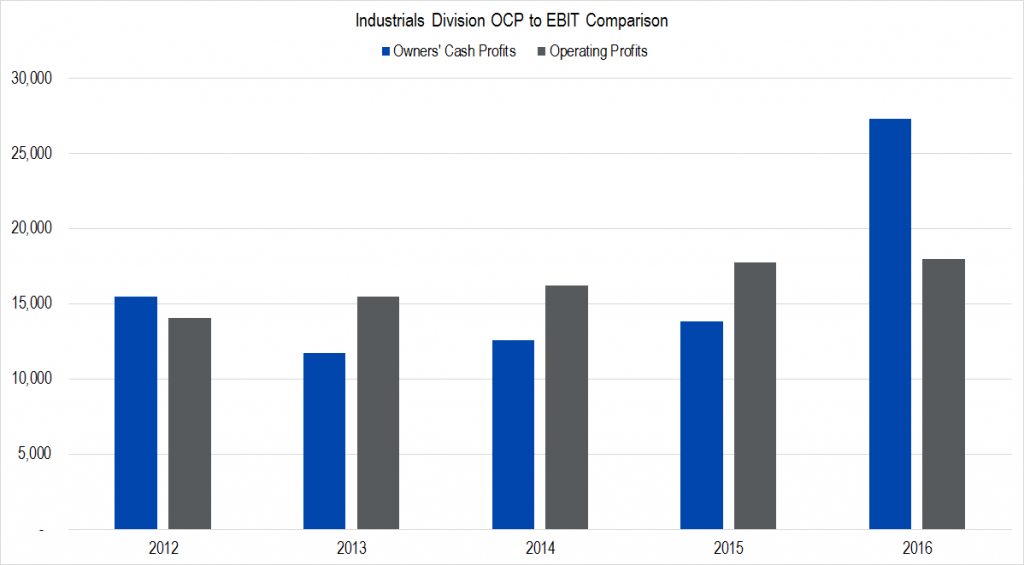

What of the analyst’s contention that there is a big difference between cash and non-cash (i.e., accounting) earnings? This is easy to test as well.

Figure 5. Source: Company Statements, Framework Investing Analysis

The firm reports operating profits on a segment basis as well, so we can compare the Industrial segment’s OCP directly to its Operating Profits. This chart shows that, while Operating Profits are usually higher than OCP, the two figures are not drastically different except in 2016.

There is a simple reason why Operating Profits is usually higher than OCP, by the way: Operating Profits are a pre-tax, pre-interest payment number whereas OCP is a post-tax, post-interest number.

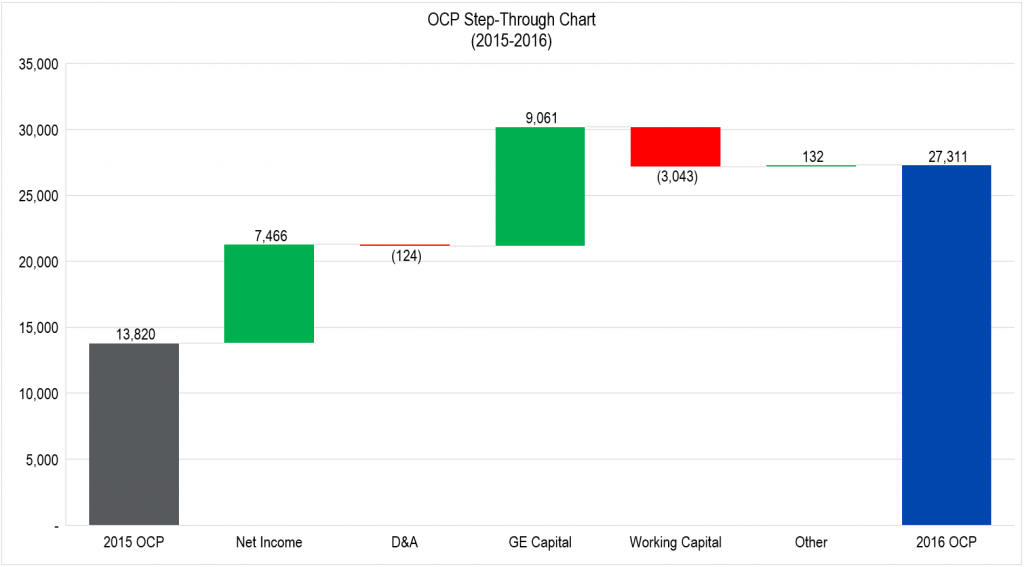

Let’s take a look at the big jump in OCP from 2015 to 2016 since this has to do with the analyst’s claim that the dividends paid by the Capital segment is subsidizing a weak and struggling Industrials segment.

Figure 6. Source: Company Statements, Framework Investing Analysis

In this OCP step-through chart, where I show the progression of a change in OCP from 2015 to 2016, note that I am using the numbers adjusted for divested businesses. Analyzing a company that is in the midst of transforming itself is tricky due to adjustments like this, and in my opinion, the Deutsche Bank analyst simply got confused.

The first thing that I like to see is that the net income is showing a positive effect. As I have mentioned in previous videos, I like to see earnings increasing in these charts from year-to-year and usually discount changes in working capital, which tend to be more transitory.

The drop in OCP due to changes in working capital is, by the way, caused by a $3.7 billion gain on the divested Appliances business. That gain is recorded in a different part of the Statement of Cash Flows, so even though that column is red, it’s not a warning signal in my view.

The big increase – over $9 billion – in the amount received from GE Capital this year sticks out. The Deutsche analyst might be worried that this will not repeat, and certainly, he is right about that. This added dividend comes from the fact that GE was able to free up a lot of capital when its designation as a SIFI was rescinded – GE Capital simply paid that freed up capital through to GE’s Industrial segment like it always does.

The new GE Capital does not make dodgy mortgage loans to consumers or sell snowmobiles on installment to sporting goods dealers anymore. It supports each of the Industrial “verticals” and contributes, we believe, to a lot of the tax sheltering that GE is either famous or infamous for, depending on your perspective. The ongoing dividend from the new GE Capital is, in our opinion, simply a facet of GE’s operating strategy and not contingent on further divestment or regulatory status changes.

Investment Strategy

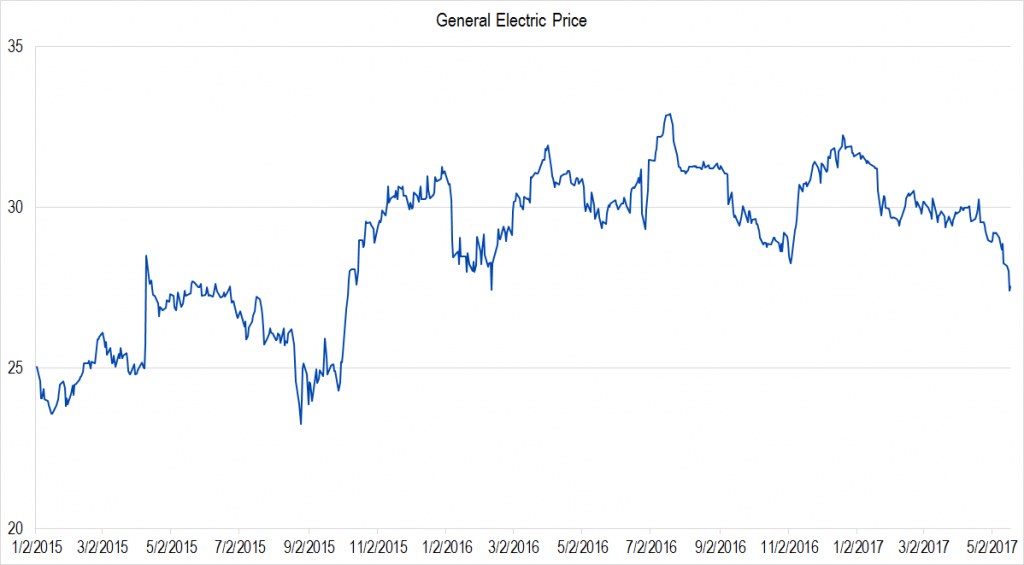

I started building my position in GE in late 2014-early 2015. The position represented roughly one-fifth of my portfolio and included a moderately levered allocation using ITM call options in addition to the shares.

Figure 7. Source: YCharts

Last year, nervous about the potential chaos of the new administration, I eliminated my leverage on this investment when the stock was in the low-$30 range, and also reduced the size of the stock portion of the allocation by about one-third. This ended up allowing me to book a nice profit on that portion before the stock price headed down.

At this point, I have about 10% of my portfolio invested in an unlevered position in GE. With the stock now down to just a dollar and a half above where I originally bought it, I was considering increasing and relevering my position once again.

Rather than jumping into a larger position, I’ve decided to take a fresh look at GE’s value now that it is most of the way through its transformation and will post a report to Framework Investing members when this work is complete.

For now, the main takeaways are:

- Using a sensible framework for understanding value provides a great help in analyzing analyst opinion changes.

- The Deutsche analyst’s points about GE not being able to generate enough cash to fund dividends or buybacks is provably false.

- Because GE essentially reports three versions of its financial statements – Consolidated, and Segment-level with and without adjustments for divestitures – we think the analyst simply got mixed up.

- We will update Framework Members once we finish our entire analysis.